Google ❤️ SGE, Review Response Uplift, Location Data Drought

Google: SGE Is Boosting Search

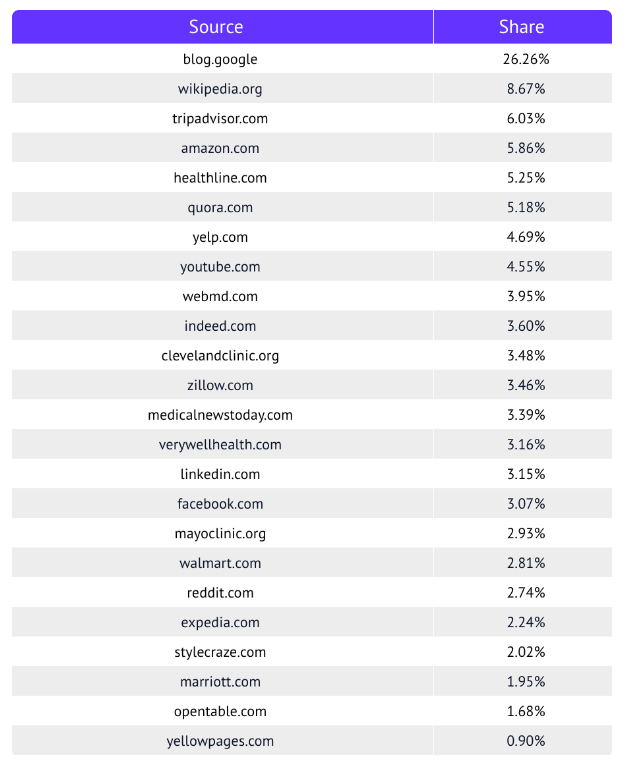

On Google's earnings call, following its "blowout" Q1, the company was upbeat about SGE. CEO Sundar Pichai argued that including AI answers in search increases engagement: "We are seeing early confirmation of our thesis that this will expand the universe of queries..." In a blog post he added, "We’re encouraged that we’re seeing an increase in Search usage among people who use the new AI overviews, as well as increased user satisfaction with the results." Gartner infamously predicted Google would lose 25% of its traffic to AI by 2026. So far there's little or no evidence that's going to happen. While more search competition would be refreshing, we can probably look forward to Google's continued dominance but with AI snippets gobbling up informational queries, where most of the search volume resides. A new study from Ziptie reinforced many of the things that have already been said about Google SGE and SEO: AI results appear for 82% of queries (Autoritas says 86%), answers are often quite long (pushing other results down), UGC is favored (e.g., Reddit, Quora), and links are drawn from beyond the top 10 organic results (new competitors). The post also argues that SGE will make ads more competitive and expensive.

Our take:

- Other than Google's own comments about SGE, we have no user data. That may come soon, as a general launch may happen at Google I/O.

- Another variable is engagement. Users must click to expand SGE results, on average, 57% of the time. It varies by category and they may not click.

- Ziptie (and others) argue for a new approach to content/optimization. The post offers advice, most of it familiar – e.g., focus on the customer journey.

Study: Review Responses Boost Visibility

Does responding to reviews increase your visibility in local search results? A recent correlation analysis from GMBapi.com argues it does. According to co-founder Michael Van Luijtelaar, "Every 1% increase in your reply rate... leads to 0.31% increase in impressions and actions (calls/clicks/nav) and 0.14% increase in rating." This is based on an analysis of the company's entire client list. He added, "We researched all of our customer data for 2023 and found that on average, 41% of the reviews collected by our customers were replied to." Review response rates are typically uneven. (An estimated 79% of local business reviews are on Google.) And the majority of businesses do not respond to reviews – although reputation platforms and AI have made it easier for multi-location brands. Luijtelaar added, "The longer it takes you to reply the more likely your conversion rate is to drop." Responding to reviews has not been seen as a ranking factor by the majority of leading Local SEO professionals. Near Media research has found most users don't actually read reviews; they look at review volumes and ratings. However, those who actually read them frequently care about responses.

Our take:

- Correlation vs. causation: businesses that respond to reviews might also engage in other Local SEO best practices that increase visibility.

- Google could be tracking local engagement (with reviews) and these "responding profiles" might drive higher engagement. We know Google has used behavioral signals to rank results.

- Beyond ranking, it's important to monitor and respond (in most cases) to reviews. They offer valuable customer, brand and operational insights and are an important CS channel.

Location Data Drought

Location intelligence is the subfield of mobile marketing that uses location data to identify audiences and track the efficacy of media channels on real-world user behavior (did they visit a store after an ad exposure?). It evolved out of mobile "geo-fencing" and has been likened to "cookies for the real world." But just like third party cookies, location intelligence and location data may be disappearing or at least severely curtailed. Apple landed a significant blow with location tracking permissions and AppTrackingTransparency in 2021, which required explicit consent for tracking. And consumers have largely turned against non-consensual use of their data. The proposed American Privacy Rights Act (APRA), which has bi-partisan support, would among other things require affirmative consent for use of location data. Most people will only consent to first party use cases (e.g., sharing location for directions). They won't allow their data to be sold to others. And the FTC has increasingly been cracking down on data brokers that don't obtain consent for data transfers to third parties. More recently, the FCC has fined the major US mobile carriers for illegally sharing access to customers’ real-time location data sans consent.

Our take:

- Location data usage in the EU already requires consent. If APRA passes, the US will be 100% opt-in. Regardless, the FTC and FCC are already acting.

- Maybe 20% of users will allow tracking. Some things could be extrapolated. But there will be much less location data for marketers. The major platforms might have workarounds, but then lawsuits.

- Contextual location targeting and location targeting in paid search would still be available because they don't rely on real-time user location data.

Recent Analysis

- Near Media podcast episode 155: An interview with Dana DiTomaso: to Google GA4 analytics Hell and back again.

Short Takes

- Apple enables custom links in local listings on Maps.

- Reviews alone won't win in the Local Pack.

- Whitespark's AI-aided content creation process.

- Reddit: the dark side of "barnacle SEO" is "parasite SEO."

- Google testing "ad" (vs. "sponsored") label again.

- When keyword optimization works ... and when it doesn't.

- Brands win in Core Update vs. marketplaces and affiliates.

- Core Update saw 45% reduction in low quality content – or did it?

- After HCU/CU, will articles just get longer and longer?

- Survey: 25% of CMOs say they're not using marketing technology.

- Meta's AI ad tools boosting CPMs, burning through budgets.

- Report: TikTok will shut down in US rather than sell the app (WSJ).

- Beyond Google, Apple talking with OpenAI for iPhone.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.