Too Much SEO, Google AIO Caution, Products over Research

Overly 'SEO'd' Sites Appear to Suffer

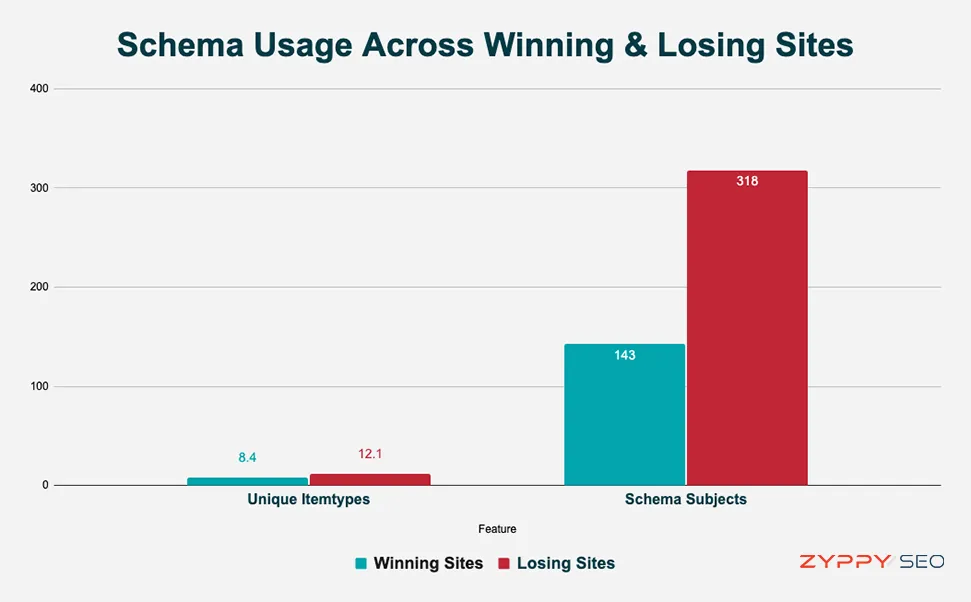

A new "winners and losers" study from Cyrus Shepard suggests that SEOs may need to rethink what he's calling "over-optimization" – widely used tactics that Google may now be punishing. For the study, Shepard looked at 50 "informational" websites and several SEO "best practices." Those were anchor text variety, page update frequency, title tags and schema usage. Here's what he found: sites that had more anchor text variation lost traffic; pages that were updated more frequently performed worse; clickbaity title tags also saw traffic losses; and sites with heavy schema tended to be losers in Shepard's sample. He also looked at several other variables but found a more-or-less neutral impact. Those included heavy dependance on Google traffic, author information, using tables-of-contents, word count (shorter articles better) and Google Business Profiles (having one didn't help). Shepard was careful to add caveats and qualify that is a correlation study and that his sample size was small.

Our take:

- Some of these findings seem to fly in the face of SEO conventional wisdom. But the landscape is dynamic as Google tries to beat back various competitive threats and restore SERP credibility.

- There's a lot of ranking speculation (post Search API Leak) out there. And it's important to be careful, experiment and "test and learn."

- In March we interviewed Shepard for the Near Media podcast about his on-page ranking factors study and experience as a Google Quality Rater.

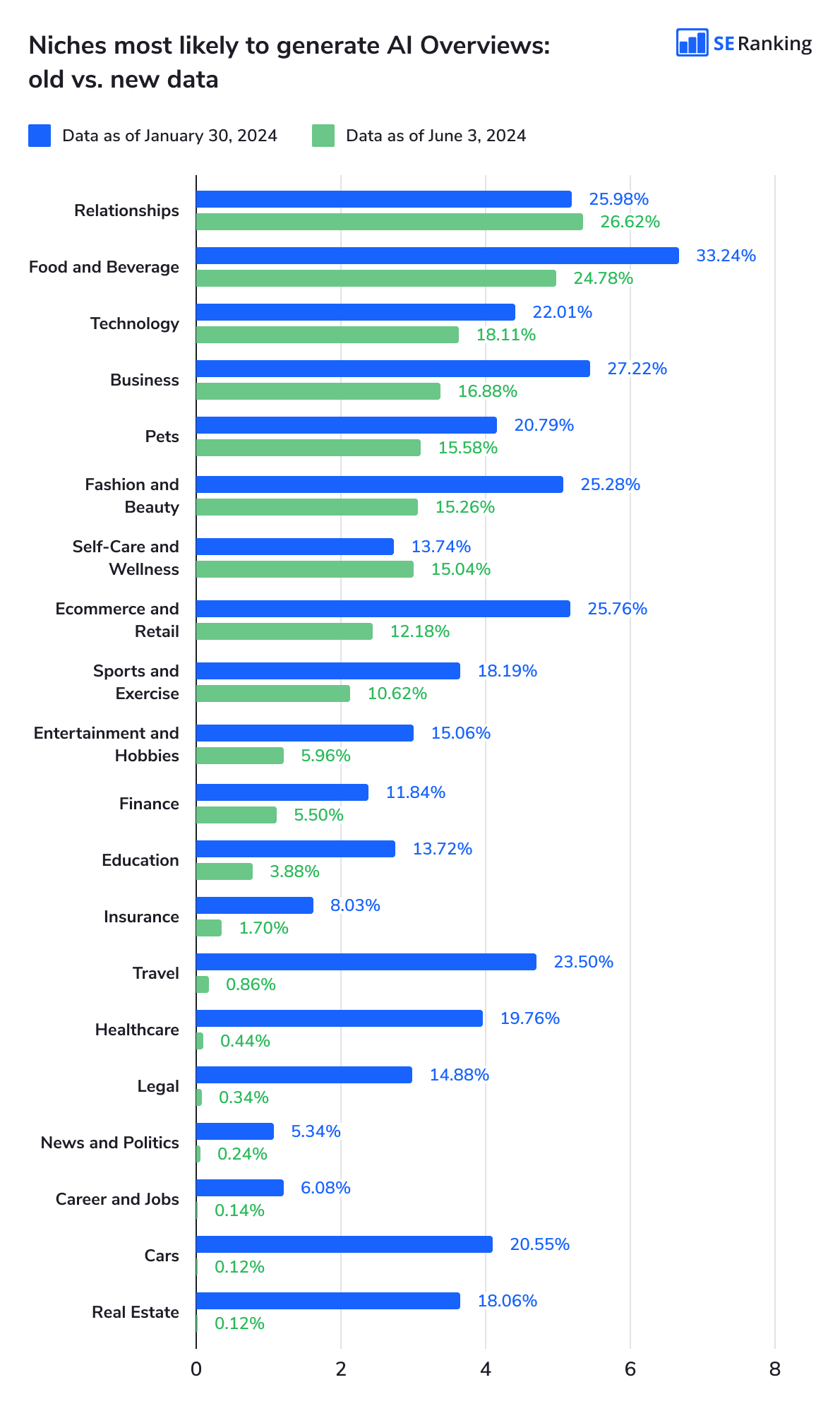

Google AIOs Down to 9%

Another study examines the current state of Google AI Overviews (AIOs) and their SERP frequency. This one, from SE Ranking, confirms the diminished visibility of AIOs, currently only seen by signed-in US users. The big finding is that "only 8.71% of keywords (out of 100,013) have AI Overviews." SEO Clarity earlier found it was 7.6% – a massive decrease vs. the SGE Labs period (64% to 80%+) and post-I/O rollout. According to SE Ranking, AIOs appear more often in certain verticals and are triggered by longer keyword strings (10+ words). Interestingly, AIOs are also correlated with "keywords with lower CPC values, typically below $0.5. Lower CPC keywords are often associated with informational, niche-specific, non-commercial queries." Relationships, food and beverage and technology are the top three verticals (see chart). Conversely, Real Estate, Cars, Careers and News see the fewest appearances. AIOs generally link to well-known domains with recognized authority. Some of those have changed in the past several months, however. For example, Reddit and Nerdwallet are gone from the top 10. But generally, the sites that show up in AIOs are "trusted information sources and [ ] highly visible in organic search results."

Our take:

- There are almost zero AIOs (if not zero) in local. They really didn't add much to the Pack, during the SGE time period.

- It makes sense that AIOs appear more often for informational queries and in certain verticals, but it's hard to discern the vertical logic here.

- Google is now being very cautious, given past AIO snafus. It's not clear, however, that they can avoid future gaffes without a major AIO overhaul.

Google Culture: Profits over Research

Google acquired London-based AI research firm DeepMind in 2014 for approximately £400 million ($650 million at the time). Almost a decade later, in 2023, Google merged its homegrown AI efforts (Google Brain) with DeepMind to streamline disparate and often competitive AI operations. Since that time, reportedly, Google has pushed DeepMind to be less of a research unit and more of a product development pipeline. Google would undoubtedly dispute (or spin) this. Bloomberg, reporting on the history of Google AI and the DeepMind merger, says the company "has faced internal challenges, including cultural differences and balancing commercial and scientific priorities." An internal critique is that "pure research is being overshadowed by commercialization efforts." While productizing and commercializing AI makes sense in many cases, there's concern that research will suffer and Google is pushing too hard to make money off of AI.

Our take:

- Google is under pressure to generate double-digit quarterly revenue growth to please investors, who now seem to be its primary audience.

- As we and many others have argued, Google's AI efforts are at least partly reactive and, allegedly, driven by panic.

- Google's hastily put together Paris 2023 event (a day after the BingGPT unveiling) seems to be some evidence of that.

Recent Analysis

- Near Memo ep. 161: Rand Fishkin interview: Zero click, regulating Google & marketing in a zero click world.

- Hindsight: Self-Preferencing Behind Google Maps' Rise, by Greg Sterling.

Short Takes

- Google Maps exploit can screw your rankings and get you suspended.

- Google rewards regularly updated Google Business Profiles.

- Google Local Knowledge Panels get new menu button.

- In the EU, it's ads and Local Pack results; organic less visible.

- Google: If you don't like AI Overviews use the "web" filter.

- Slightly fewer links to Reddit in search results but traffic way up.

- YouTube tests server-side ad injection to defeat ad blockers.

- How to adapt your SEO strategy in the an era of social search.

- Reddit plans to serve new "conversation ads" in comment threads.

- Report: Perplexity ignores robots.txt and other shady stuff.

- Mozilla buys ad measurement and optimization tool Anonym.

- Responding to OEM backlash, Apple cedes some control over CarPlay.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.