AI Search 8%, Mrwhosetheboss, Google DMA Compliance

Is AI Search Rising?

There's an ongoing debate about whether Google is seeing any usage erosion from social sites or AI. Survey data suggest yes, while behavioral data argue no or not much. However, a relatively new survey of 1,300 US adults conducted by investment banking firm Evercore (h/t Christian Ward) found that 8% of users now rely on ChatGPT as their "go-to search engine," up from 1% in a previous survey. The firm also reportedly found that Google’s consumer market share "dropped from 80% to 74%." (We're relying on coverage because we don't have access to the data directly.) This survey seems like an outlier and probably not an accurate reflection of the market as a whole. Indeed every third party traffic data source shows Google with a significantly greater share. But the Evercore survey does suggest or reflect some vulnerability for Google. And when you look at this data in the larger context of everything else, it does seem like there's movement happening. Is it material? Not yet. Google believes, however, that its experience and its data advantages will enable the company to prevail against rivals.

Our take:

- The comments about search experience and data advantages were made by Google’s head of search Liz Reid at a conference this week.

- Arguably, Google's search data advantages are the result of monopolistic behavior, recently criticized by the Google antitrust trial court.

- It would be a mistake to assume anything here is inevitable – one way or another. But Google is unlikely to be "dethroned" any time soon.

Mrwhosetheboss Google Takedown

Arun Maini, a British YouTuber known to his 20+ million subscribers as "Mrwhosetheboss," wades into the debate over Google search quality. The video he produced (below) repeats all the familiar arguments about Google's alleged decline. The video is going viral and may be persuasive to those not in the industry. His three main arguments are: 1) search results have too many ads, 2) cynical SEO tactics have made search worse and 3) Google has become enshittified and is focused almost entirely on maximizing revenue. Maini, who reminded me of a British Marques Brownlee, pivots at the end (hypocritically) to a pitch for a sponsored VPN product. But before that moment I was engaged. We still don't know how widely the views he expresses are held by "ordinary users" (vs. industry insiders). From Google's perspective this is another unwelcome, high-profile broadside against its brand and reputation.

Our take:

- Cumulatively, the numerous Google critiques over the past several years have got to be taking a toll on Google's brand perception.

- That may be reflected in the company's loyalty numbers, which have meaningfully declined over the past two years.

- Included in Maini's criticisms are AI Overviews, though consumers appear to like them. The Google antitrust trial exhibits, which Maini also discusses, have made people much more critical of Google.

Google DMA Compliance Research

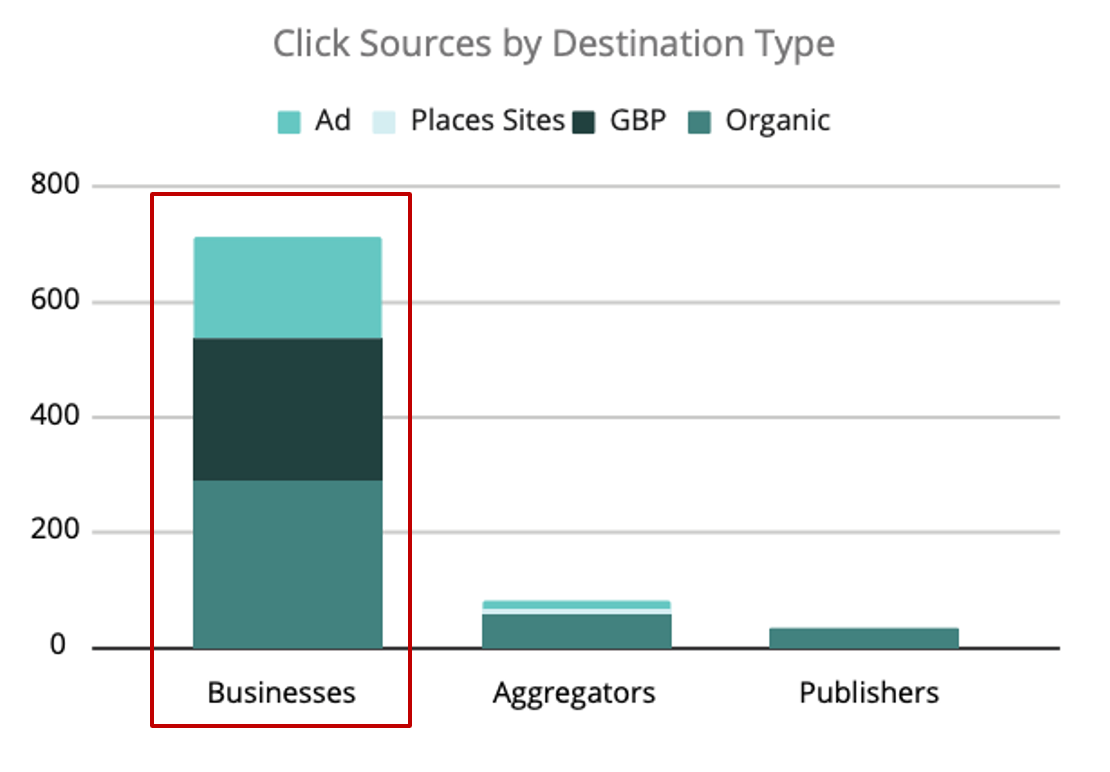

Earlier today we presented new research at the SIINDA conference in Croatia on Google DMA compliance in Europe. The research was a joint initiative of Near Media and SIINDA and involved behavioral testing in a home improvement sub-vertical in Ireland, Germany and France. The findings, at a high level, are consistent with what we separately discovered in Restaurants and Hotels. Google's DMA accommodations – i.e., Places Sites, Aggregator Carousels, refinement chips – are having a negligible impact on engagement, clicks and traffic. For example, Local Packs/GBPs saw 20x more engagement than Places Sites, which captured only 2% of all engagements. Beyond DMA compliance, the research offers insights into buyer journeys in Europe, which vary by country and by vertical. For example, Germans clicked more ads, the French were more brand-focused and the Irish used "near me" queries more often. And although Pack/Maps/Finder/GBP data were a dominant source of local business "considerations," there were still CTRs to websites. Zero-click search is now widely assumed to be the norm, but here we found 71% of searches ended with at least one click to a website.

Our take:

- Traffic sources to websites roughly broke down 40% - 40% - 20%: GBP, organic search, and ads in that order.

- Places Sites and Local Packs were usually in top SERP positions, except in France where they were often further down. France also had fewer ads.

- The pattern of citing reviews as top influence but not reading them held true here too – though more read them (~50%) vs. earlier studies.

Recent Analysis

- Near Memo episode 178: Google tests AI organized carousels in local, Facebook tests new local tab, Google customer loyalty declines.

- Google AI Organized Restaurant search results, by Mike Blumenthal.

Short Takes

- BrightLocal business listings visibility study.

- Mapquest introduces Android app "private maps."

- Google review appeal tool allows selection of multiple reviews at once.

- A new approach to content creation in a zero-click world.

- An SEO strategy for AI powered search.

- Moz: A content and SEO model for a changing search landscape.

- Campaign: Digital OOH, AI and Pods, with location-sensitive messaging.

- Handicapping potential Google antitrust remedies.

- Perplexity gets "cease and desist" from the NYT.

- Shopping: traffic from gen-AI engines have "surged" since last year.

- MSFT's AI CEO Suleyman is trying to simplify Bing.

- Survey: top ranked tools for technical SEO.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.