Apple's $30B Ad Future, Agency AI Ambivalence, Tricks for Ad Clicks

Next week most of our content will move behind a paywall; please continue to support us by subscribing. We're thankful to all our readers and subscribers. And to all those in the US, Happy Thanksgiving.

Google Expects Apple Ad Competition

As Apple confronts the loss of Google's massive $20 billion in default search payments it appears to be ramping up its own ad business. The company will sell ads directly in its increasingly popular News app. As Axios commented, "The shift toward direct sales represents a significant milestone in Apple's advertising ambitions." In 2022, Google started thinking about Apple's inchoate advertising ambitions and what it would be like to have Apple as an ads competitor. Google issued an internal report ("Project Black Walnut") containing their informed speculation. It became a Google anti-trust trial exhibit in the current Google ad-tech trial (via Business Insider). Google estimated that "long term," Apple could build a roughly $30 billion advertising business. By comparison Google saw $238 billion in 2023 ad revenue; Meta posted $132 billion and Amazon had approximately $47 billion. Google expects Apple to monetize its own apps first, followed by third party apps and then eventually "the Safari web." Google speculated that Apple was generating $4 billion in mostly app store ad revenue "today" (2022).

Our take:

- Google expects Apple to monetize Maps, Spotlight Search and Apple TV among other properties.

- Spotlight Search will likely be merged with an improved Siri at some point. Maps and Search ads are logical to recoup some of Google's $20 billion that Apple is likely to lose.

- Apple has differentiated from Google's partly on the basis that it doesn't sell ads. Broad adoption of ads across properties creates a brand risk.

Agency AI Ambivalence

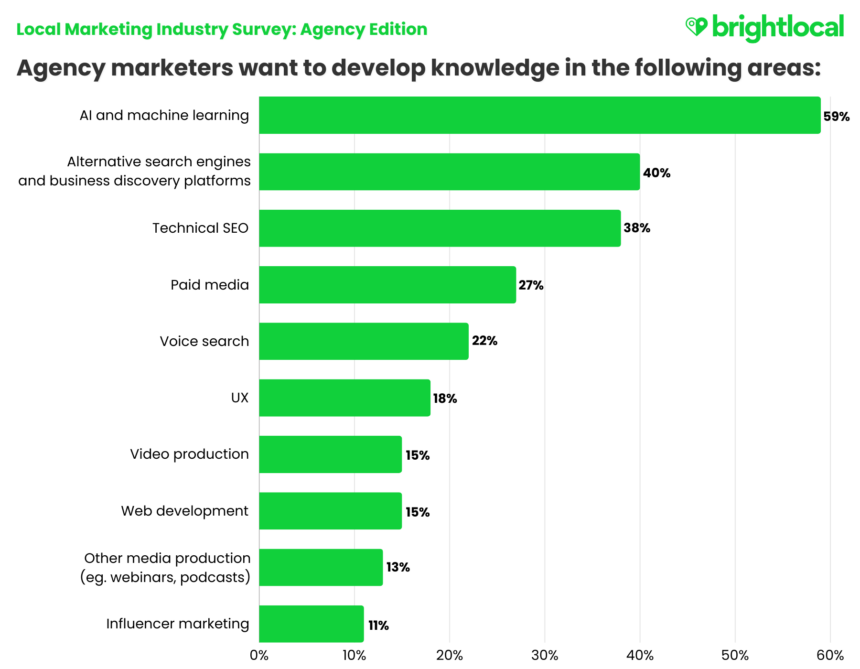

BrightLocal released its fourth Local Marketing Industry Survey, which is full of information about gender pay disparities, job satisfaction, hiring, training and technology investments. Conducted in August and September, the survey had 385 respondents. There's lots in there that's interesting; I'll focus on a few highlights. The most commonly offered agency services were GBP management (68%), SEO audits (65%), content creation (65%), technical SEO (63%), reporting/analytics (62%), web design (60%), on-site optimization (60%), citation building (53%), social media management (53%), and competitor research (51%). Strangely, reputation/review management didn't make the top 10. The top three reasons for churn were budget cuts, disappointing results and in-housing. Biggest opportunities for clients included foundational SEO (e.g., E-E-A-T), GBP optimization and "alternative search engines and business discovery platforms" (e.g., AI search). Indeed, AI was cited as the biggest area of opportunity for agencies themselves, with a majority (59%) of local marketers seeking to develop more AI expertise. But there was also skepticism and concern about the overselling of AI and its benefits. Full survey results are here.

Our take:

- BrightLocal did not discuss agency headcount, client numbers or revenues. We need to assume these are smaller agencies overall.

- Regardless of agency AI ambivalence, it will have a major impact on their businesses going forward in multiple ways. It may also prompt more in-housing among target clients.

- In Near Media's 2022 agency survey, the optimal services mix was 1) SEO, 2) web design, 3) paid search and 4) content marketing. They had highest demand, profitability and retention – but findings varied by agency size.

Google Tricks for Clicks

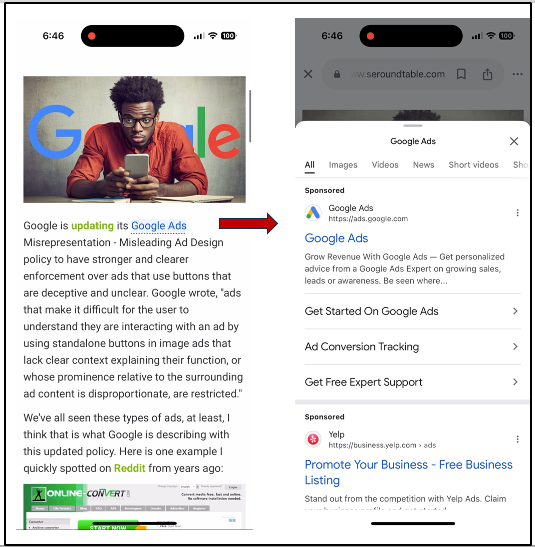

Google's justification for almost everything it does is "helping users" or "improving the user experience." Typically, anything that frustrates Google's intentions or designs "undermines the user experience" (see, e.g., DMA compliance responses.) If we pierce the veil of this rhetorical unreality, there's generally a business or revenue justification lurking just below the surface. That's likely what's going on with a newly introduced feature in the Google app for iOS: Page Annotation. Barry Schwartz first flagged the new feature. When Google recognizes entities on your site, it will turn them into links that generate Google searches. Here's Google's explanation of the purported consumer value: "This new experience allows people to quickly get additional context about people, places or things - without leaving the site they're on." As a practical matter what this is likely intended to do is generate additional search volume and more ad clicks, as Anthony Highman's example below illustrates. Highman speculates this move is intended to "hide losses in query growth." Regardless of whether it's actually hiding query losses, it's about generating more searches and ad clicks rather than consumer value.

Our take:

- Some data sources show Google's search market share increasing; however considerable anecdotal evidence argues against that claim.

- ChatGPT's referral traffic has been growing and there's evidence to suggest people are "diversifying" their search behavior.

- Google will remain the dominant search engine. However even a hint of slippage will put the fear of God into investors.

Recent Analysis

- Near Memo episode 184: GBP suspension woes and support #fails, Siri 'Sherlocking' search, and the coming fragmentation of search.

Short Takes

LOCAL

- In-store product inventory improves local rankings.

- Google showing LSAs in Local Pack for category searches.

- Optimizing location pages for local ranking and conversions.

- GBP: Age restricted products (e.g., alcohol) now require storefront.

- Yelp completes RepairPal buy, to add a third revenue vertical.

AI & SEARCH

- AI best practices for content creation.

- SearchGPT will be available through iPhone shortcuts.

- More people in the UK are using AI for product search/holiday shopping.

- And now an AI deep fake detecting browser.

- Longer posts are LinkedIn were probably written by AI.

GENERAL SEO & MARKETING

- Major Google clickthrough trends for Q3, by industry and platform.

- Google promised more search personalization; is it happening?

- Most marketing spend doesn't align with actual influence channels.

LAW & POLICY

- A mostly unconvincing argument against "breaking up" Google (NYT).

- Antitrust: FTC says it will investigate Microsoft's cloud business (WaPo).

- Summaries of closing arguments in US v. Google (ad-tech case).

- Google argues DMA demands hurt consumers, as it struggles to comply.

OVERFLOW

- Apple iPhone 17 "Air" will reportedly require multiple compromises.

- Overshadowed by Blue Sky, Threads says 35M signed up in November.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.