Biggest Traffic 'Referrers,' Online Oligarchy, 79% of Reviews on Google

Zero-Click Search 3X on Mobile

Two simultaneous reports provide a snapshot of the current state of the "open web," who's sending and who's receiving traffic. With the help of third party clickstream data, Rand Fishkin's SparkToro offers a detailed analysis of the largest traffic referral sources as well as "traffic hoarders." The study looked at traffic patterns between January 2023 and 2024. The data show that "Google’s almost 10X larger than the next largest referrer in our dataset." Google is also the source of 85% of search-referral traffic in the US. After that comes Microsoft sites, YouTube, Facebook, Reddit and Twitter (a much longer list is discussed). Fishkin also examines traffic referrers to the "long tail": sites outside the top 170. That list is a version of the first one with a few differences. The general thrust of the piece is that referral traffic to the open web is declining over time – an extension of Fiskin's zero-click thesis, which we've observed in our user behavior research. Perhaps most interesting is the finding that desktop Google refers out 3X the traffic of mobile Google (chart below). That pattern is also true, but with a much smaller discrepancy, for Facebook. Who's getting the most traffic from Google is the next item below.

Our take:

- None of this is a surprise: Google is the top traffic source overall to most sites and the dominant source of search-specific traffic.

- With the exception of search and social sites, the trend is toward traffic "hoarding." Big hoarders include GoodReads, Mayo Clinic and US News.

- OpenAI grew 82% YoY as a traffic referrer though it only delivered 0.32% of overall search traffic. Fishkin puts OpenAI in the search bucket.

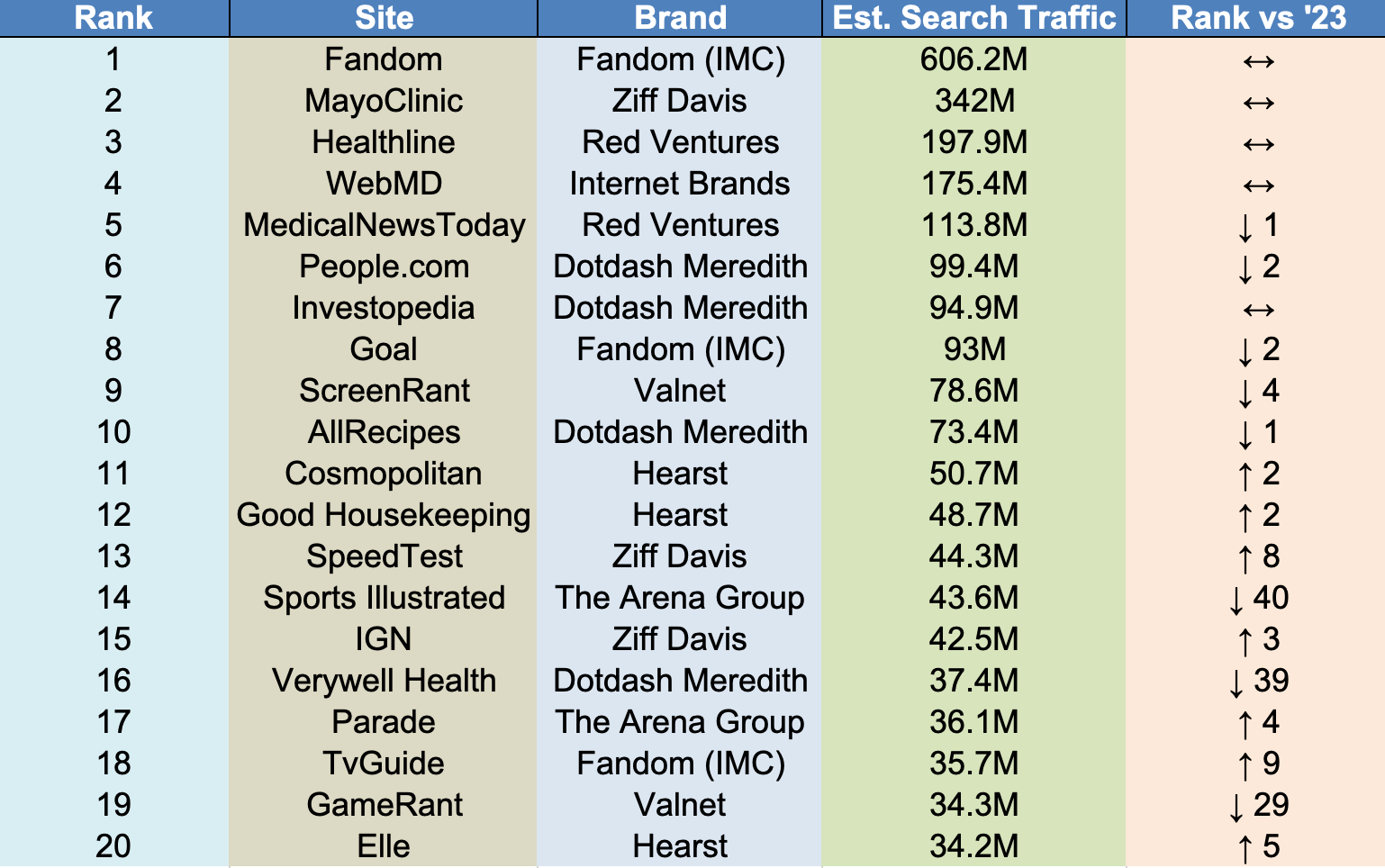

Online Oligarchy: 16 Publishers Dominate

Just as SparkToro's study showed a relatively small number of platforms dominate traffic referrals, Glen Allsopp's new report looks at the content publishers most benefitting from that traffic, with a focus on Google. His conclusion is that just 16 companies, and their subsidiary online brands, dominate Google results in English (chart below). The data come from several sources. Allsopp points out that the "[16] companies in this report owned 12 of the top 20 content sites and 7 of the top 10." Many of these publishers are heavily using affiliate links. (In an earlier, related discussion, Allsopp analyzed affiliate spam on Reddit.) Rather than a critique of Google, the post is an SEO analysis of some of the top 16's portfolio. Among other factors, Allsopp examines the impact of "bold" web design (and site-design features), keyword targeting strategies, niche site content, the benefits of investing in human-generated content, repurposing content, writing better headlines, social proof and other variables. These content publishers heavily rely on search for between ~50% and ~75% of their traffic, depending on the company, which translates into billions of dollars in annual revenue collectively. The flip side of that is that they're presumably vulnerable, some of them more than others, to Google's algorithm changes.

Our take:

- Allsopp's post is a set of observations/suggestions rather than SEO "rules." An interesting companion is Cyrus Shepard's "helpful" on-page elements analysis.

- Fishkin's post and Allsopp's together show how concentrated the sources and recipients of traffic truly are. It's a kind of online oligarchy.

- Allsopp's post is yet another illustration how Google's algorithm effectively controls the internet, including content and site design.

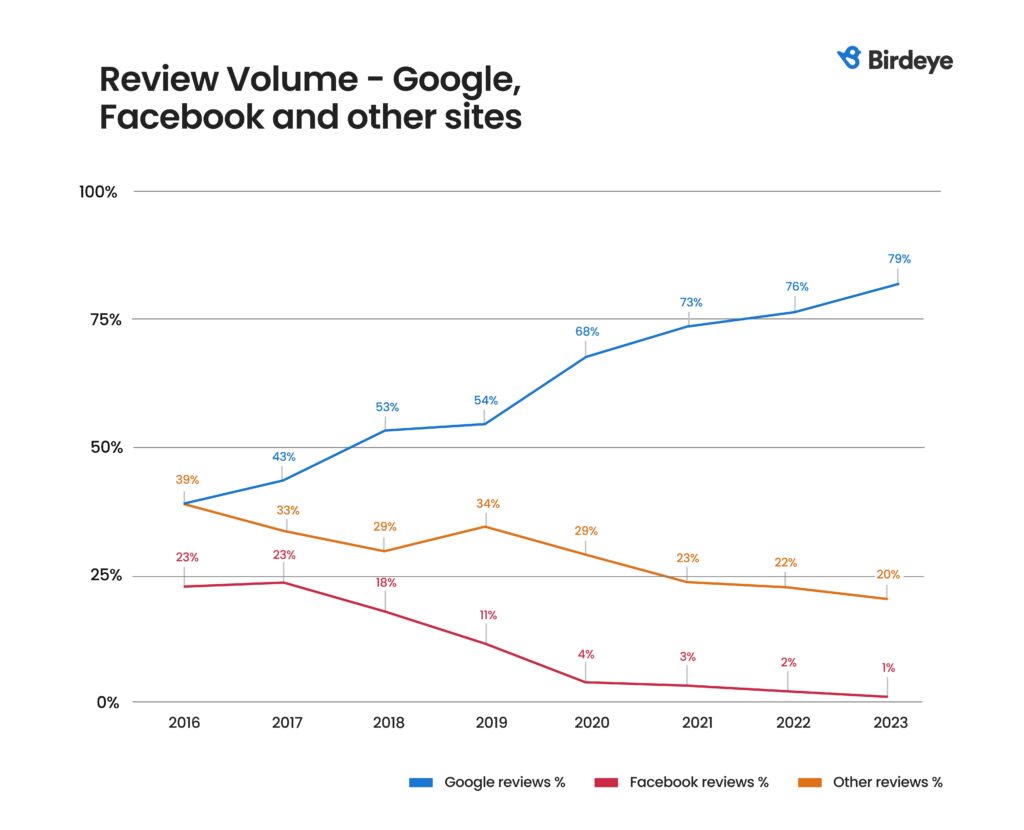

Report: 79% of Reviews on Google

Last month reputation management platform Birdeye released a State of Online Reviews 2024 report, drawing upon data from 150,000 customers across industry verticals. It paints a generally upbeat picture of the overall state of reviews (it doesn't discuss review fraud). And in a finding that will surprise no one, "79% of all reviews are written on Google." (Numerous review sites, including vertical sites, are discussed.) However, in some verticals Google's share was much larger: Retail (97%), Healthcare (94%), Legal (92%), Home Services (90%). Overall, review volume growth was 5% year-over-year, but 15% on Google. The report found that the average (Birdeye customer) star rating was 4.6. During the relevant period (2022 - 2023), "each business location, on average, received 66 new Google reviews." The dominant channel for review solicitation was email (60%) but SMS is growing (6%) and has higher response rates. Birdeye observed, "The average open rate for review request emails was 20%, with a 7% click-through rate. SMS review requests had a click-through rate of 37%." BrightLocal's recent consumer reviews report confirmed email as the top review request channel, but also showed SMS gaining. Birdeye said that 63% of reviews received a response (up 10%) and more than 40% of those responses were automated, with the Home Services and Legal categories showing the highest percentage of automation.

Our take:

- While a massive sample, these are also exclusively Birdeye customers. Review response rates and average ratings are not representative of all businesses.

- As with the other two items, this report (especially the chart above) shows Google's sustained and increasing dominance – this time in the reviews space.

- But even as Google dominates local reviews, consumers are increasingly looking to multiple review sites (77%) as a kind of hedge against fraud.

Recent Analysis

- Near Media podcast 149: Google’s Core Update & FUD, BrightLocal Consumer Review Survey, Do Searchers Use the Local Finder?

- Google Doubles Down on the Local Pack in EU, by Mike Blumenthal

Short Takes

- Google testing competitor LSAs at bottom of Business Profiles.

- GBPs with real photos outperform those with stock images.

- Google manual actions targeted sites with AI content.

- Google: Don't scale content with AI to compensate for traffic declines.

- Google Core Web Vitals (FID-->INP) change won't impact rankings.

- Walmart using gen-AI to improve search and better compete with Google.

- Strategic decision: Musk is open-sourcing X's AI Grok.

- Apple testing Performance Max-like ads platform.

- Tech companies pull back on ad spending with big agencies.

- Study: social media engagement does not translate into website pageviews.

- Google StreetView making a comeback in privacy obsessed Germany.

- Car OEMs spying on drivers, selling data to insurance carriers (NYT).

- End of "location intelligence"? FTC cracks down on location data brokers.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.