Branding vs. Paid Search, Location History, Judge vs. Jury

AirBnB: Branding vs. Paid Search

It's probably unfair to say Google's almost continuous algorithm updates, UI changes and the advent of SGE are part of a larger "conspiracy" to drive ad revenue. But that may be their practical effect. For example, Local Services Ads are highly effective for Google, evidenced by continued category expansion. They "capture" significant traffic that would otherwise go to the Local Pack or organic listings. And, depending on the category, local businesses may feel compelled to use them. Brand building is one response to all this – as a hedge against SERP volatility and the pressure to buy search advertising. One case in point is AirBnB. Since 2019, the company has increasingly shifted focus from performance marketing to brand building. Company executives said last year that more than 90% of its traffic is now direct or organic and that they use paid search in a more limited way post-pandemic. AirBnB is no longer "buying customers," says CEO Brian Chesky but doing "education" through brand advertising. The focus on brand was a major strategic shift that has apparently paid off. Revenue has continued to grow since cutting its SEM budget without traffic losses.

Our take:

- Companies shy away from brand campaigns because they often don't produce immediate results and they're challenging to execute.

- Paid search has a role to play for sure. But if you're dependent on it for traffic and customer acquisition, you're in a vulnerable position.

- It's challenging, though not impossible, for local businesses to build brands with great products/services, social media, video and PR.

Google Does Right Thing on Location History

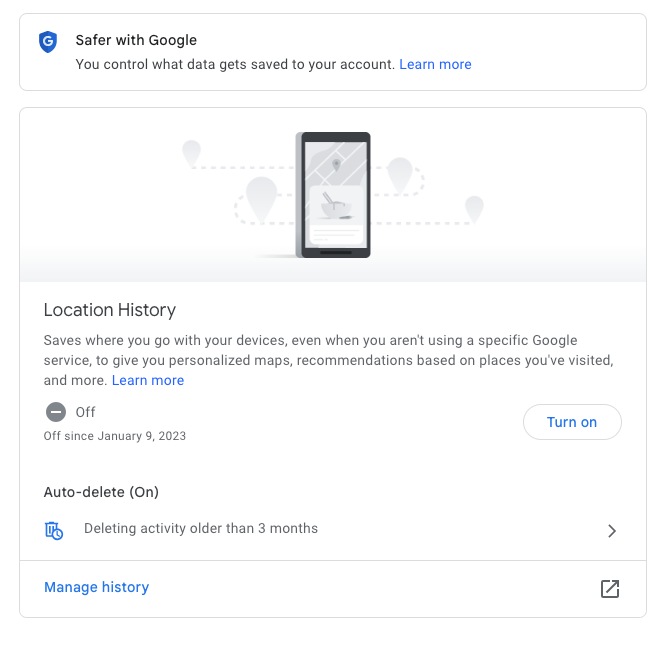

Google's tracking and storage of location history has become increasingly controversial since 2018. The company has been repeatedly accused of deceiving users and sued. Most recently it paid $155 million to settle claims – following an earlier $392 million settlement – that it misled consumers about about location tracking. Google needs/wants user location for multiple purposes, including ad targeting and attribution. Many of its services also work better with location turned on. However, the company didn't make managing location transparent or easy for most users. And the storage of massive amounts of user location data made Google attractive to law enforcement, which sought so-called "geofence warrants" that required surrender of information on all devices in a specific geographic area (just found unconstitutional). In the post-Roe world, location history was also being seen as an enforcement tool by abortion opponents. Given these headaches, Google announced changes to how it manages location. Most significantly, location history will be stored on the device, not in the cloud, making it more private. This change is partly self-interested but also the right move.

Our take:

- Apple has been selling privacy as a competitive advantage. And location tracking was becoming toxic for Google among the privacy conscious.

- Google wants people to turn on location. It's seeking to assure users that location is not synonymous with "surveillance."

- It's not entirely clear that law enforcement won't still try to access/abuse location data but Google's move has made that less likely.

Google Antitrust: Judge vs. Jury

There's been speculation about why Google recently lost its trial to Epic and Apple, facing the same antitrust claims, prevailed (though Epic is appealing). One of the key differences was the presence of a jury in Google's case. Apple's was decided by a judge. A jury unanimously found Google’s app store was an illegal monopoly. If that's the major difference, the fact that the current DOJ case against Google is a "bench trial" (judge only) could be positive for the company. The DOJ case ruling won't come until late May or June and US District Judge Amit Mehta said he has "no idea" what he'll decide at this point. Most reporting on the trial suggested that the government's case was effective. Even though Google remains one of the biggest global brands, its reputation has suffered generally, which may partly account for the jury's decision in Epic. So the judge-only trial in the DOJ case may benefit Google. But any outcome will likely be appealed and take years to be resolved. Breaking up Google is probably not in the cards and investors will probably be unmoved by any negative outcome for Google. As we've argued, consumer behavior is also unlikely to change either.

Our take:

- If nothing changes will all this have been a colossal waste of time? Yes, unless there's a dramatic remedy, which we're unlikely to see.

- ChatGPT/AI stand a better chance of challenging Google's dominance than the DOJ's antitrust case. However, that's looking less likely now too.

- The next antitrust case against Google (alleged ad monopoly), will start in 2024. If liability is found, there are more clear-cut remedies (restructuring).

Recent Analysis

- Near Memo episode 138: Google's Reactive Behavior in 2023, LSA Ad Efficiency, Notebook LM: AI for the Rest of US.

Short Takes

- Moz: 27 SEO-related predictions for 2024.

- Google: business hours was a ranking signal but now turned up.

- New Google Local Services ad categories added.

- New/old share feature for Google Business Profiles.

- Review bombing not policed on Amazon-owned Goodreads.

- As we predicted, the Adobe-Figma deal is dead.

- If you've got a low-quality site, AI content might help your SEO.

- Hallucinations: AI chatbots not a reliable voter information resource.

- Google launches first paid campaign to promote Bard to consumers.

- The European AI Act won't come into effect until 2026.

- Hedge fund newspaper ownership continues to destroy local news.

- TikTok wants to be more like YouTube but that may backfire.

- December Xmas shoppers more likely to go into stores.

- Pinterest is being revived by GenZ.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.