ChatGPT Omni, HCU Travel Losses, CPCs Up CVRs Down

ChatGPT: Search Successor

After anticipating a "search engine" and direct Google competitor, what OpenAI announced instead was ChatGPT-4o ("o" for "omni") – an improved voice assistant with faster and better performance. It can "reason across audio, vision, and text in real time." The company also made GPT-4 free to all users, opened up access to its GPT store, announced a desktop application and cut the price of API access by 50%. In an economical 26-minute presentation, CTO Mira Murati discussed and demonstrated some of the new capabilities, including real-time translation (50 different languages), interactive math problem solving and impressive computer vision. The assistant is now more conversational, has more "personality" and can read emotion in human faces and presumably voices. Web search is still provided by Bing. No, this isn't a search engine but it sure feels like the successor to search.

Our take:

- An informal poll I conducted last week shows there is anticipation and pent up demand (in the industry) for a viable alternative to Google.

- ChatGPT has the "magical" quality that Google used to have – it offers a simple UX that hides massive complexity.

- ChatGPT has claimed the mantle of technology innovation from Google. There's still hallucination and uneven "search results." But AI could replace Google for most "informational" lookups.

Google’s HCU Impact on Travel

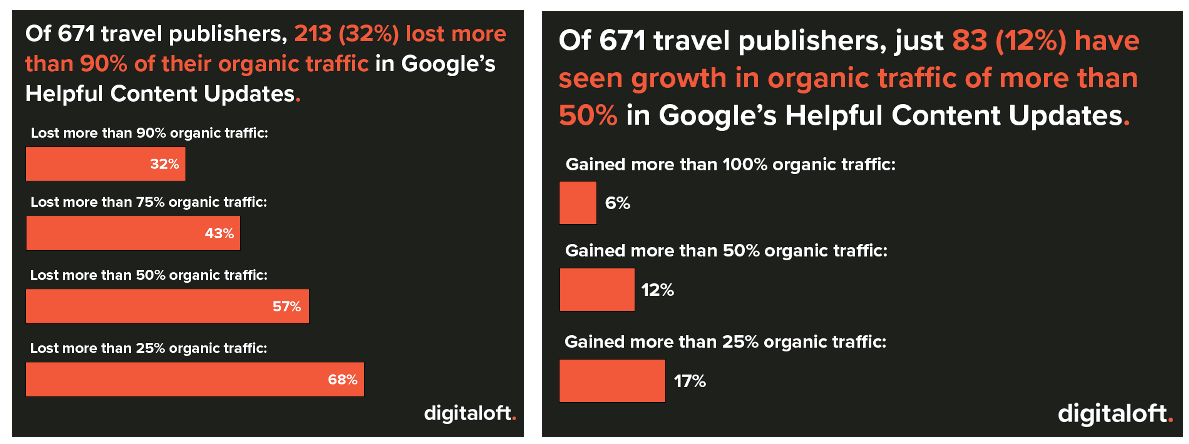

"The definition of ‘helpful’ is massively subjective," argues Digital Loft in its analysis of the Helpful Content Update's impact on hundreds of travel sites. It paints a detailed picture of a mostly punitive update that caused significant traffic losses to numerous well-recognized travel destinations. Indeed, the vast majority of sites in the study lost traffic, in some cases more than 90%. Only a relatively small number gained traffic by comparison. On the winners list were Fodors, Cruise Critic and Lonely Planet. Losers included The Culture Trip and Thrillist, two popular travel sites. Digital Loft theorizes that many of the sites that lost traffic were "pushing the bounds of [travel] relevancy" with "content created because it can rank and drive traffic." This is what Google said it was going to do: punish content created "for search engines," cynically trying to rank for keywords. Digital Loft also points to many sites that were justly demoted but it argues that "many travel publishers that experienced traffic losses [ ] didn’t deserve it .... way too many sites have been caught in the crossfire of the HCU."

Our take:

- All publishers create content for search engines – a necessity. It's really a question of degree more than "content for people vs. search engines."

- Google faces existential threats in the combined form of AI content spam, AI search alternatives and social media with younger users.

- Its algorithm updates are about trying to hold on to usage to protect revenues. There's a lot of collateral damage happening as it does this.

Google Ads: Costs Rising, Conversions Aren't

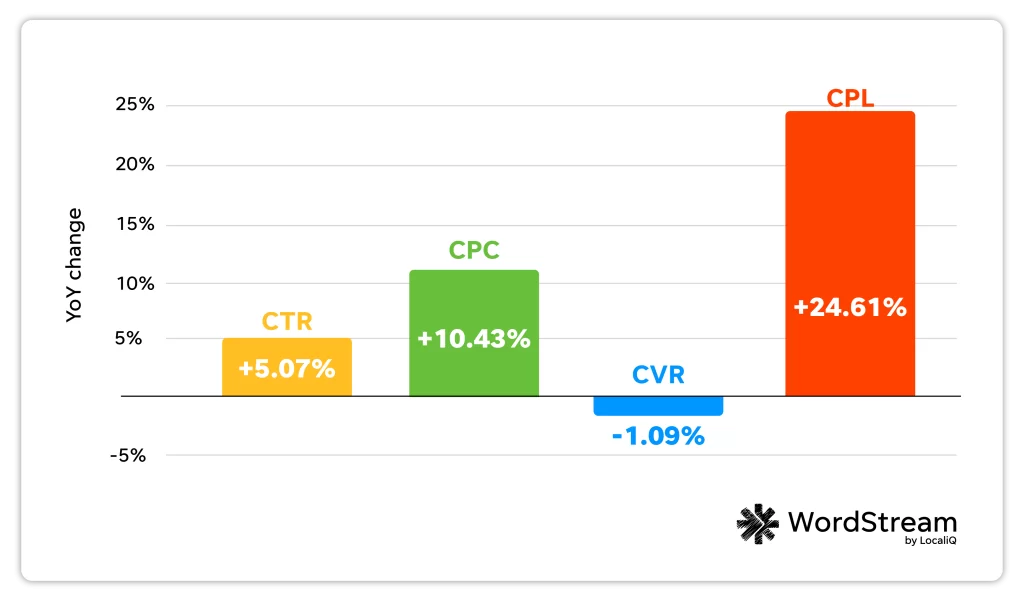

The good news (for Google) is that click-through rates are up 5% year over year, according to the latest Google Ads benchmarking report from Wordstream. The bad news, for search advertisers, is that costs are up considerably – hence Google's "blowout" Q1 – but conversions are down: CTR 5.1%, CPCs 10.4%, conversions -1.1%, cost per lead 24.6%. The report partly attributes all this to broad match and a blurring of ads vs. organic results, which has been an ongoing complaint and discussion topic. "As ads are blending into organic results, and often take up more space on the SERP, even for search terms with low commercial intent, lower CVRs may be more common ... because of an increase in clicks from people who may not be ready to convert," argues Wordstream. Google and third party experts, in the report, assert that rising costs are due to macroeconomic forces and "inflation." Really? CTRs, CPCs and conversions vary considerably by industry, among the 23 verticals in the report. It also presents year-over-year comparisons.

Our take:

- The report provides high-level recommendations, including prioritize ROAS, do frequent audits, adapt ads to be more "conversational" and others.

- Not mentioned: diversify away from Google to other channels. Double down on SEO and organic, but ...

- With SGE/AI answers and the anticipated loss of organic traffic, Ads will become even more competitive and costly.

Recent Analysis

- Near Memo episode 156: Is Google finally fixing LSA reviews?; why Google fails; DOJ slide deck details abusive Google ad practices.

- Is Google Replacing LSA Reviews with GBP Reviews?, by Mike Blumenthal.

Short Takes

- SGE is rolling out this week in the US.

- GBP testing business owner attribute/identity.

- Google testing more prominent social media posts in GBP.

- Four searches show how Google is changing (WaPo).

- Six unpopular SEO opinions you need to consider.

- Looks like Apple going with OpenAI to beef up Siri.

- Booking.com a new "gatekeeper" under DMA in Europe.

- USAToday: Google anti-coupon moves hurt consumers, SMBs.

- Traffic to news sites from Facebook fell by 50% in the last year.

- Vector embeddings: keyword + link-based SEO thinking outdated.

- OpenAI building its version of robots.txt to allow opt-outs.

- TikTok testing AI search highlights, trying to prompt more searches.

- Despite antitrust issues, Google still in the hunt for Hubspot.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.