Competition vs. CX, Metaverse Minority Report, More SMB SaaS Data

Is Promoting Competition the Enemy of CX?

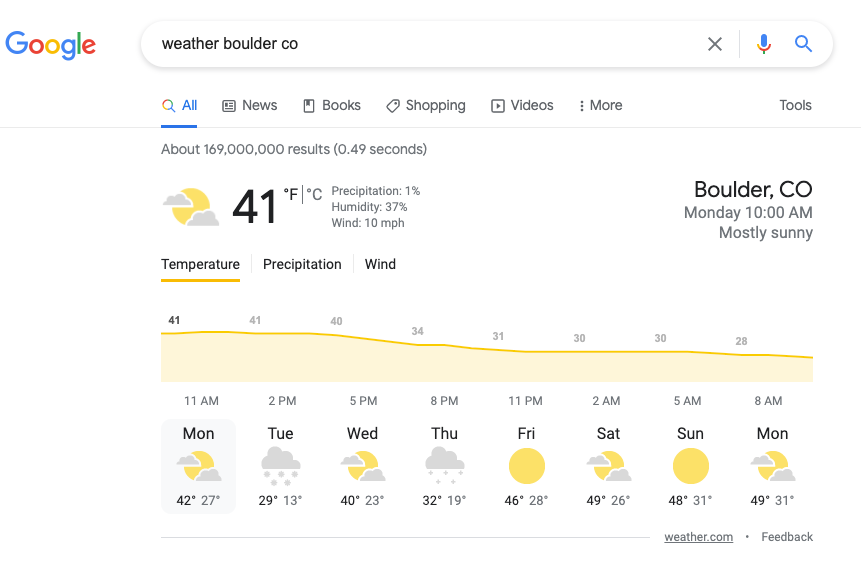

The anti-tech lawsuits and legislation are piling up. Bills to end "surveillance advertising" and platform "self-preferencing" are moving through Congress. And last week the European Parliament approved the proposed Digital Services Act, which does multiple things to rein in "big tech," including limiting ad targeting. The tech firms themselves, sensing new vulnerability, are aggressively lobbying on both sides of the Atlantic. One of the arguments the major tech companies make is: bundling or integrating multiple products improves customer experiences. (They're not entirely wrong.) The classic example is the visible integration of GBP/Google Maps into the SERP. Critics argue, however, this limits consumer choice and offers a worse experience – because Google doesn't necessarily have the best version of the product in question.

Our take:

- As a guiding principle, more choice is better. But frequently consumers just want information (e.g., weather, sports scores, business hours). And the big tech platforms are generally more trusted than unknown brands.

- Restricting "self-preferencing" could improve choice but would, in some cases, introduce "friction" or produce a less convenient experience.

- The tension: how to promote competition/choice without crippling useful "integrated" experiences. Extremely challenging in practice.

Minority Report in the Metaverse

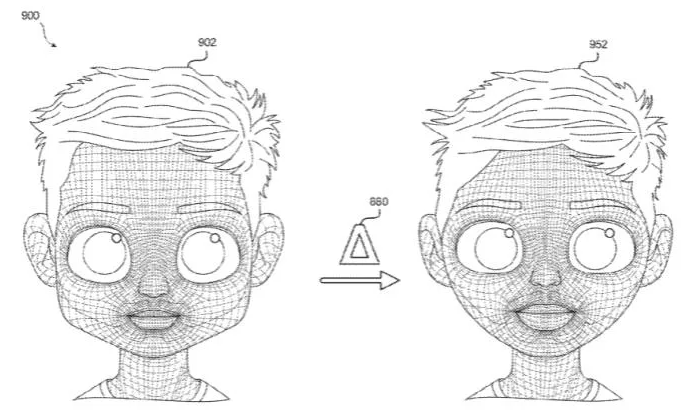

A week ago The Financial Times reported on numerous Meta patent applications tied to potential monetization of VR and virtual worlds. Depending on your perspective, these ideas are either intriguing and logical or highly invasive and profoundly creepy. Digital goods that correspond to real-world objects, branded and targeted ads are of course present among the patents. There's considerable discussion of replicating the real world in 3D, including likenesses of people, described by one critic as a "human-cloning program." Indeed, personalization is a prominent part of the company's intended monetization plans. And much of all that reportedly depends on capturing biometric data: eye and face tracking, facial expressions/emotional reactions, posture and body position. These inputs would be combined with age, gender, interests and more to deliver ads and content designed to elicit the desired engagement or actions.

Our take:

- Expect a frenzy of metaverse patent applications (if not already happening) mining every conceivable angle. Lawsuits will come later.

- If this were another company, biometric data usage would be creepy but perhaps not quite as creepy as it appears here.

- There will likely be pre-emptive legislative or regulatory attempts to block some of the revenue/advertising vision, given Facebook's history.

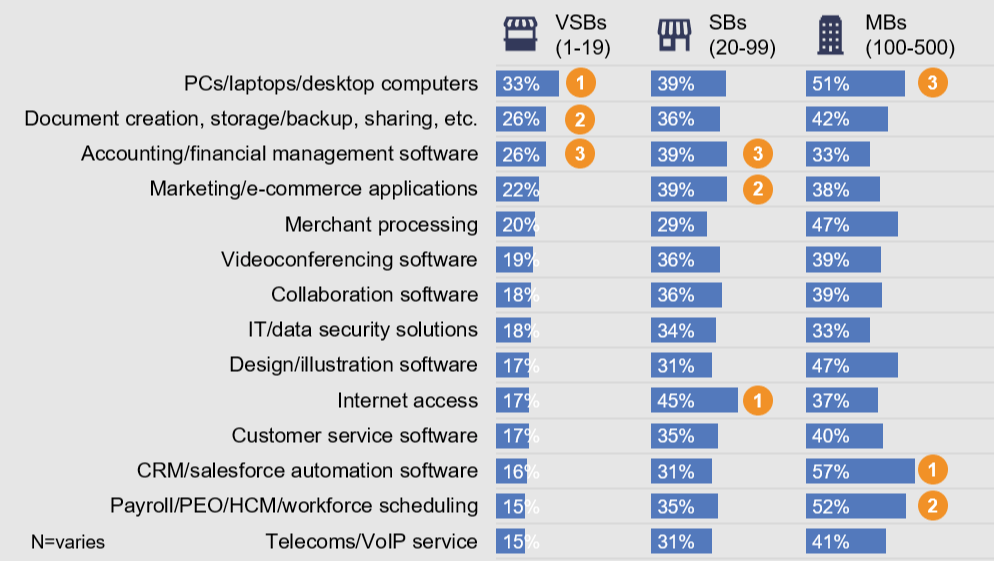

SMBs Focusing on CX, Ops with SaaS Choices

Last week we discussed a vCita survey of "micro and small business owners" about adoption of SaaS tools during COVID. A majority (60%) were using 1 - 3 new tools, although there was some ambiguity in the results. Now SMB consultancy Bredin has produced a similar set of findings. Based on a sample of 500 business owners (up to 500 headcount), it speaks to technology adoption in 2022 – both upgrades and new tools. Intended upgrades differed by company size. Overall, however, customer service solutions led across segments, followed by design software. Regarding new adoption (chart below), hardware was first, followed by operational tools. In fourth place was marketing/e-commerce. But for SMBs with 20 to 99 employees, it was: 1) internet access and 2) marketing/e-commerce. Businesses over 100 employees were most focused on CRM software.

Our take:

- This is a more nuanced set of findings vs. vCita's survey, although the latter had a considerably larger SMB sample (3K+).

- Bredin's data suggests most SMBs are using a wide array of largely disconnected SaaS tools, more than vCita's finding of 1 - 3 (60%).

- Freshworks data showed SaaS tools improved CX for SMBs' customers. Yet roughly half of SMBs don't trust their providers and may churn.

Recent Analysis

- Near Memo episode 48: Ending surveillance ads, SMB use of SaaS tools growing, Niantic and the "metavearth."

Short Takes

- Aldi Shop & Go is Amazon Go for Europe.

- Open Table: In-person dining approaching 2019 levels.

- Amazon, Google and MSFT thumb noses at FTC with buying spree.

- Walmart's GoLocal delivery service is totally white label.

- Convenience store 7-11 launches subscription-based delivery service.

- Googleplex architect says lavish perks create company "dependency."

- Google sued for allegedly false influencer Pixel testimonials.

- Opinion: Cryptocurrency is a giant ponzi scheme.

- E-commerce checkouts nearly even on desktop and mobile.

- Super Bowl ad slots $6.5M for 30 seconds (a record), nearly sold out.

- Marriott tapping TikTok influencers for global travel campaign.

- UK: Who are the people ditching their smartphones?

- B2B and verticals are sustaining VR as it waits for mass adoption.

- Virtual events one place where mixed reality may shine.

- Coke, Gucci, Louis Vuitton dabbling in "the metaverse" (read: games).

- Localization of the supply chain a trend in reaction to shortages.

- Video rated the the most effective channel, search a distant second.

- "Defamatory links": Google warns of potential SERP censorship in Oz.

- Five years out: Here come the flying taxis.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.