New Research: European Local Search Behavior in the Home Services Vertical

The results that follow below are an excerpt of our recent investigation conducted in partnership with Siinda into how European consumers search Google for home services.

Introduction

Near Media and Siinda assessed how consumers searched for kitchen remodeling professionals, how they evaluated the results presented by Google, and what elements of a business’s digital presence received the most engagement.

Among the questions we sought to answer:

- What search result interface types received the most engagement, and by extension, did the local search interface elements introduced by Google in response to the Digital Markets Act receive meaningful searcher engagement

- How widespread is the “zero-click search” phenomenon, whereby a searcher never leaves Google’s own properties before making a decision?

- What attributes of a business’s digital presence did consumers mention most frequently as influencing their choice of remodeling professional?

- Ultimately, where and how should a kitchen remodeling business prioritize its digital activities?

Additional background information:

- Our study methodology

- Near Media's prior European consumer research in Hotels and Restaurants

- A visual glossary of terms used in this analysis

Executive Summary

Google most commonly displayed its Business Profiles in positions 1 and 2, generating 20x the engagement for itself as the DMA-driven Places Sites module generated for Aggregators and Publishers. Where Google Local Packs appeared in the top two results, consumers were highly likely to ultimately choose a business based on its Google Business Profile.

Consumers in all three countries demonstrated a willingness to scroll deep into the page to find a professional that resonated with them prior to deciding whom to contact first, whether searching in Google Business Profiles or traditional organic results.

While reviews and ratings were important to consumer decision-making in all three countries, behaviors and specific attributes mentioned by consumers appeared to reflect meaningful differences by country.

German searchers were more likely to be drawn to ads – and a website with a professional look-and-feel. French searchers were more likely to be drawn to larger brands, and tended to evaluate one extra professional before deciding whom to call first. Irish searchers were more likely to include “near me” or explicit references to location in their queries, and had a lower review volume threshold than their German and French peers.

There was little evidence of zero-click search in the kitchen remodeling space – in fact, website photos mattered almost as much as customer reviews when it came to choosing a professional to contact first.

Selected Results of Our Research

SERP element visibility and position

Google's own profiles

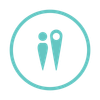

Google Business Profiles were visible for 78% of explicitly localized searches (and for 39% of other searches where Google inferred implicit local intent), usually in Position 1 or Position 2.

New DMA response element: Places Sites

Places Sites were visible for just 48% of localized searches and 20% of others.

New DMA response element: Aggregator Carousels

Aggregator Carousels were nearly nonexistent, visible for just 3% of explicitly localized searches, and receiving just 1 out of 848 total clicks.

SERP element engagement

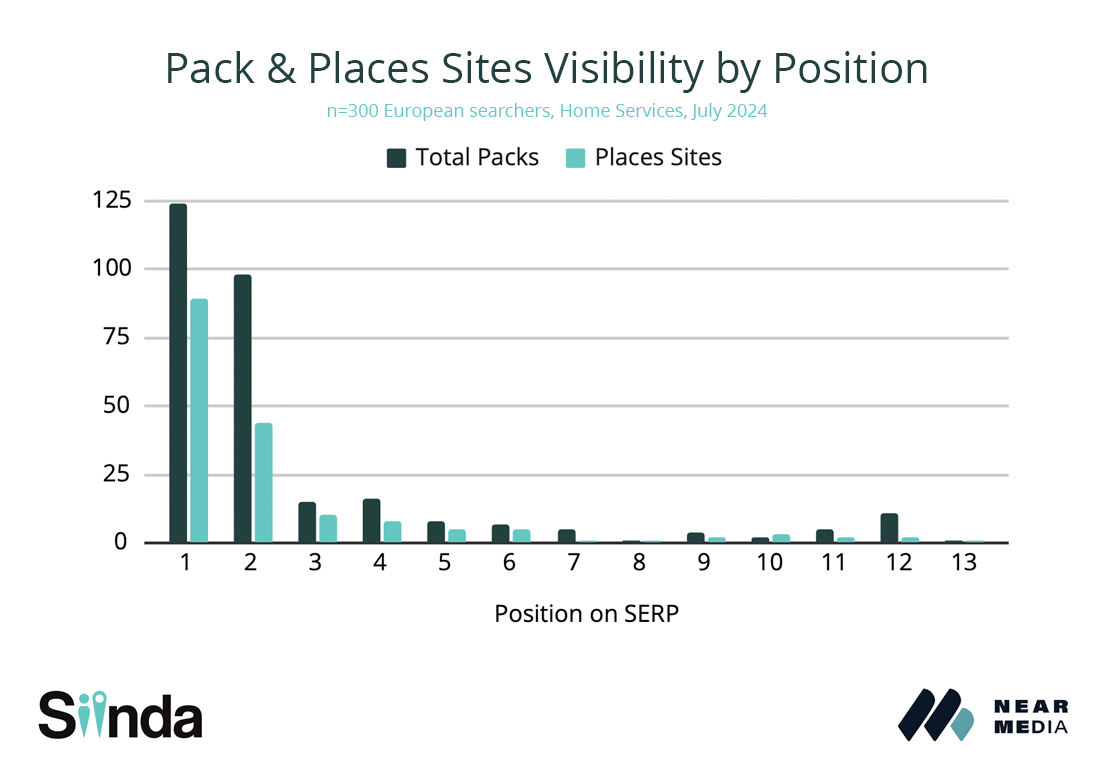

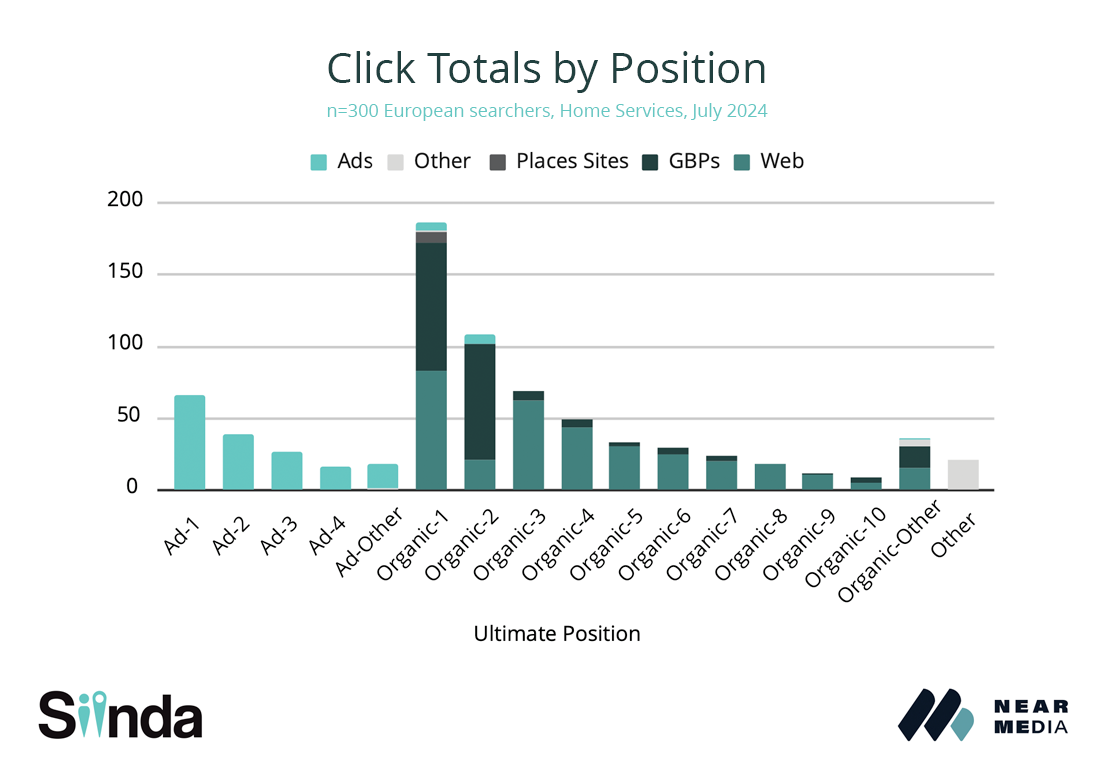

Engagement with Google Business Profiles drove 42% of all clicks for searchers where they were visible. Most clicks on Google Business Profiles came when the Local Pack was in the first or second position; 75% of clickthroughs on position 2 went to Google Business Profiles, and 50% of clicks on position 1.

Meanwhile, Places Sites received just 2% of clicks when they were visible, even though they were frequently positioned above the Local Pack. From a clickshare standpoint, clicks to Places Sites came at the expense of traditional organic results: Google Business Profiles’ click share dropped only 0.5%.

Zero-clicks

Unlike our previous research in the restaurant vertical, we saw very little evidence for so-called “zero-click search,” where consumers began and ended their journey without leaving Google.

71% of all searches ended with at least one click, and most searches that ended without a click were simply unsatisfied queries, where the user subsequently refined their query and clicked through to at least one website. Users made very few choices without clicking through to the website of their chosen business.

Organic clicks

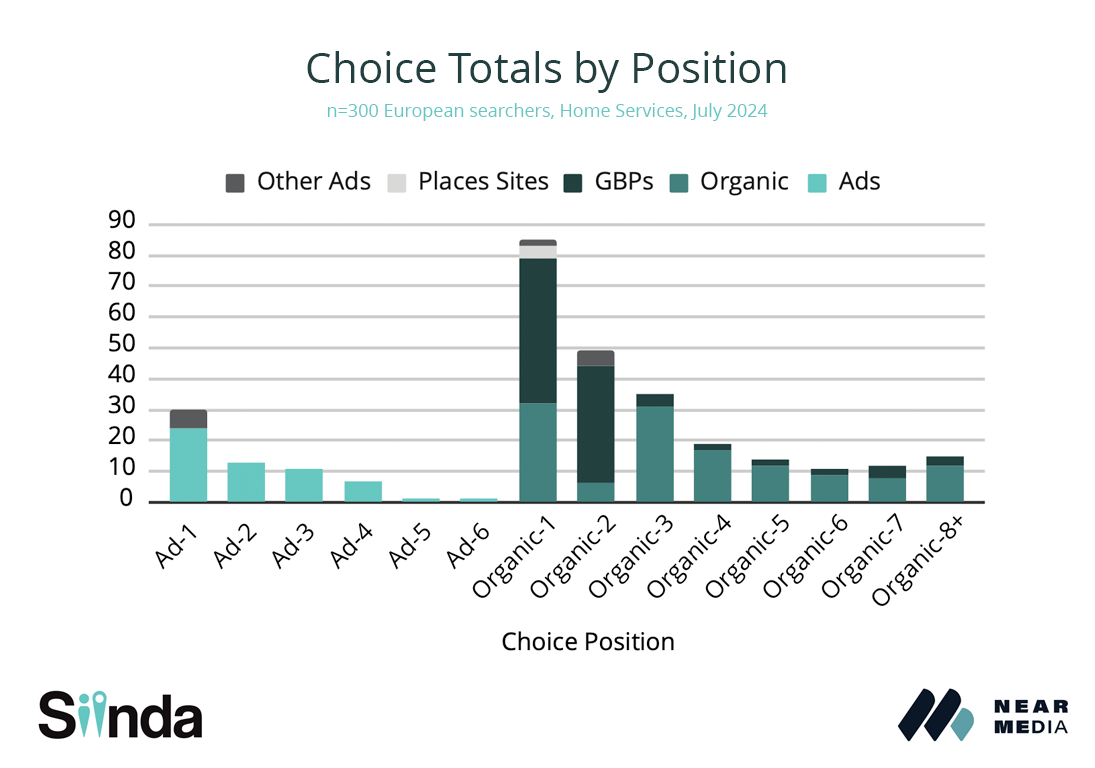

Users typically considered organic results well beyond the #1 placement. The “tail” of organic clicks all the way through position 9 was notable, with just as many organic clicks coming from the 5th and 6th positions in aggregate, for example, as position 1.

Google Business Profile clicks

The click distribution by position was similar for Google Business Profile results as for organic results.

While the top three Google Business Profile positions unsurprisingly drove the lion’s share of engagements, in the aggregate, more clicks came from users engaging with the map (where the concept of ranking is irrelevant) than from the #1 result across both interfaces. We saw plenty of deep scrolling in the local finder, with consumers using reviews and Google Business Profile photos to qualify (and disqualify) providers.

Click destinations

8 out of 10 clicks overall went to businesses (“Suppliers”). Just 1 in 10 went to Aggregators, and barely 1 in 25 clicks went to Publishers.

The vast majority of Aggregator traffic came from organic results (73%), not Places Sites (10%). For businesses, 41% of their traffic came from organic results, 35% via Google Business Profiles, and 24% via Ads.

Most consumers who conducted specific brand searches engaged with a brand’s website via organic results. While not prevalent, where brands employed review schema on their pages, these tended to draw searchers’ attention (and clicks).

Searcher choices

19% of all participants whose SERPs contained ads made an explicit, unprompted comment to the effect of “I always skip the ads” or “I don’t trust the sponsored results.” And yet Ads also drove 20% ultimate choices of business – in a few cases, even from Ad skeptics!

Only half the number of consumers who mentioned reviews and ratings were important to their choice of professional actually took time to read the text of reviews, however. Half simply used the rating and volume as a heuristic.

Choices followed a similar curve as discovery search clicks. The primary

difference was a slightly deeper Click exploration of Organic results below position 8, which rarely yielded Choices.

Reviews and ratings were mentioned by the greatest number of searchers as influencing their decision of whom to contact, with website photos–especially before-and-after project photos–a very close second.

DMA-related conclusions

- Google shows its own Business Profiles prominently for the vast majority of local searches–78% in the case of kitchen remodeling– and almost always in Position 1 or 2. Places Sites are visible at a much lower rate, just 48% of the time even for explicitly localized queries.

- Users are dramatically more likely to engage with a Google Business Profile than a Places Site: 20x more likely in the case of our kitchen remodeling scenario.

When the Local Pack was visible to users, Google Business Profiles drew the plurality of their engagement (42%). Google Business Profiles received twice as many clicks as aggregators and publishers in our study, many via the Google Map interface which appears prominently as part of the Local Pack and Local Finder elements.

Conversely, Places Sites drew just 2% of user engagements when they were visible. These clicks appeared to replace organic traffic that Aggregators and Publishers ranking in the same spot organically might have already received. Aggregator Carousels received a paltry 0.1% of all engagements.

Taken together, it would be hard to describe this as a fair and contestable playing field, as aggregators and publishers are ineligible to appear in Google Business Profiles.

Conclusions for home services businesses and home services aggregators

Businesses in all three countries should invest in a well-rounded presence, given the 40%-40%-20% breakdown of clicks and choices between Google Business Profiles, organic results, and Ads.

Consumers showed a strong desire to browse multiple results, frequently across multiple search queries, to find a provider that resonated with them. The top organic position certainly drove its fair share of clicks (and ultimate choices), but a well-optimized website didn’t need to rank #1 to win a consumer’s business.

The attributes of Google Business Profiles that swung the needle most for consumers were a strong review profile (median 4.9 reviews and 80+ reviews in Germany and France) and a nearby location (in some cases, a retail showroom). Many consumers conducted follow-up brand searches for a deeper dive into a business’s reputation, though only 50% of consumers actually read reviews at this stage of their remodel exploration.

Reviews and ratings are highly likely to influence a potential customer’s choice of professional, and customers have very high expectations: a 4.9 rating from a minimum of dozens of former customers.

Aggregators and larger brands should be sure to implement review schema to enable Google’s display of first-party ratings in organic search results.

Methodology

We recruited a panel of 300 German, French, and Irish consumers, split equally by country and across Desktop and Mobile devices, presented them with a home services search scenario, and analyzed and aggregated their narrated behavior in their native language:

You've wanted to remodel your kitchen for a long time and you're finally going to get started on it this summer. You've decided that it's too big a project to take on yourself and you're going to hire professionals for the job.

You decide to search Google to help find professionals for your project.

Browse and click any results you’d like. Please “think out loud” as you search and describe your thoughts and reactions.

We loaded the default Google.com homepage in their browsers at the start of the task. We then recorded their screens and audio narration (with permission), and aggregated and analyzed their behavior and decision-making rationales.

Any click was deemed to be a “consideration,” as was any extended lingering on an individual profile with narration that indicated the participant was evaluating that provider.

About Near Media

Founded by three veteran local and vertical search analysts in 2021, Near Media is an applied market research firm helping marketing executives maximize their SEO & paid search investments.

Through our unique combination of proprietary consumer research, localized search result page analysis, and step-by-step performance improvement roadmaps, we are the go-to strategic and tactical advisor for brands seeking to maximize their investments in paid, organic, and local search.

Focused largely on Google and its place in the local search ecosystem, we publish a twice-weekly newsletter and a weekly podcast on the latest updates shaping local search visibility and consumer behavior, and regular analyses of search product releases and local search market dynamics.

About Siinda

Siinda is the leading European based non-profit association bringing together agencies, brands, media and technology companies in the local search, digital advertising, media, mobile and “on demand” industry sectors. We foster partnerships through our extensive members network, containing many of the most prominent media outlets in Europe and globally.