Search Marketing Implications for European Hotel Suppliers

In Part II of our analysis of 300 European consumers' hotel search sessions on Google, we take a deeper dive into where and how they engage with search results, surfacing ways in which hotel Suppliers might improve their chances of acquiring a guest in this challenging ecosystem.

Part II of Google and Booking: The Symbiotic Gatekeeper Relationship in European Hotel Search

Summary

Our analysis of 300 European consumers reveals that Booking.com dominates hotel search results on Google. Consumer engagement with Google’s Aggregator-centric Places Sites module is almost non-existent, but so is organic consumer engagement with Supplier websites. Given the predominance of ads and ad clicks, hoteliers are almost entirely dependent on their Google Business Profiles for visibility, but even from these Profiles, consumers frequently choose to book a room via an Aggregator.

That Booking is an important player in European hotel search will surprise no one, though we at Near Media were surprised by the scale of its dominance.

In Part II of our analysis, we take a deeper dive into where consumers engage with search results and how they evaluate those results, surfacing ways in which hotel Suppliers might improve their chances of acquiring a guest in this challenging ecosystem.

For more on our methodology, hypotheses, and Digital Markets Act implications, please see Part I of our results.

Results

The kinds of results consumers engage with

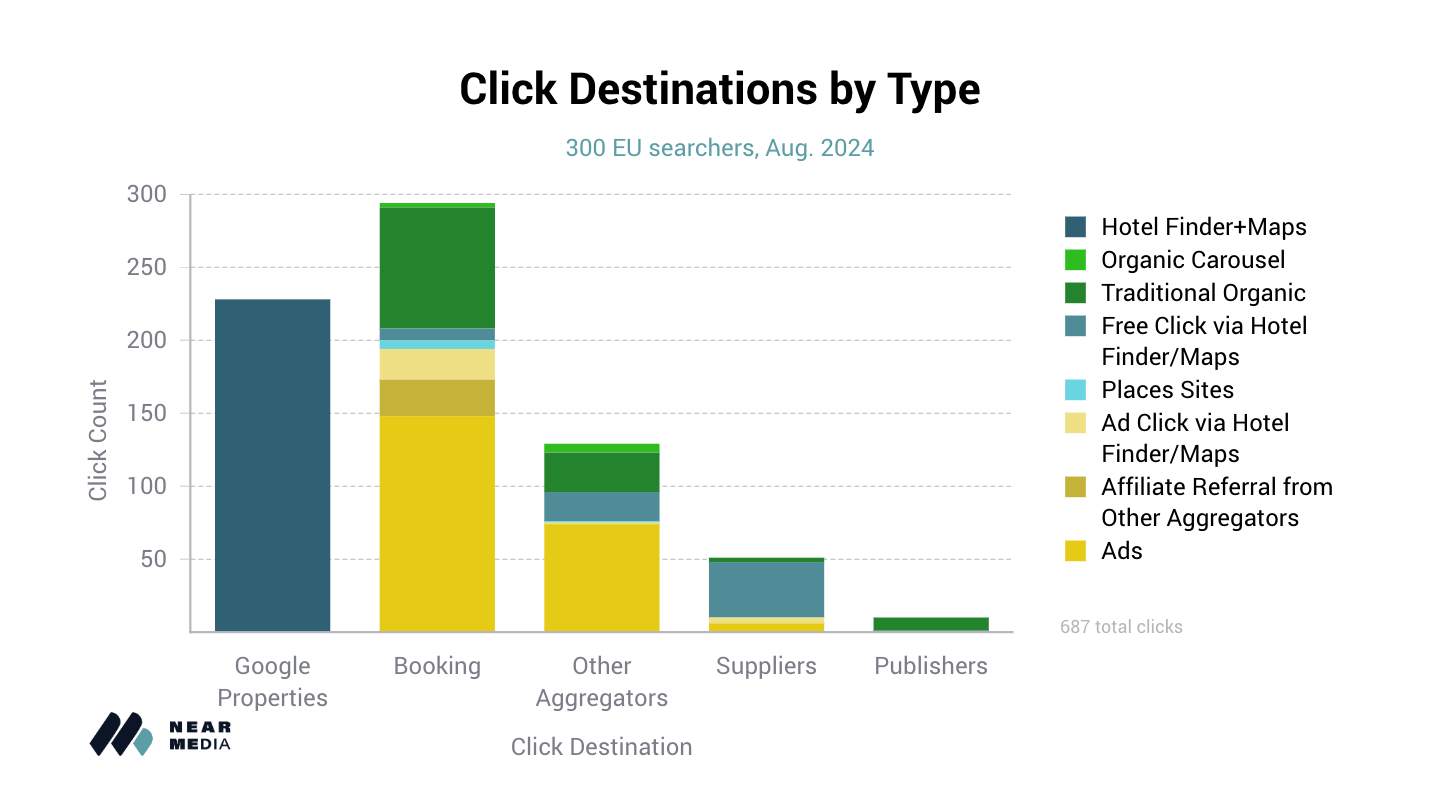

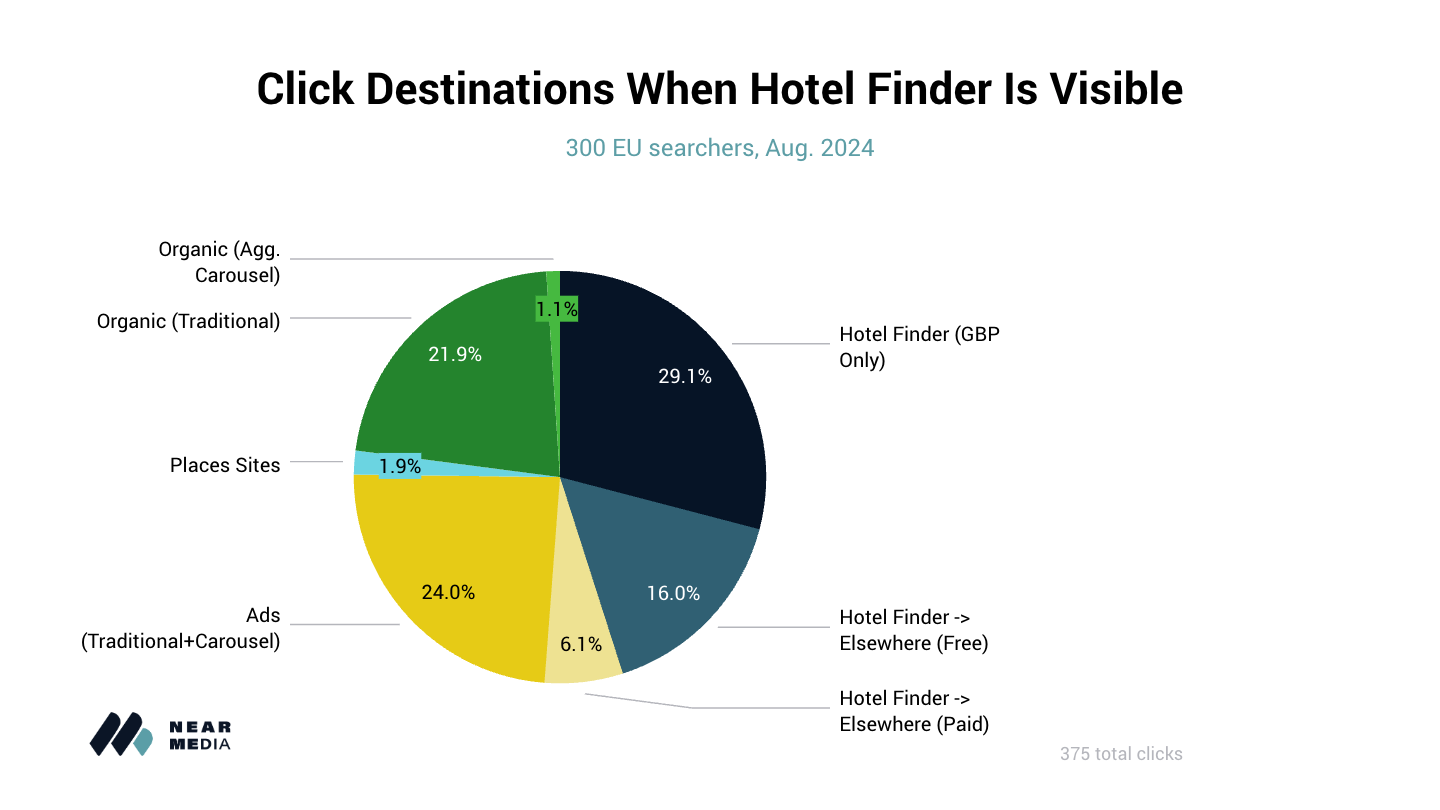

As we discussed in Part I, consumers overwhelmingly engaged with Booking.com results (especially via ads) and Google Business Profiles via the Google Hotel Finder.

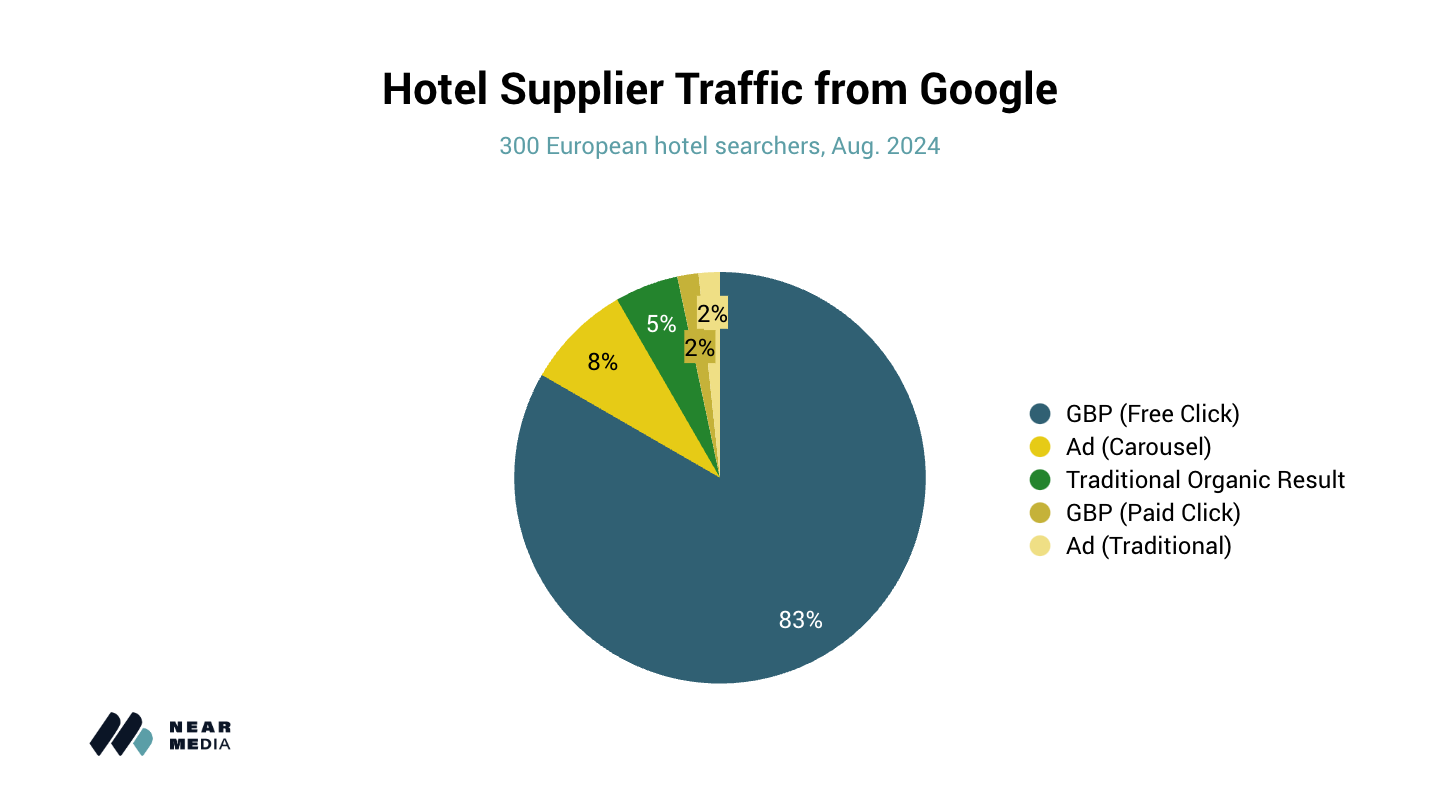

Supplier websites received just 10% of clicks overall, with organic search driving just 3 of the 61 total clicks to supplier websites. Almost all Supplier engagement came via the Google Hotel Finder, with 83% of Supplier clicks coming from the Hotel Finder or Google Maps.

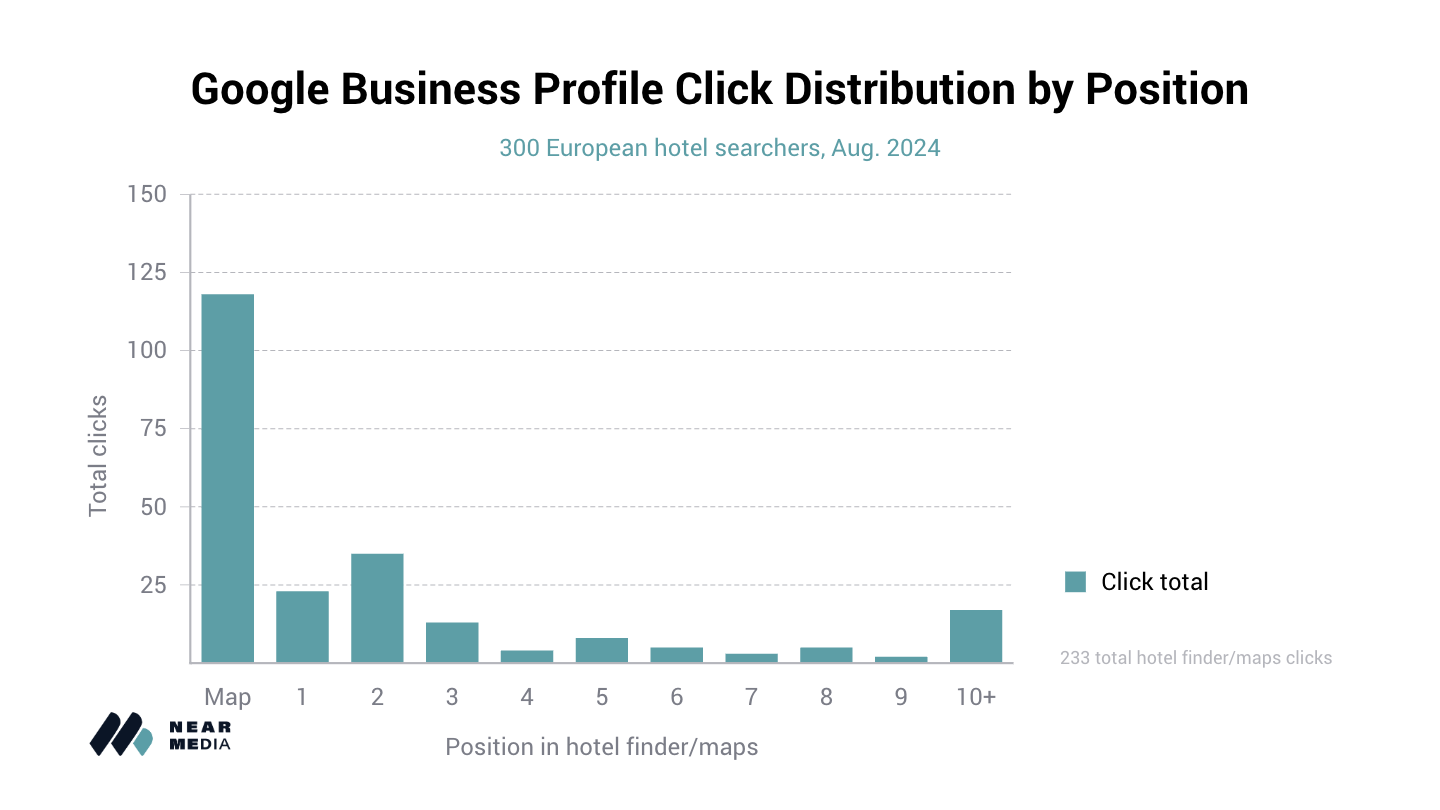

Position within the Hotel Finder mattered far less than we’ve seen in other verticals, with consumers making the majority of clicks within the Map interface, and frequently scrolling well down lists of hotels beyond the default three visible on the primary Google SERP.

(Keep in mind our finding from Part I of this research that the Hotel Finder almost always appears in Position 1 or Position 2, if consumers scroll past the near-ubiquitous ad block at the top of most search results.)

Fewer than half of all Hotel Finder engagements led to a click outside the Google ecosystem, however, showing the degree to which consumers use the Hotel Finder not just to make hotel choices but to disqualify properties which don’t meet their specifications.

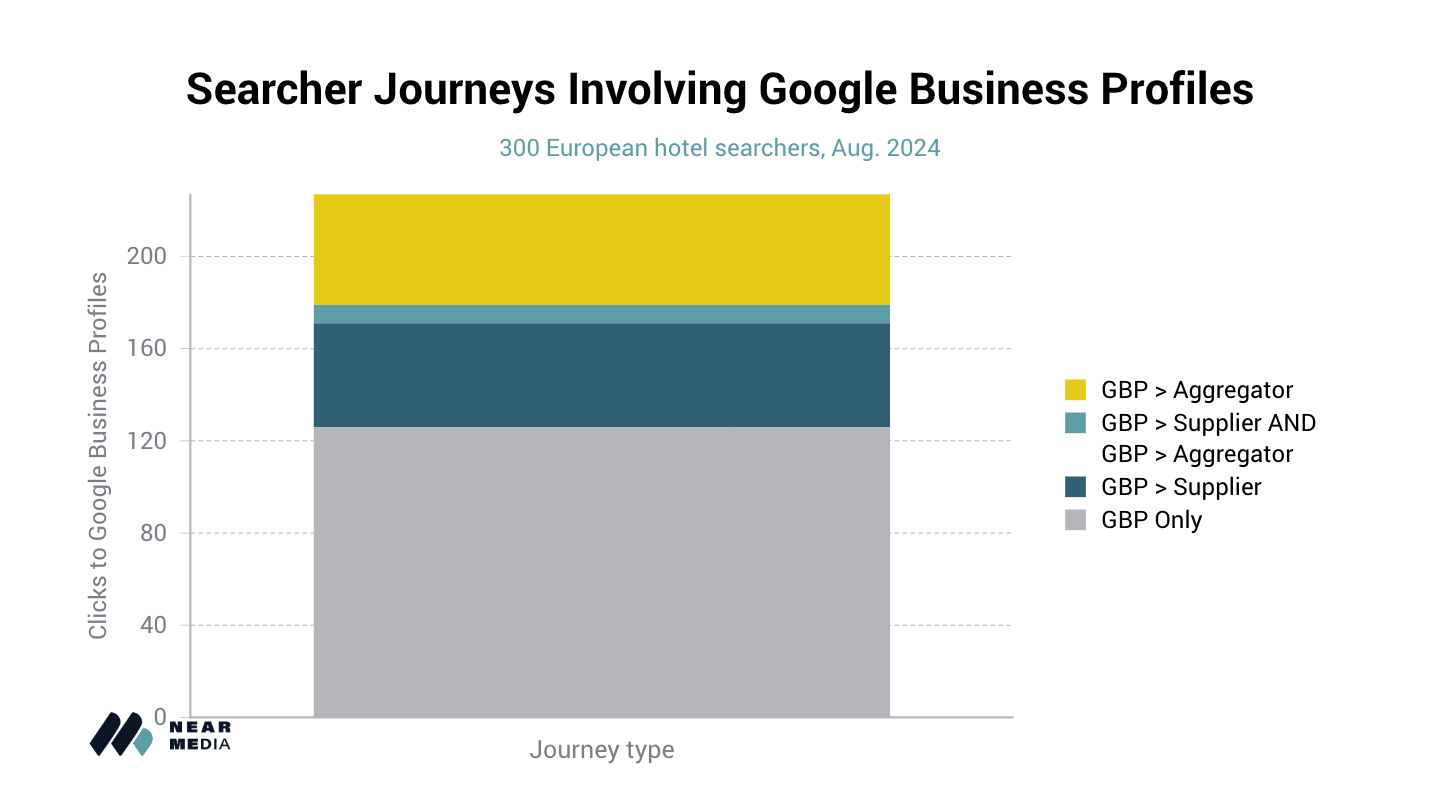

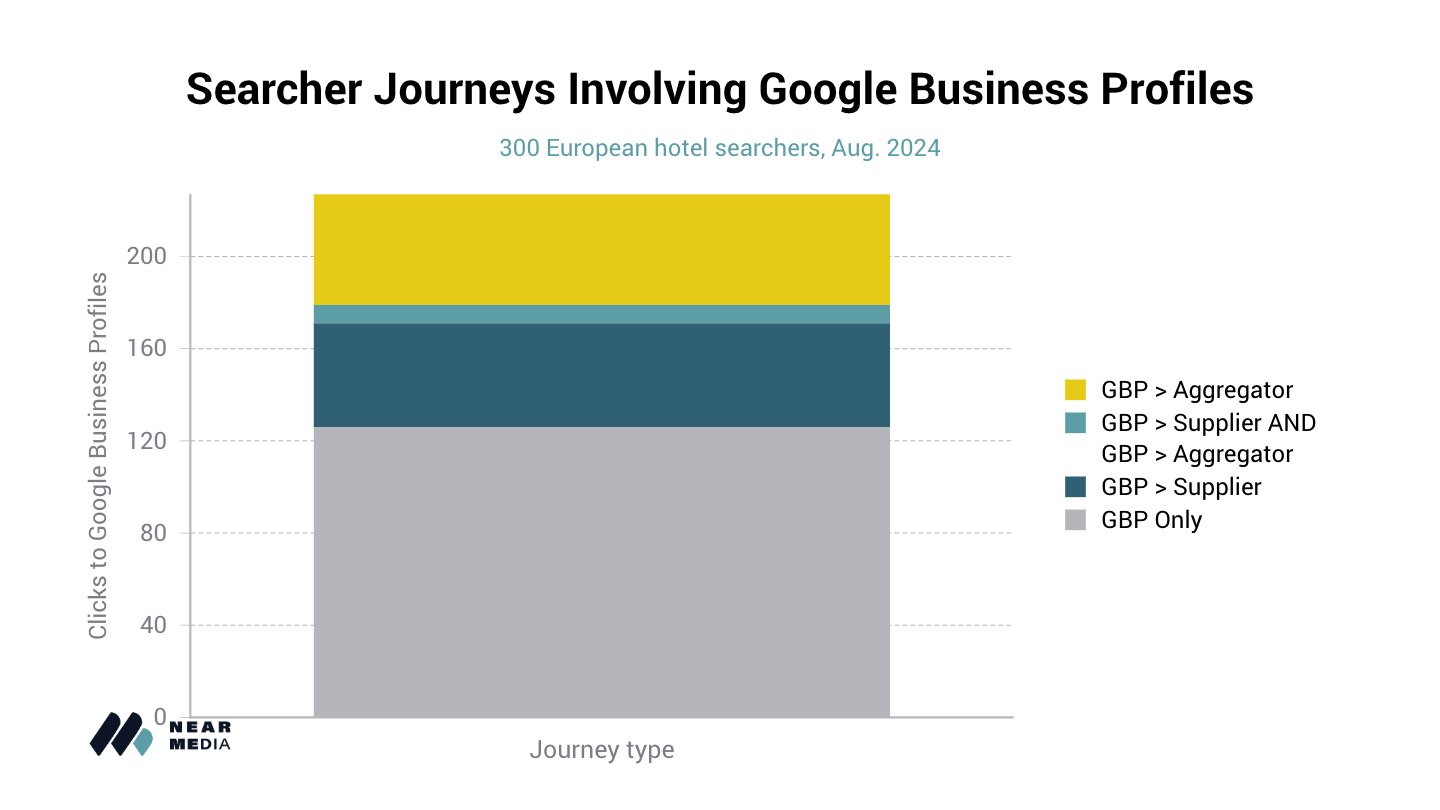

In fact, as demonstrated in the graphic below, consumers were over twice as likely to stay on Google.com ("GBP Only") as to click to a Supplier website ("GBP > Supplier" or "GBP Supplier AND GBP > Aggregator"), and were more likely to click an Aggregator website ("GBP > Aggregator") from a Google Business Profile than the official Supplier website for that property.

Carousel Ad Strategy

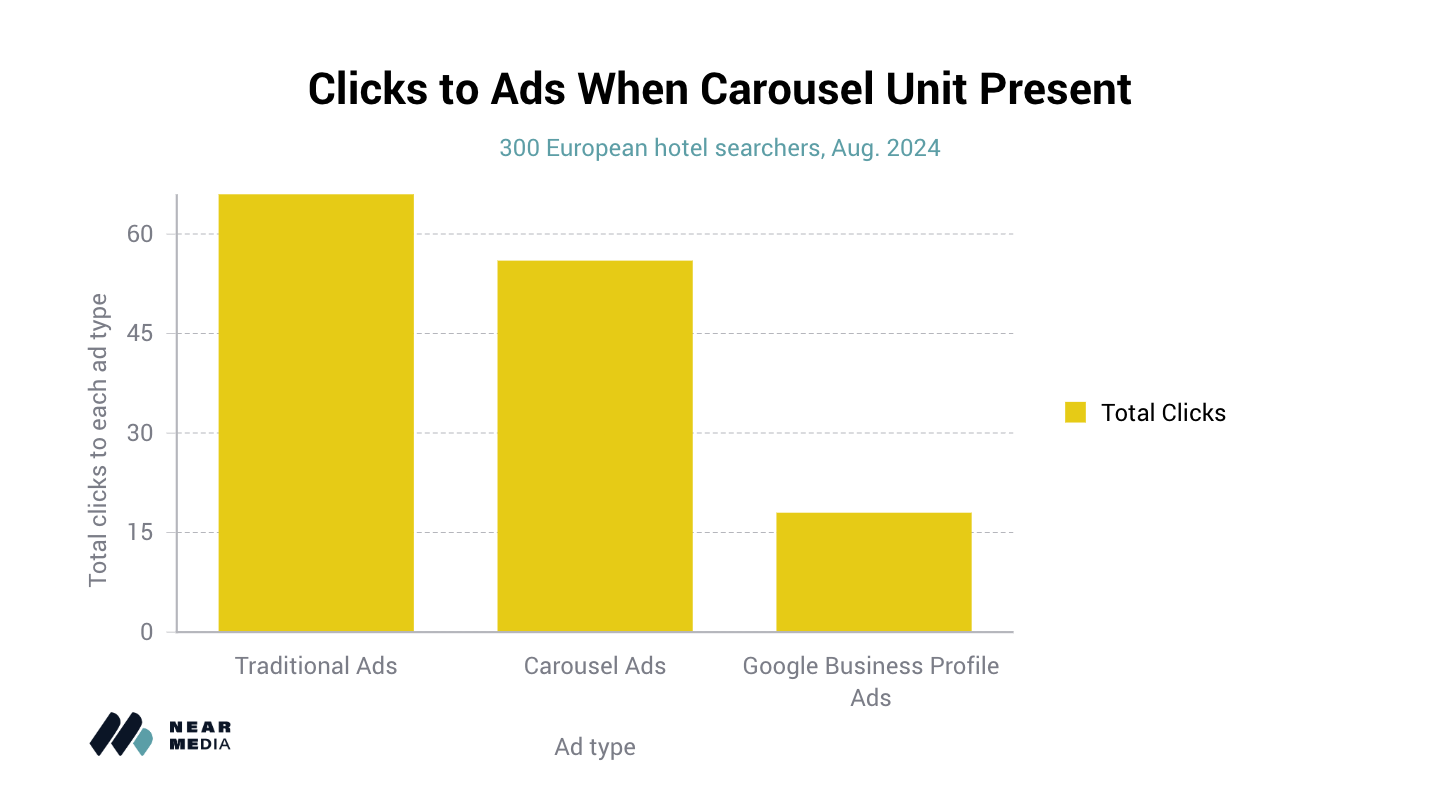

While ad carousels made up only 8% of Supplier clicks, they are clearly Suppliers’ second-best chance at search traffic.

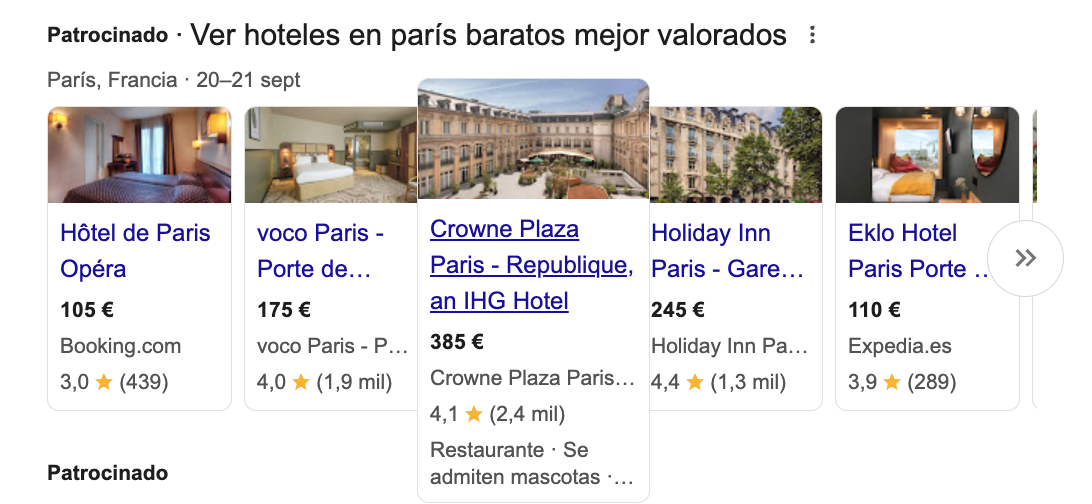

Though carousels only appeared on just under half of discovery search results, when present, they’re always at the very top of the page. Consumers are highly attracted to the photos, star ratings, and prices that accompany each carousel ad.

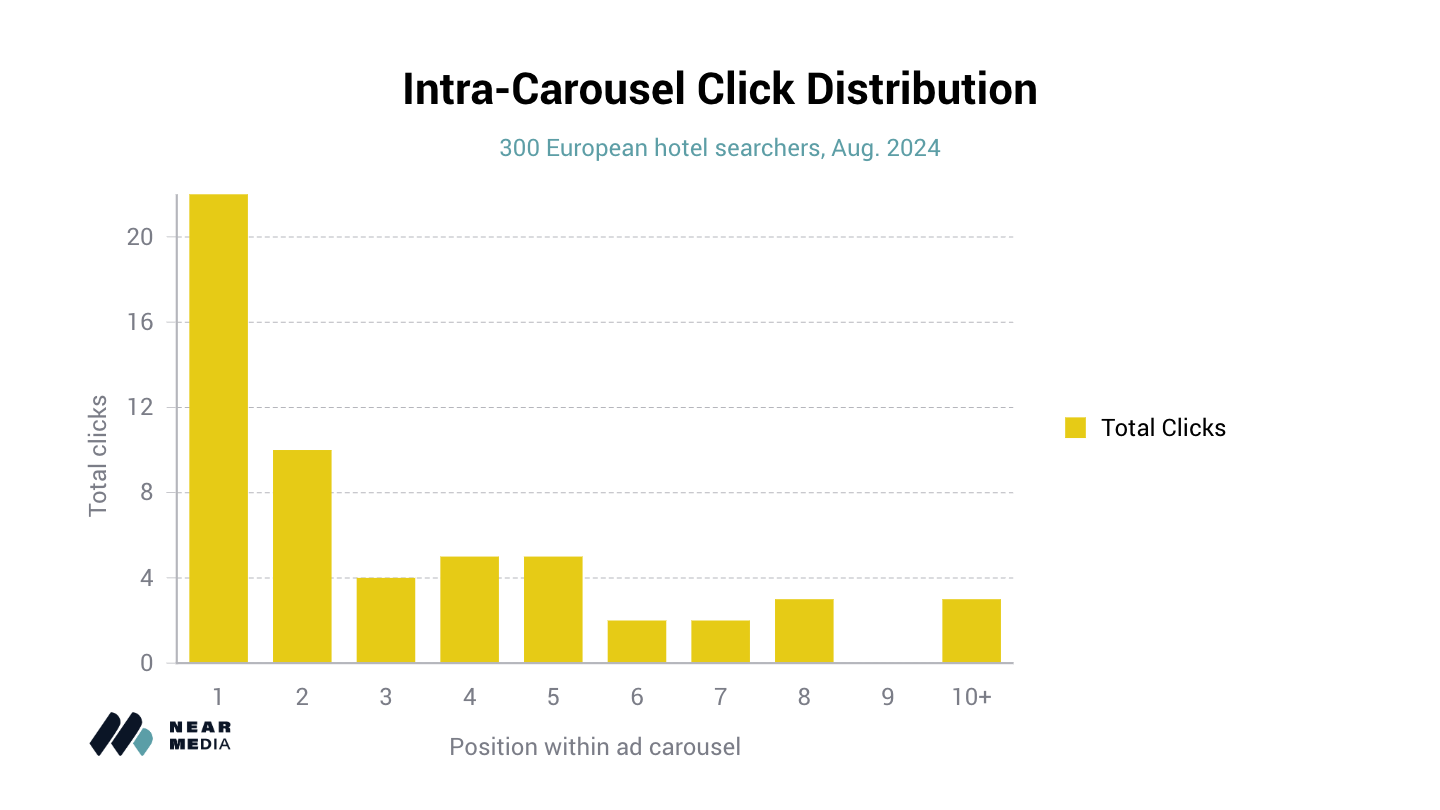

If Google charges less (or even a comparable price) for a carousel click than a traditional ad click, we would suggest Suppliers shift more of their ad budgets here, as consumers frequently scrolled deep into these results: 27% of carousel clicks came on ads beyond the fourth position.

Though traditional ads still received more clicks than carousel results, the conversion rate on Carousel clicks was slightly better than traditional ads. Both were astonishingly high: 46% vs 42%.

One of the reasons for this incredible conversion rate lies in Aggregators’ landing page strategy: Suppliers should strongly consider mimicking this strategy with their carousel ads.

Suppliers typically send their carousel ads to a landing page exclusive to the single property they are advertising.

Aggregators typically send ads to a list-style landing page featuring the property being advertised--increasing the odds that a visitor will find a property they are interested in booking, even if not the same property they initially clicked on from Google.

Drive your carousel ads to a list-style result, where the specific property you’re advertising is featured at the top of the list of other properties in your portfolio (as opposed to the canonical URL for that property). Doing so will likely increase the chance that a consumer will choose *a* property from your website, even if it’s not the same one they clicked from their initial search at Google.

(As an aside, Aggregators also employed this strategy even from the direct-booking links displayed on Google Business Profiles.)

How Consumers Evaluate Hotel Results

As we mentioned above, consumers frequently disqualified hotels they browsed in the Google Hotel Finder–not to mention on Aggregator websites. They made extensive use of filters, and almost always considered multiple properties before arriving at a choice of hotel.

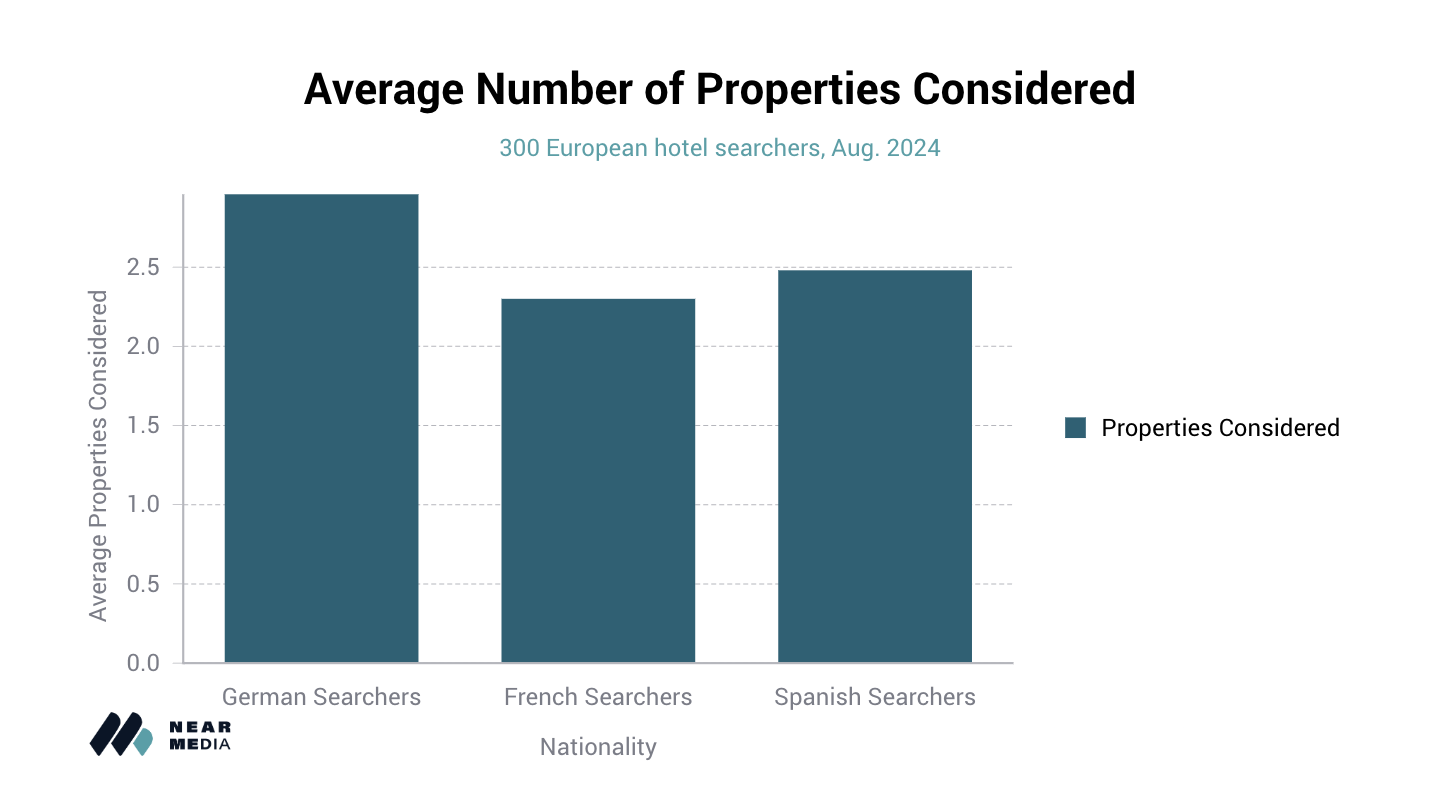

German searchers in particular considered multiple properties, checking out an average of 3 hotels prior to making their choice.

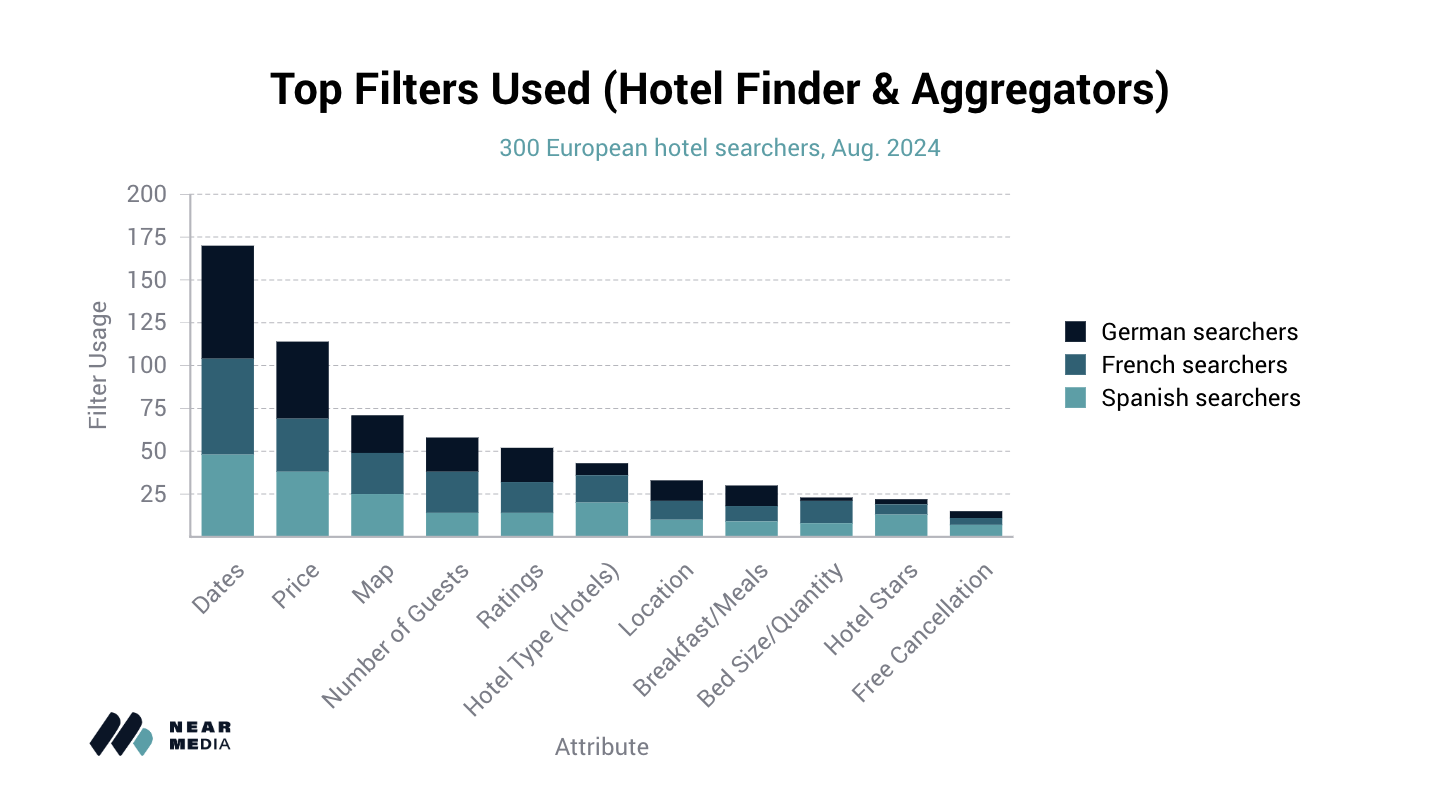

Unsurprisingly dates and price were the two most commonly used filters; dozens of users also included the dates of our fictitious long weekend directly in their search queries.

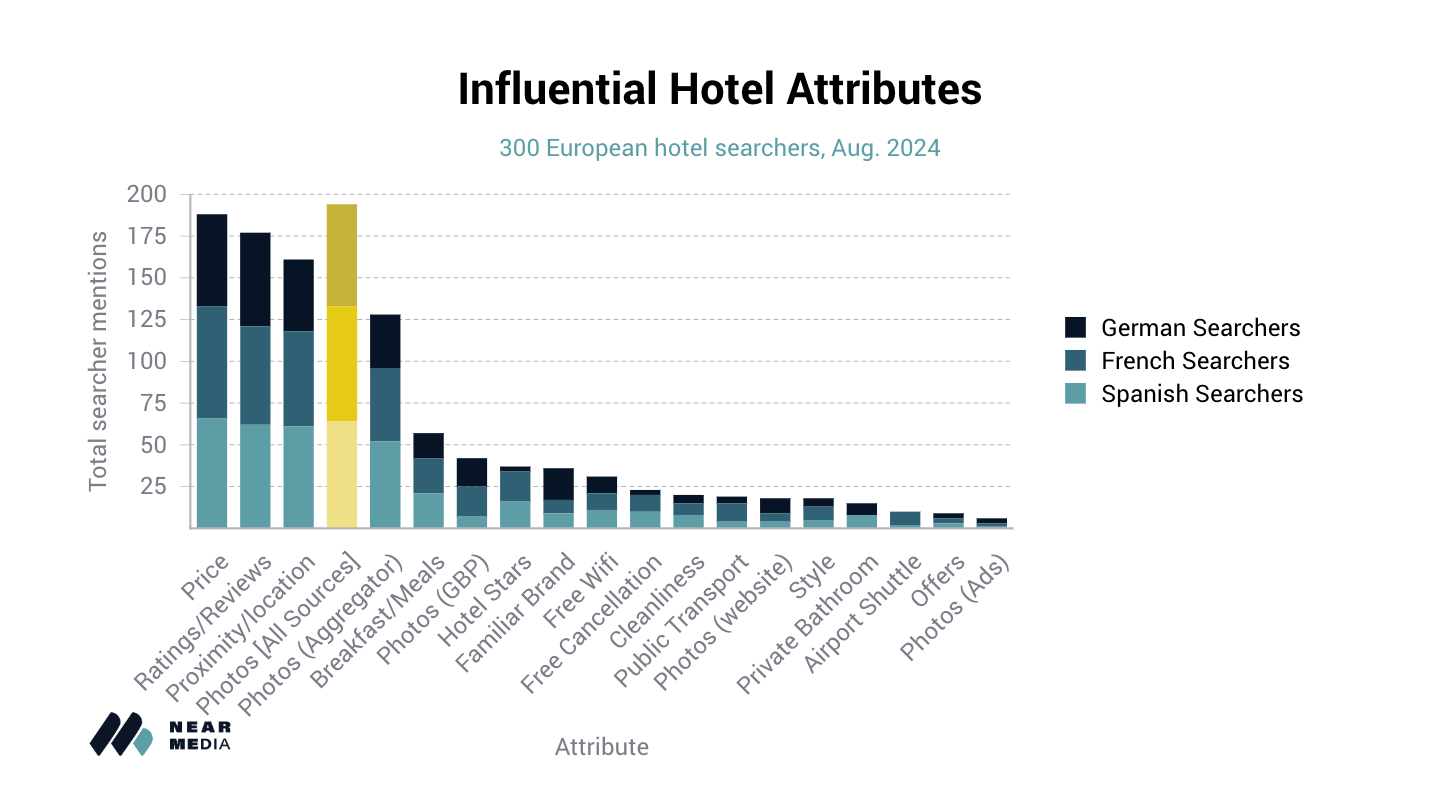

Price was the single most-common driving factor in searchers’ choice of hotel, with nearly 2 in 3 mentioning it or proactively filtering their results based on it. Ratings and reviews were nearly as important, followed by location.

Note, however, that summing the numbers of consumers mentioning Photos (or property features seen in photos) across sources–-not to mention visual descriptors like “cleanliness” and “style”–photos are clearly the most important attribute of hotel listings.

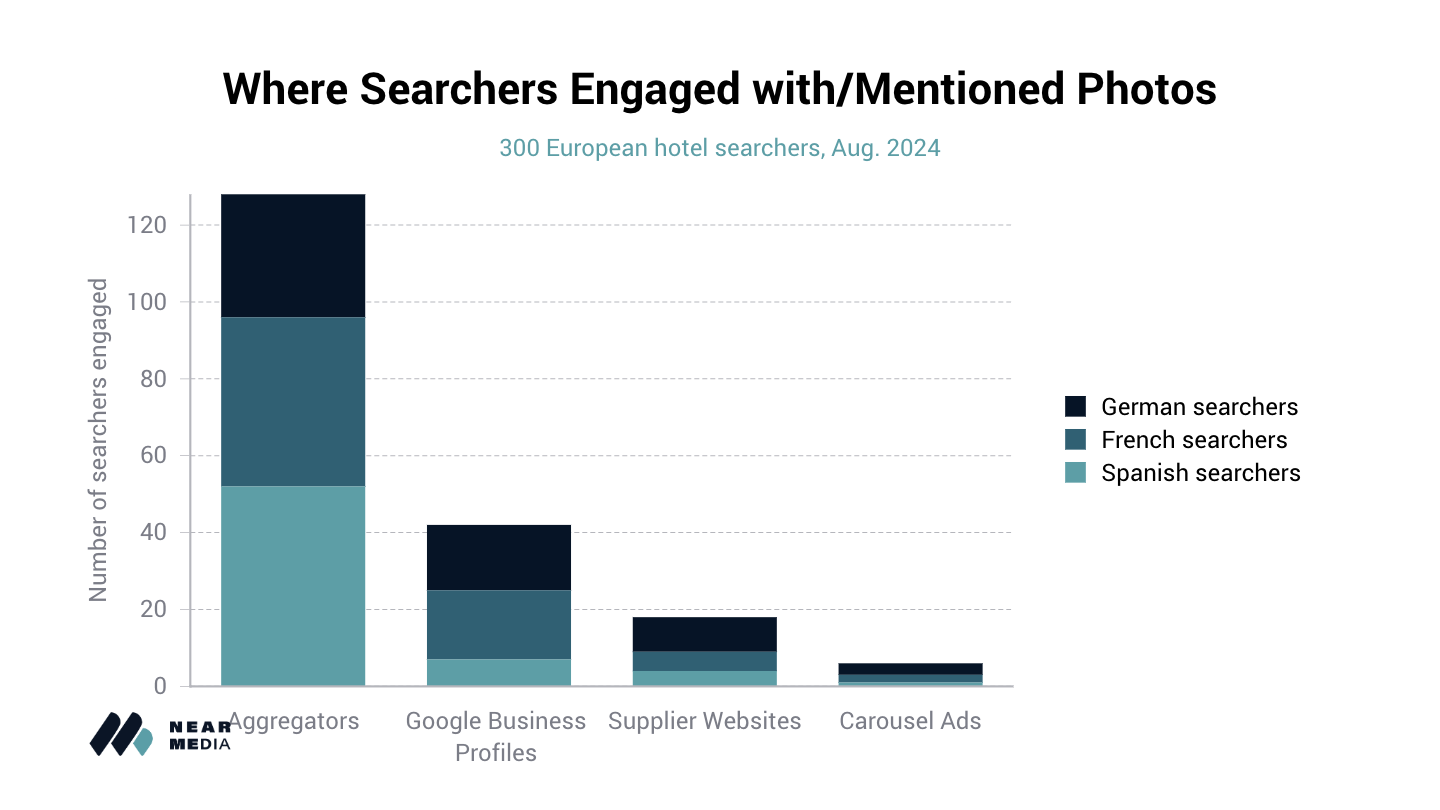

Searchers were most likely to consume photos on aggregators, followed by Google Business Profiles. Supplier websites were a distant third. Investing in superlative photography of their property is arguably the most important digital marketing tactic for hoteliers, and distributing that photography to aggregators and Google Business Profiles is also essential. Third-party sites are where photos will most likely grab consumers’ attention.

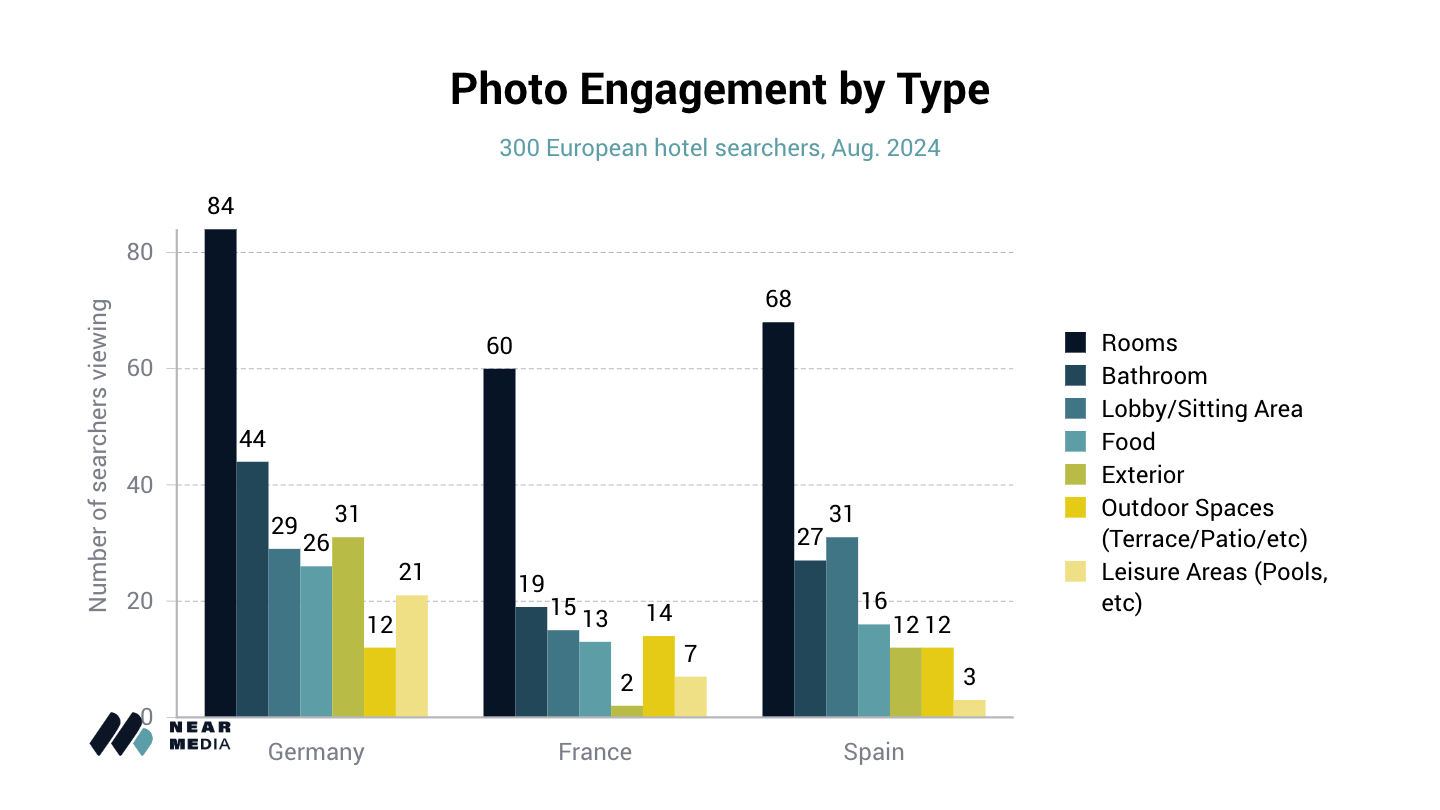

Rooms were certainly the most common photo type with which searchers engaged, but bathrooms, lobby areas, and exterior shots were also viewed or engaged with by significant percentages of consumers.

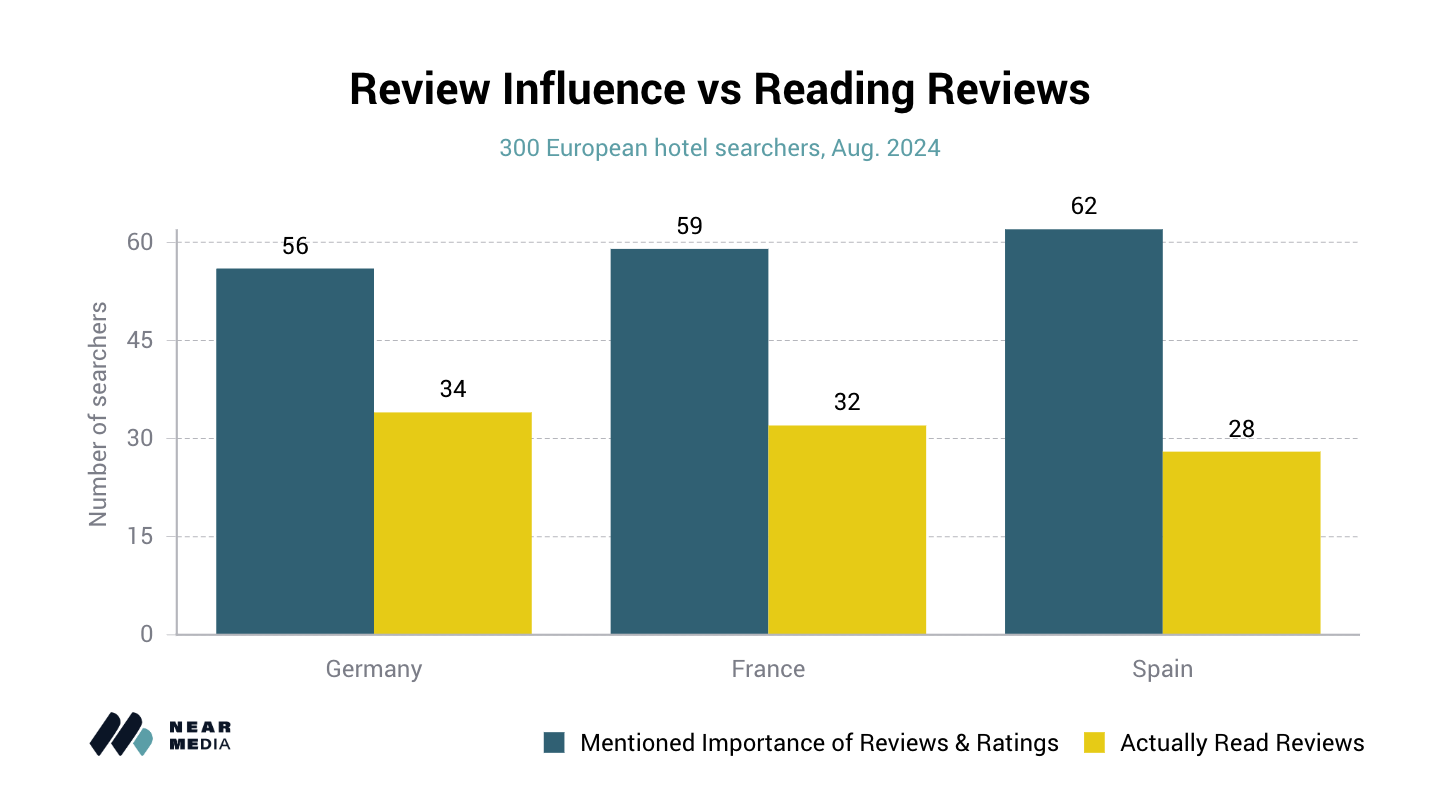

As mentioned above, reviews and ratings were important decision-influencing criteria for consumers, but as we’ve seen in every other vertical we’ve studied, only half of consumers who mentioned their importance (53%) actually took time to read reviews. Star ratings and review volumes are what drive consumer behavior.

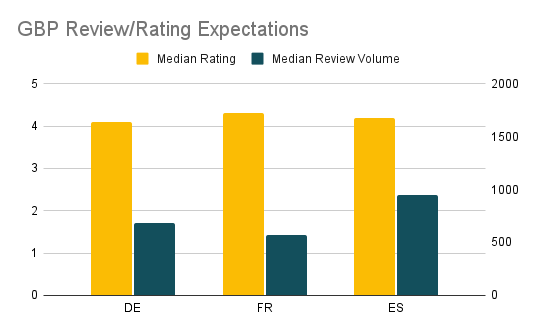

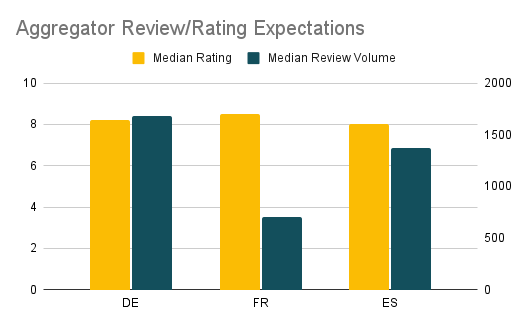

Consumers had relatively high, though not astronomical, rating expectations. The median rating of properties chosen via Google Business Profiles was 4.2 out of 5 stars, and via Aggregators with a 10-point scale, 8.2 out of 10. (In other verticals, we’ve seen median ratings closer to 4.8.)

Rating expectations are equivalent across Google Business Profiles and Aggregators when scales are normalized; review corpuses of chosen hotels were double that of Google Business Profiles, however.

Not surprisingly given the category, the median volume of reviews of chosen hotels was astronomical – north of 500 Google reviews in every country, and approaching 1000 Google reviews for hotels chosen by Spanish participants. For aggregator-driven bookings the numbers were even higher–north of 1000 reviews in all but France.

There was a somewhat interesting difference in search behavior between countries, as the graphic above reflects–French searchers had the highest rating expectations amongst any of the three nationalities, but tended to choose properties with lower review volumes–perhaps reflecting a willingness to try less-established properties that were nevertheless well-rated.

Given the consumer behavioral choices we outlined at the top of our results, hoteliers should be asking guests for reviews where those reviews are most likely to be seen by future guests – on Booking.com and on their Google Business Profile. Less-established hotels likely have a long path ahead of them before their review corpus is large enough to make them eligible for consideration by most consumers.

Conclusion

Hotel Suppliers, frequently outbid for ad space by deep-pocketed Aggregators (especially Booking.com), receive a minuscule percentage of traffic via Google’s traditional organic results, making them heavily dependent on the Google Hotel Finder for visibility.

Almost all Supplier traffic comes from the Hotel Finder, but consumers are 2.3 times as likely to stay within the Hotel Finder to browse properties than to click through to a supplier website, and are more likely to click an aggregator website from a Google Business Profile than they are a supplier website.

Carousel ads seem to offer the most efficient opportunity for Suppliers to bid on paid traffic, particularly if they adopt Aggregators’ landing page strategy of featuring the clicked property at the top of a list, rather than the canonical page or microsite for a single property.

Aside from price, reviews/ratings and photos are the most influential levers that hoteliers can pull to attract more consumers. It’s important to distribute photos and reviews where they’re most likely to be seen–specifically, Booking.com and Google Business Profiles.

Despite their importance in consideration and choice, only half of consumers who mentioned the importance of reviews and ratings (53%) actually took time to read reviews.

Based on how Google constructs its search results today, Google itself and Booking are the clear winners in hotel search, with hoteliers of all sizes getting squeezed by both gatekeepers.

Even if well-ranked by Google’s organic algorithm, in Google’s current hotel SERP construction it’s unlikely consumers ever encounter a Supplier website in a hotel search journey, given the positional and visual dominance of Booking ads and the Google Hotel Finder.