GBP Optimization Blueprint, Waiting for Search, Here's AMZN's Rufus

Blueprint for GBP Optimization

Although Google has "disappeared" most AI Overviews (AIOs), they still represent a (potential) competitive challenge to content publishers. Local is one area that has been relatively unscathed by AIOs; though AI may show up in different ways in local. In this new AI era, arguably, Google Business Profile (GBP) optimization is more important than ever, partly because Google is increasingly self-preferencing with GBP content. Miriam Ellis at Moz has created an excellent overview of GBP profile fields that have a documented impact on local ranking. She cites 11 (or 12) categories that must be optimized and offers helpful discussion and context. Not all of these are equally impactful but have been shown by SEOs to affect local visibility. Here they are, not necessarily in order of tactical priority: Business Name, Address (for proximity), Primary Business Category, Website Link, Business Hours, Reviews, Attributes, Services, Products, Popular Times, Menu Items, Photos. (Menus largely applies to restaurants obviously.) At a minimum, local businesses need to be paying attention to these things, with special emphasis on reviews and images. This advice from Miriam represents a kind of must-do baseline for businesses hoping to improve their local visibility. Also, check out Mike Blumenthal's excellent article on how local search is changing and evolving.

Our take:

- There's a ton of zero-click behavior in local. We've seen this directly in our user testing in multiple categories in North America and Europe.

- Many people will engage extensively with GBPs, including reviews and especially images. Often decisions are made entirely from GBP content. So that's lost revenue if the GBP isn't fully optimized.

- In other cases, users will click through to a website from the GBP, which might not rank in organic results otherwise.

Waiting for Godot: Search Edition

There have been reports from various news outlets for months that OpenAI was going to directly take on Google with a next-generation search tool of some sort. OpenAI CEO Sam Altman himself seemed to confirm this with comments about "reimagining search" on a podcast. But the long-rumored announcement hasn't come to pass. The last one turned out to be the reveal of ChatGPT-4o instead of a search engine or direct Google competitor. Now the CEO of The Atlantic, which has a content licensing deal with Open AI, suggests that a more search-like OpenAI product is in fact coming. We've heard this before, although today ChatGPT can replace Google for many types of queries. So why do these rumors persist? I think there are several reasons. First, there's dissatisfaction with Google and pent up demand for a genuine alternative. Then there's the fact that it's entirely logical that ChatGPT should evolve a better web search capability; they crawl the web and can access web search results via Bing. So they're already doing the mediocre version. There are Altman's own remarks and those of seemingly knowledgeable sources. And finally, ads. The paid search business model is extremely attractive, even though Altman says he hates ads.

Our take:

- The same types of rumors swirled around Apple for years and there was a certain logic there too. Yet a search engine never came.

- Despite all the early analyst hand-wringing, Google's search volumes have seemingly not been impacted by ChatGPT, Perplexity or others.

- I'm confident that some sort of next-generation experience will come, which more elegantly marries gen-AI with search.

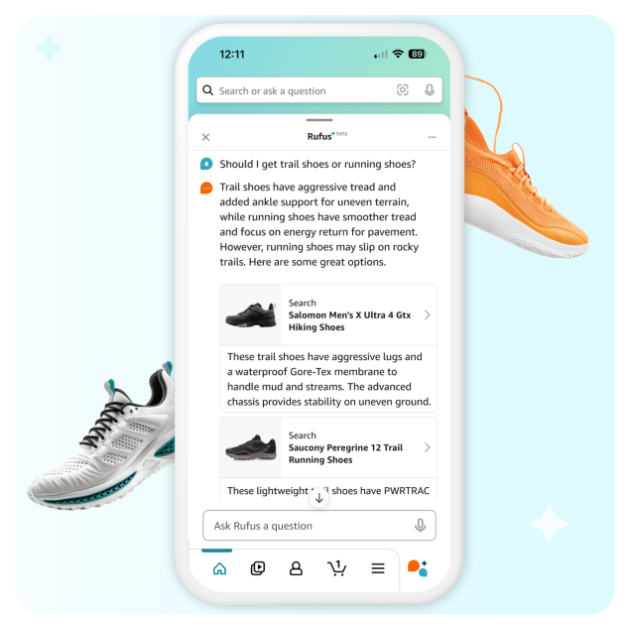

AMZN Rufus Impact: Reviews, Ads, Google?

Amazon's recently introduced AI shopping assistant, Rufus, was apparently named after a dog who was a fixture in Amazon’s first warehouse in the mid-90s. Just in time for Prime Day, Rufus has been released to the general public. (It's not yet showing up for me.) But it promises to make shopping "more personal" and more precise, with the capacity to respond to very specific questions and get answers about products, your orders or even non-product questions (including local recommendations apparently). It was trained on Amazon data, including reviews, and the web more generally. Unless it blows (to use the colloquial expression), Rufus promises to be popular and raises interesting questions. For example, will consumers start to use Rufus instead of search on the Amazon app; or will Rufus be adopted for more specialized use cases? Amazon now has billions in revenue tied to search ads; how will Rufus affect that (and Amazon sellers)? Will Rufus make Amazon reviews less or more impactful? And how will Rufus, a new assistant brand, co-exist with Alexa, which is in decline? For years, Google has been pushing aggressively into product search. Will Rufus have any impact on that? In other words, will even more informational/commercial top-of-funnel queries go to Amazon vs. Google ?

Our take:

- While we don't have precise figures, review fraud on Amazon is rampant. AI review summaries mask and thereby exacerbate it. Rufus could make Amazon fake reviews even more opaque.

- Amazon's push for more ad revenue has "enshittified" it. Rufus might partly redeem the UX, getting people to recommendations without crossing a sea of ads. Yet, Amazon won't disrupt its ad business.

- Amazon once had local ambitions, will Rufus offer some new opportunities in this arena for the company?

Recent Analysis

- Near Memo podcast episode 165: Seattle surgeon pays $5 million fine for review fraud, local search increasingly shows Google GBP results.

- How Google's (Local) Development –>Deprecation Process Affects Innovation, by Mike Blumenthal.

Short Takes

- Here are some reasons why your Google reviews are not appearing.

- New Google Maps design for Android rolling out.

- Google Chrome gives special privileges to Google-owned properties.

- Gaming publisher meets with Google after traffic apocalypse.

- Forums have grown at the expense of niche content sites.

- Twitter in violation of EU's DSA, could face fines of 6% of global revenue.

- Why lower-ranking sites are appearing (as links) in Google AIOs.

- Cloud security startup Wiz would be Google's largest acquisition at $23B.

- LinkedIn AI ad tool, with positive early buzz, rolling out globally in Q3.

- French startup unveils LLM exclusively for digital ad creative.

- Google domains sold to Squarespace hijacked.

- More interesting AI skepticism from Ben Evans.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.