Google Antitrust Part 2, Social + Stores, Local Inventory

Google's Second Antitrust Trial

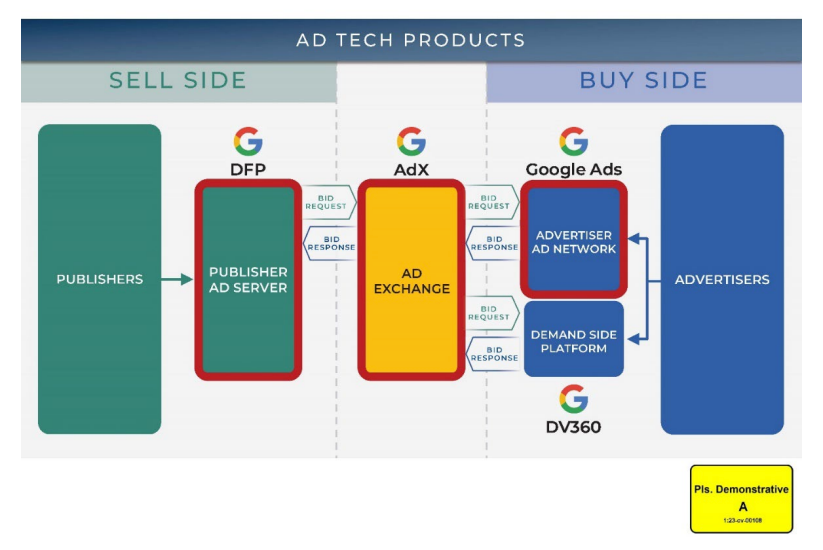

Google's antitrust search trial got much more attention than its sibling adtech trial, which recently concluded in federal court in Virginia. To briefly recap, the Department of Justice (DOJ) alleged Google had monopolized markets for ad servers, ad networks and exchanges through acquisitions (i.e., DoubleClick), tying arrangements, self-preferencing and other exclusionary actions, creating publisher lock-in. At trial Google argued the industry is extremely competitive (see Facebook, Microsoft, Amazon, Criteo, others), its DoubleClick acquisition benefitted publishers and advertisers, its fees were reasonable and it has not locked publishers and advertisers into using its platforms. A week ago the DOJ and Google filed findings of fact for the court to review. These documents reiterate the parties' positions, supported by evidence. Closing arguments will be held November 25. Judge Leonie Brinkema will then issue a decision in early 2025. If the DOJ prevails there will be a trial on remedies, which almost certainly will include a request for divestiture (breakup).

Our take:

- As with the search antitrust case, the government presented strong evidence of prohibited behavior using eye-brow-raising internal communications.

- Google's strongest argument is that the display market is highly competitive. This is the weakest part of the DOJ's case and Google may prevail accordingly.

- If there's any adverse outcome, Google will appeal. While a breakup in the search case is extremely unlikely (post-Trump), it's possible here.

SMBs, Social Media & Stores

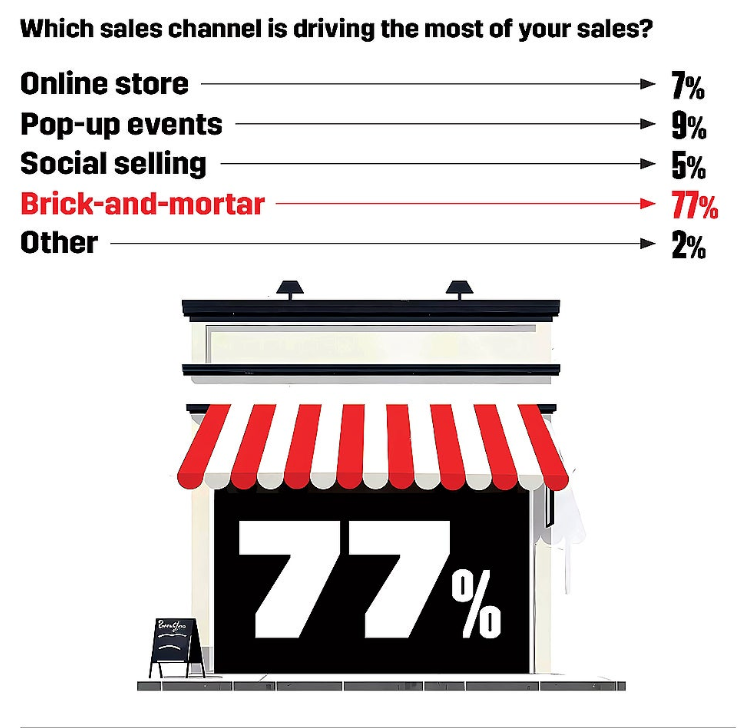

Entrepreneur and online marketplace Faire recently surveyed 1,200 small business retailers asking a range of questions, including about concerns, marketing and sales tactics and top business priorities. Customer acquisition and inflation where their top priorities and concerns, respectively. They said their "most effective" marketing tactics/channels were 1) social media (54%) and 2) local community engagement (21%). Social media is consistently the top channel used by SMBs and usually leads all other channels by ~20 points. (The full range of potential answer options wasn't made clear.) An even bigger gap appeared in responses to the sales channel question: what's driving most of your sales? Social media sales and e-commerce each appeared in single digits. Brick and mortar store was the top answer (77%); pop-up events was number two (9%). Again, the full list of available responses wasn't made clear. What struck me was that these results seemed more like they were from 2014 (or maybe 2004) than 2024.

Our take:

- Most SMBs don't closely monitor digital analytics and rely heavily on instinct and intuition to determine "what's working."

- These are retailers so of course stores will figure prominently in their sales figures. But we don't know much more about them (size, category).

- It's not explicit but the difficulty of tracking digital marketing to offline sales seems to be implicated here. And it's mysterious search is nowhere.

Waiting for Local Inventory

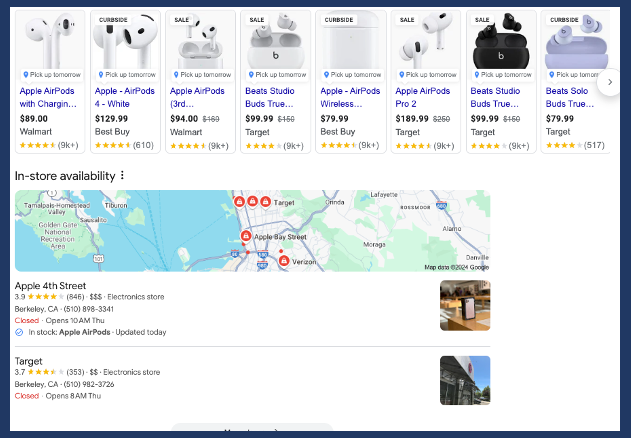

Almost 20 years ago, there were at least 10 startups working on the problem of getting local product inventory online. You may remember some of these names: Milo, Shopatron, Krillion, NearbyNow, ShopLocal, uLocate, StepUp, Where2GetIt, Channel Intelligence, Yokel, GPShopper and Askthelocal (UK). Back then Google was taking local inventory feeds from StepUp and ShopLocal. And many big box retailers were experimenting with BOPIS. It seemed we were on the cusp of an online-offline, local inventory revolution. I prematurely wrote this back in 2007: "Very soon consumers will be able to do online product research and then learn, fairly quickly, where they can buy the desired product offline. This is the future of online shopping..." Oops. We're still waiting for that future to arrive. Of those early players, Google is essentially the only one standing (and Bing, sort of). Today, Google gets local inventory feeds directly from merchants, Near.st and Shopify. That inventory data appears in various places: Ads, Local Pack, GBP, Maps, organic search, Google Shopping. Others, including Meta, have taken baby steps in this direction but nobody (even Google) has given it the push it deserves.

Our take:

- There are many reasons why this is still not a "solved problem." The short version is: the infrastructure is hard, the data is hard.

- Irish startup Pointy had a brilliant solution for SMBs but then Google bought it and absorbed it into the Google "omnichannel" team.

- Google doesn't do much promotion of its local inventory feature(s). I bet if ChatGPT did something in this area, we'd hear more about it.

Recent Analysis

- Near Memo episode 182: A Google “pardon”?, Siri’s search improvements, search from ChatGPT is really good.

- Siri Finally Gets Local Search, by Mike Blumenthal.

Short Takes

- A look at Google's new hotel "metasearch" format and its implications.

- A 30K foot look at Google's Local Guides program and where it's been.

- How to get more (and better) local business reviews.

- Yelp bought RepairPal for $80 million in cash.

- Why traditional SEO metrics are losing relevance and what to do.

- Survival guide: 17 tips on the future of SEO.

- NPR disses AI Overviews, questions why there's no opt-out.

- Perplexity reveals more about ads, including labeling and formats.

- Google to remove news pubs from some EU SERPs to show traffic value.

- Amazon Haul: lots of cheap (crappy) products to take on Temu.

- The 'Xodus' picks up steam: Bluesky gains a million users post-election.

- Meta must face antitrust trial over WhatsApp, Instagram buys.

- Location sharing is making us miserable (WaPo).

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.