Google Astroturfing, Amazon Threatens SMBs, Privacy Not Personalization

Google, Amazon Caught 'Astroturfing'

Most of big tech companies use small businesses (SMBs) as a sword or a shield in advocating for or against regulations or public policies. That also shows up in competitive contexts. For example, Facebook invoked SMBs as it argued against Apple's mobile privacy initiatives. Google has used SMB welfare to oppose pending antitrust legislation. Generally, the argument goes: if the government regulates us, it will hurt SMBs (and consumers). As the email below indicates, Google has been trying to scare SMBs into helping the company fight Congressional antitrust efforts. Google (and Amazon) have also enlisted seemingly independent groups such as the Connected Commerce Council to oppose antitrust legislation. Claiming to be a grassroots SMB advocacy organization, the Connected Commerce Council is pure "astroturf," funded by Google and Amazon.

Our take:

- While the tech companies, with their trillion-dollar market caps, are unsympathetic, everyone cares about SMBs.

- Google is entitled to make any arguments it wants on its behalf (e.g., "unintended consequences"). But this astroturfing behavior is unethical.

- The revelation that Google and Amazon are funding fake grassroots groups will ultimately harm their cause among legislators.

SMBs: 'Amazon Is Our Biggest Threat'

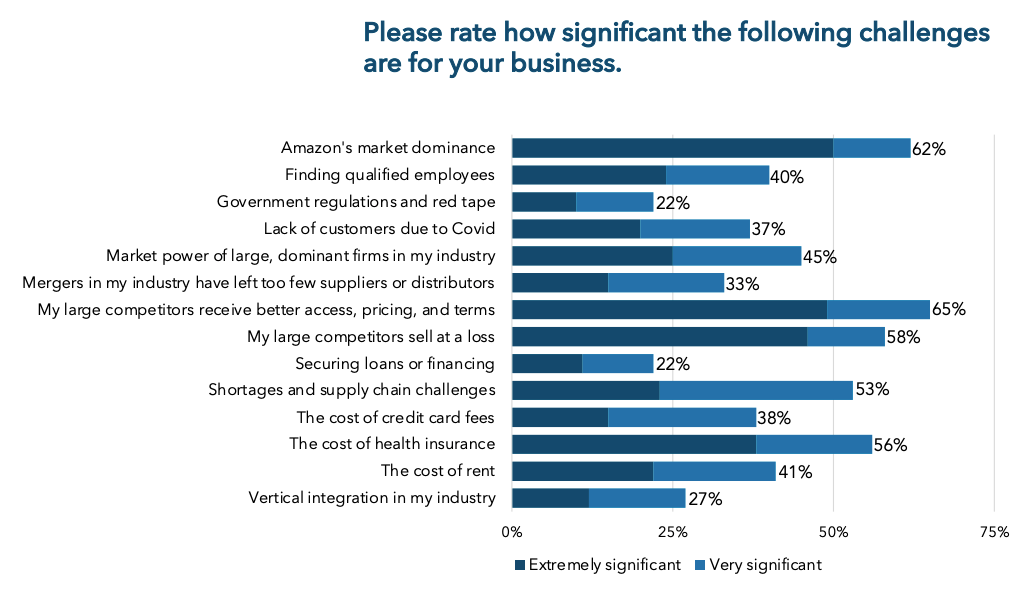

Consistent with what we said above, Amazon promotes the idea it's helping SMBs succeed online. It boasts, "More than half of everything sold in Amazon stores comes from small and medium-sized businesses." However, a new SMB survey (n=908) from the Institute for Local Self-Reliance paints a very different picture. Amazon's market dominance was cited as the "biggest threat" SMB retailers face. More broadly, these respondents are concerned about larger competitors that receive "better access, pricing and terms" from suppliers. Asked about a range of potential remedies and policy actions to help them succeed/survive, these SMBs said: 1) "ending subsidies and tax breaks for big business" and 2) "breaking up and/or regulating Amazon." A companion survey of SMB Amazon sellers (n=94) found widespread dissatisfaction with its algorithms and fees.

Our take:

- 60 of the 94 (63%) Amazon SMB sellers said "there was no viable alternative" to selling on Amazon, which is why they continue to do it.

- This is just one survey but it's striking how scared/angry these SMBs are about the dominance of larger companies – specifically Amazon.

- Antitrust legislation would address some (not all) of these SMBs' complaints and specifically Amazon favoring its own products.

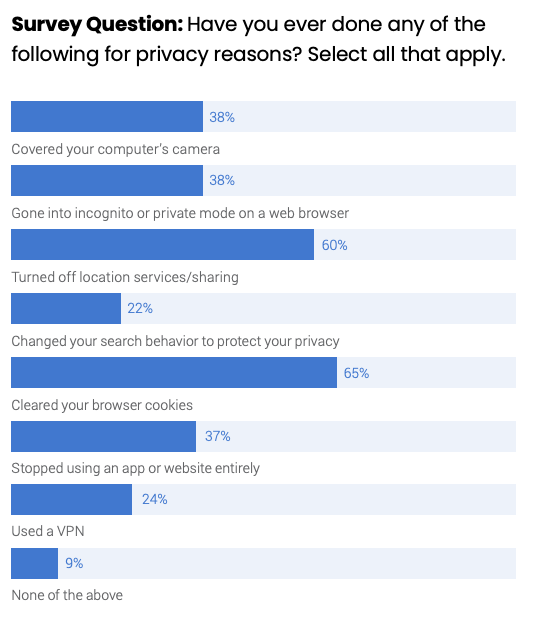

Consumers Want Privacy Not Personalization

Marketers often argue consumers and brands are not that far apart on privacy. And there are many surveys asserting, with the right "incentives," consumers are happy to divulge their data. In reality, marketers and consumers are quite far apart. Digital platforms want as much data as possible, while consumers really don't want to give it to them. A new privacy survey from Tinuiti (form) illustrates this divide, as well as some of the nuances of the discussion. The survey found consumers were very concerned about their data and want companies to do more to protect it. Hacking/identity theft are big concerns. Yet consumers have a mostly favorable view of the major tech companies (save social media). Under some circumstances (e.g., free shipping, offers) they will share limited information. And ~90% have taken some action to protect their online privacy, including: 1) clearing cookies, 2) turning off location.

Our take:

- About 90% of respondents would rather see ads than pay for content, but 70% would opt out of tracking, even if it meant less "relevant" ads.

- Marketers will continue to argue consumers want personalized ads. But only the minority do. Contextual is one way to reconcile privacy and ad relevance; opt-in targeting is another.

- The cat and mouse game will likely continue with marketers paying lip service to privacy while still trying to capture as much data as possible.

Recent Analysis

- Consumer Review Trust Down but Usage Up, by Mike Blumenthal.

- ICYMI: Yelp's Hidden Headwinds: Declining Traffic and Aging Reviews, by Mike Blumenthal.

Short Takes

- Google Maps bundling and terms focus of renewed DOJ scrutiny.

- The rise of visual search on Google (mobile SERPs).

- Uber wants to get more deeply into "local commerce" logistics.

- ~50% of Lyft, Uber drivers have quit/driving less because fuel costs.

- Google's "highly cited" news label seeks to "elevate original reporting."

- Post-Coinbase commercial, QR codes eyed as offline attribution tool.

- BrandMuscle's new AI assistant dispenses local marketing advice.

- Facebook ad fraud: Court certifies SMB class action.

- Google introduces advanced site search for retailers.

- Google P-Sandbox: Topics, FLEDGE, Attribution Reporting test-ready.

- Alexa to notify Prime members of sales on saved Amazon items.

- Wix Restaurants integrates with DoorDash's white-label delivery.

- Yelp adds health grades/inspection data for restaurants across US.

- Digital payments: The end of cash is the end of privacy (NYT).

- Grubhub, Uber Eats, Postmates face antitrust suit over costs/fees.

- Tech bro Patagonia vest now an object of ridicule.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.