Google Fallout, Apple Search Speculation, Stores Rule

Google Monopoly Ruling: The Fallout

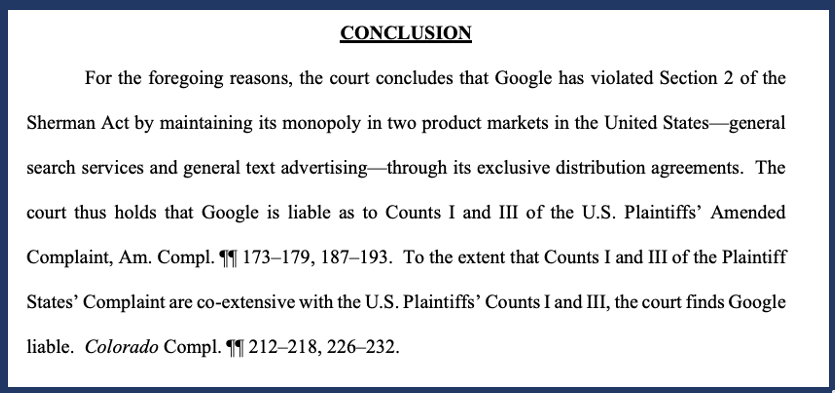

Unless you've been in a coma, you know that Google was found this week to be an illegal monopoly in violation of the Sherman Antitrust Act. The court determined that Google abused its search dominance to thwart rivals, prevent Apple from building its own search engine and raised PPC prices with impunity. But, as we previously said, a finding of liability is mostly symbolic unless there are meaningful remedies. The remedies portion of the trial begins next month. There appear to be three broad options available: breaking up Google, search/click data sharing and elimination of Google's default search agreements. There may be other possibilities on the paid-search side around pricing or auction transparency. The judge's ruling took many people in the industry by surprise – although the same thing happened to Microsoft in 1999. Will the judge be bold in his remedies decision or more "balanced"? Arguably the real remedy is breaking up Google; that's unlikely to happen. Apple's default search deal is probably done however. And there will likely be some sort of data sharing/selling requirement with competitors, as in Europe. In the near term, nothing will change for consumers or marketers, including SEOs. It will be BAU for the foreseeable future.

Our take:

- Prognosticators: here's a general set of fallout predictions; and here's Dr. Pete from Moz, who believes the biggest impact will be on paid search.

- Google's position in general search is what allowed them to so thoroughly dominate paid search. It's unclear what can be done to address that.

- Most people will choose Google anyway, if asked to choose. So in a way the court has done Google a favor by giving them back $20 billion a year.

Now, Will Apple Build a Search Engine?

Having said above that very little is likely to change, we want to explore a more interesting scenario: whether probable loss of the default search deal motivates Apple to build a search engine in earnest. Apple has been flirting with creating a search engine for years but reportedly got fat and complacent on Google's $20 billion annual rev-share deal. This was part of the judge's findings: that Google's payments kept Apple from fully competing in search. At trial it came out that Apple (or some expert) estimated it would need to spend $6 billion per year (on top of existing spending) to operate a general search engine. It was also revealed at trial that Apple currently maintains a search index with billions of sites. So it's more ready to jump into the search fray than perhaps perviously thought. There's a kind of inexorable logic to Apple developing a general purpose search engine, especially now with Apple Intelligence and the partnership with OpenAI, which recently announced SearchGPT – including local.

Our take:

- Apple clearly appears reluctant to compete in search. But it doesn't need to think about it that way. It could just built a better UX for iPhone owners that has web search (also Siri). It has the bad version now.

- In our forthcoming podcast, we discuss monetization of Apple search. The company has a paid-search infrastructure (App Store). It could make a lot potentially with one relevant ad in search results, a better UX.

- Apple is arguably the best positioned right now to have an impact on search competition if it embraced the inevitable rather than fighting it.

Why People Want Stores

During the pandemic analysts made all sorts of grandiose predictions about the death of local retail. E-commerce would continue to eat a larger share of spending as stores closed and malls died, the narrative declared. Clearly that hasn't happened. And while e-commerce continues its incremental march, stores continue to play a critical role for consumers. This was reaffirmed in a massive survey by Ernst & Young (EY): 23,000 consumers across 30 countries. The survey asked about in-store experiences, AI, customer service and other issues. EY found (globally): 57% of shoppers "want to see, touch and feel items before they buy them," while nearly 70% wanted "expert advice on high-value purchases" (presumably from in-store associates). In addition, 61% said "they would go to a retailer for a store promotion [ ] not available online." Shoppers were ambivalent about AI; 68% said they were open to AI-personalized offers, but a majority expressed disappointment, distrust and frustration with AI in online shopping. Roughly half were frustrated by generic chatbot responses and a third didn't trust AI product recommendations. Consumers also cited poor online customer service and difficult returns as digital shopping frustrations.

Our take:

- As we've said, it's not "or" it's "and." Retailers that have both an online and offline presence are much stronger, including in search.

- People are far more likely to buy something online if the can return it to a local store. It gives them confidence + trusted brand. Brand = clicks.

- The bigger challenge is using all these technology tools in a way that enhances CX and doesn't F it up, which is often the case.

Recent Analysis

- Near Memo episode 168: OpenAI & MindTrip bring AI search, search shenanigans, boost Google local rankings with engagement?

Short Takes

- New Google Knowledge Panel format live for some people.

- How to connect SMS or WhatsApp to GBP for messaging.

- GBP 'See Also' carousel shows competitors, drives more searches.

- Google to show LSA photos from the Local Service Ads profile.

- Product images in Google SERPs now showing star ratings.

- Dotdash Meredith: Google AIOs having a "negligible" impact on traffic.

- Forbes ranking for its directory of near me lawyers (probably shouldn't).

- Click prices going up, performance is flat (which means ROI down).

- Apple services profit may soon surpass its devices profit.

- UK regulator issues warning to social media sites about inciting violence.

- Nextdoor Q2 revs of $63 million, 45 million users (both numbers up YoY).

- More pages indexed in Google correlated with traffic declines.

- Stupidest thing ever: Twitter/X sues advertisers for not advertising on X.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.