Google Loses, AI Ankle Biters, GBP Menu Optimization

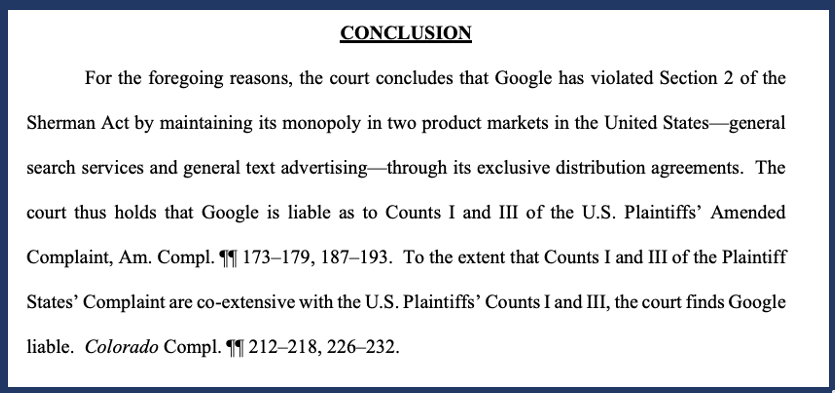

Google Loses Antitrust Case

Contrary to what you may understand, it's not illegal to be a monopoly in the US. Rather, it's illegal to abuse your position to maintain that monopoly. That's what Judge Mehta of U.S. District Court for the District of Columbia found in his almost 300 page ruling, which largely goes against Google. Specifically, the court found that Google holds monopolies in "general search services" and "general search text ads." Its default search deals (e.g., Safari) were found to be anticompetitive. The judge also determined the company charged "supracompetitive prices for general search text ads," allowing Google to "earn monopoly profits." What the court essentially said is that Google used its power in general search (and default distribution agreements) to hobble competitors and increase paid-search prices without concern about competition. The decision is a major victory for the Department of Justice and reminiscent of Microsoft's antitrust defeat 25 years ago (the company mostly escaped unscathed). However, this was only the liability phase; now comes the more important remedies phase. Google's response was mostly defiant self-justification.

Our take:

- We predicted this outcome, given the really incriminating material that came out at trial. But liability is mostly symbolic without remedies.

- Default search deals are now probably dead, which means billions lost for Apple but could really impact Mozilla/Firefox. It might also jumpstart Apple's moves into search, especially given Apple Intelligence.

- Google is going to appeal, which could tie things up for years. There are two outcomes: minimal change or structural change. My guess is that the judge won't break up the company. But there will be a ripple effect.

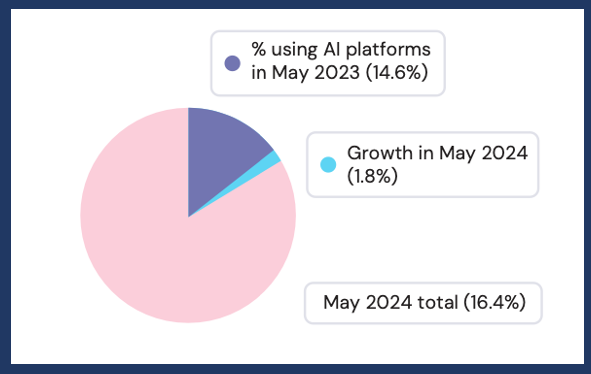

Report: AI Not a Threat to Google

It wasn't the legal system that disrupted Microsoft's desktop and browser monopolies two decades ago it was competition from Apple and Google – although Microsoft is now more valuable than ever. Similarly, today, Google is probably less concerned about the consequences of antitrust liability than the competitive threat of AI. But behavioral data so far don't seem to validate the "disruption narrative" popular among industry insiders. A new traffic-based report (gated) from Datos/Semrush and Sonata Insights uses traffic and search volume data to look at AI's impact on Google, the relative positions of AI-based search offerings (ChatGPT, Perplexity, Claude, Copilot and Gemini), social search and product search. It says that Google's traffic and share of search data has been stable since ChatGPT's launch. AI search (especially Perplexity) is growing but relatively small. And all five AI properties saw growth except Gemini. The report found that 16.4% of all search users also use an AI tool, up 2 points since May 2023. Social search isn't really a threat to Google and YouTube is the biggest "social search engine." It concludes by saying that retail search activity is "stable" (e.g., Amazon, eBay) and not yet impacted by AI. The argument is: AI is so far is more PR than product disruption.

Our take:

- There's tension between consumer survey data and the traffic data. The traffic data doesn't indicate (as the report argues) any changes. But the survey data suggest pent-up demand for Google alternatives.

- The chart above may be the most important in the report: 16.4% of searchers use an AI platform. If this continues to grow, more people may conduct AI-based searches simply because they're there.

- The analogy that comes to mind is MySpace and Facebook. Users were on both until they weren't. Google isn't MySpace but there will be erosion of usage, mostly on the informational query front.

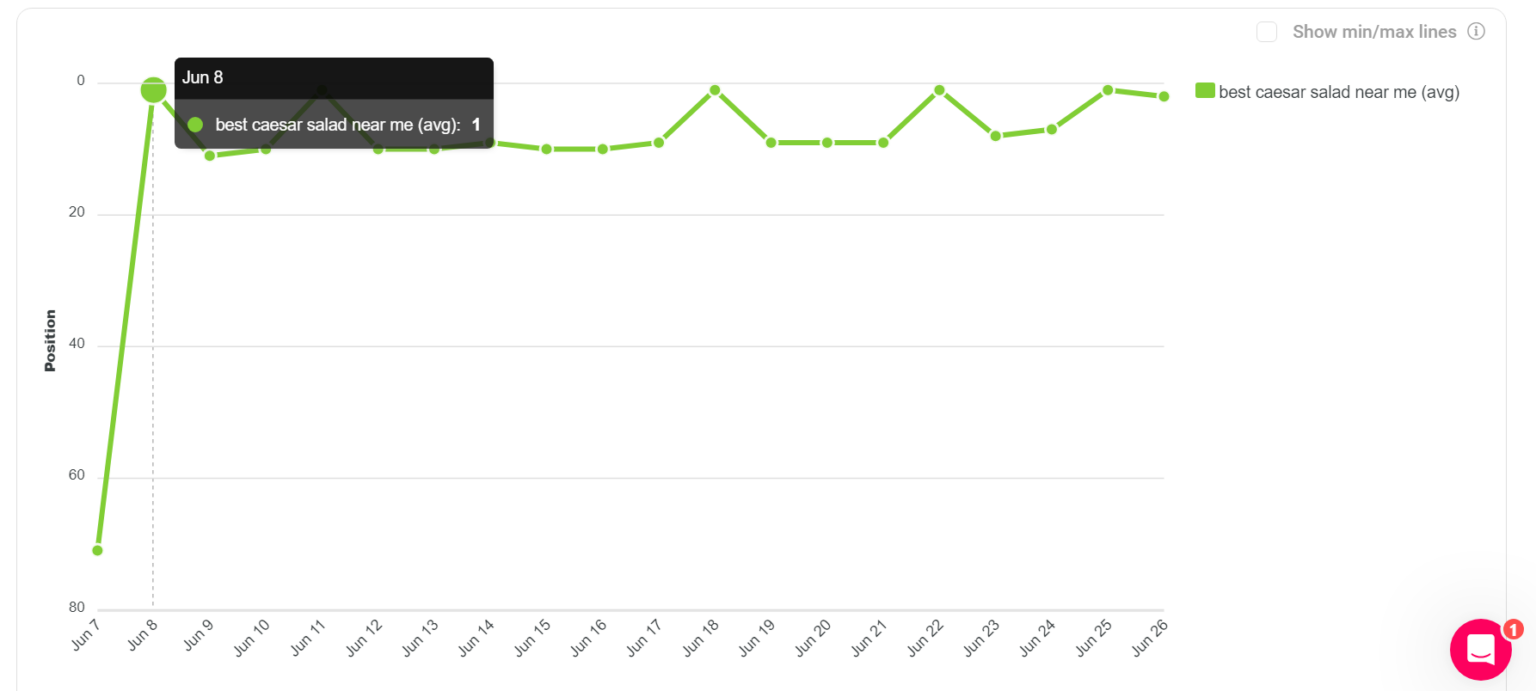

Menu Optimization and GBP Visibility

Near Media's search user research in the restaurant vertical has found, unsurprisingly, that menus drove significant user engagement. They often appear in images (menu photographs) in Google Business Profile carousels. And people frequently click through to restaurant sites to look at menus. Claudia Tomina's own research confirmed that menus and menu items help local restaurants rank. Her recent post discusses menu optimization best practices. For those doing SEO for local restaurants it offers detailed tactical advice. She says that while primary category (i.e., cuisine) is the dominant signal, "you need a combination of strategic menu naming (think query searches), relevant photos ... the right business name and consistent menu highlights..." No single factor is enough by itself. In contrast to SEO conventional wisdom, she argues that, at least here, keywords in reviews do matter – this is a fairly nuanced discussion. Understanding competitors and what they're ranking for is also a key success variable. As a bonus, she links to another guide about how to remove third party vendors from your GBP listing.

Our take:

- Tomina doesn't specifically discuss clicks/engagement; however, these changes also will boost engagement and potentially visibility accordingly.

- Images, menus and reviews are going to matter most to users when looking at Google Business Profiles, in terms of decision factors.

- I'm struck (again) by how it would be impossible for a non-corporate restaurant to do any of this on its own without professional SEO help.

Recent Analysis

- Near Memo episode 168: OpenAI & MindTrip bring AI search, search shenanigans, boost Google local rankings with engagement?

- ICYMI: Local Search Is Evolving, Here's Why You Need to Pay Attention, by Mike Blumenthal.

Short Takes

- 11 Local SEO tools you should be using.

- Google sending notifications to users to update local reviews.

- Google testing "see also" (other GBP profiles) in local results.

- How to use Apple Maps new "search here" (near me) feature.

- Google Search Console introduces recommendations.

- Distraction Control (iOS 18) will hide ads and other annoying site features.

- Sites blocking OpenAI's crawler, make its search efforts more difficult.

- Twitter closing SF headquarters in spiteful move by Musk.

- Tarnished CNET being sold to Ziff-Davis for ~$100 million (NYT).

- Don't hallucinate: Apple Intelligence "back end prompts" revealed.

- Optimizing for AI chatbots a different game vs. Google.

- Beyond the phone: Google bringing Gemini to earbuds, Nest speakers.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.