Instacart In-Store Nav, Uber's Fuel Dilemma, Local Vehicle Ads

Instacart Launches in-Store Navigation

Almost a decade ago, when Apple's iBeacon was a shiny new object, there was considerable anticipation of "search to shelf" experiences with in-store navigation. A number of mobile apps (e.g., Aisle411) worked with different retailers to try and bring shelf-level wayfinding to market (in-store AR was a part of that too). In parallel, multiple companies sought to deploy "blue dot" navigation for shopping malls, airports, museums and large department stores. Most of these startups were ahead of the market and their efforts fizzled. We're now seeing some those early visions reappear (e.g., ARKit). Accordingly, Instacart has launched in-store navigation for its workers, to speed delivery times. "This feature is being piloted in more than 80 stores across North America to start, with more stores being added over time." The specific stores weren't identified.

Our take:

- Instacart is a delivery app; this feature isn't for consumers. But it might prompt new investment in indoor navigation.

- Instacart's approach is department focused rather than product specific. There's more complexity in leading people to individual products.

- Some major retailers indicate in-store locations of products on their sites/apps (e.g., HomeDepot, Target). But it's still rare.

Gas Prices Threaten Ride-Sharing Recovery

As ridership has gradually returned Uber and Lyft have faced "historic driver shortages." Both companies are employing multiple strategies to retain current drivers and attract new ones. One example: a new Uber algorithm that gives drivers a better sense of what they'll earn before accepting a ride. Now, rising gas prices are putting the squeeze on drivers, who must absorb those costs, and threaten the ride-sharing recovery. In some cases, the price of gas has pushed driver earnings down to below minimum wage. (Drivers are independent contractors and not subject to minimum wage laws.) This is prompting some to quit and making recruiting new ones more difficult. Uber recently raised its 2022 outlook on rising consumer demand, but that may be premature.

Our take:

- Uber and Lyft have the option to raise wages/prices and take some of the pressure off drivers; they'll be forced to take some sort of action soon.

- Risk: Any price increases could discourage customer frequency and reduce revenue growth.

- The cost of gas will also hit food delivery services, which carry huge fees for customers. Those fees will increase to reflect rising fuel prices.

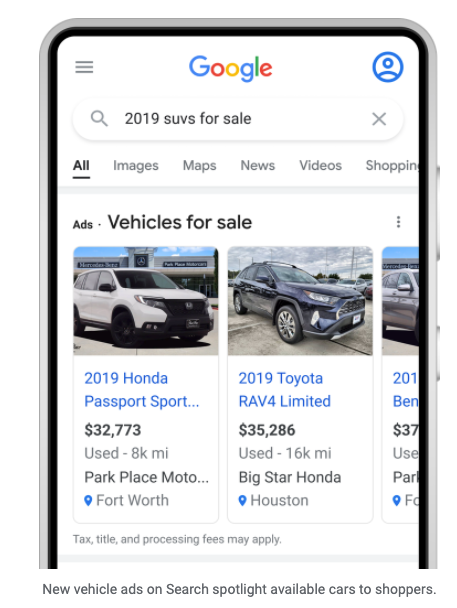

Google's New Local 'Vehicle Ads'

After testing, Google is rolling out new local vehicle ads (LVAs). It's a flavor of Smart Shopping campaigns. Indeed, users searching for car queries with a location, will see a Google Shopping-like horizontal carousel with images, pricing, mileage and other information. The landing page is hosted on the seller site but Google might try to standardize it. Google says dealers can assign value to leads (form fills) or visits (offline) for optimization purposes. LVAs are for dealers only; individual sellers can't use them. To participate, sellers need to create a vehicle inventory feed and connect it to Google Merchant Center and a Google Business Profile. However, "A store feed alternative to Business Profile linking is available if you don’t own or manage the profiles for your dealer locations." The rollout is right now limited to the US and "select [unidentified] countries."

Our take:

- This is another real-time inventory, omnichannel offering from Google.

- Smart Shopping ads appear on the Google Search Network, Display Network, YouTube and Gmail. That will probably also be true for LVAs.

- There are a number of pilot advertisers; Carvana is one, with multiple ad units in each carousel. This could be a big revenue driver for Google.

Recent Analysis

- Yelp's Hidden Headwinds: Declining Traffic and Aging Reviews, by Mike Blumenthal.

Short Takes

- Search: Google says location, language not "personalization."

- After pilot Twitter launches mobile shops.

- Twitter's (long-shot) strategy to add 100M users by 2023.

- Gender Pay Gap Bot trolls UK companies tweeting about IWD.

- It's the brand: The collapse of Facebook's cryto-dream.

- Business formation down from 2020, but higher than pre-COVID.

- Sidewalk robots are coming, so are cars without steering wheels.

- Road infrastructure needs to change for autonomous vehicles.

- Geared for enterprises, Magic Leap's new AR glasses are being praised.

- AR without apps: Niantic buys WebAR platform 8th Wall.

- Google updates Messages to make it work better with Apple's iMessage.

- Publishers up in arms that contextual ad networks scraping their websites.

- Axios trying to bring truncated style to local news reporting (NYT).

- Stripe announces support for crypto.

- COVID, inflation, Ukraine: People are suffering from chronic stress.

- People are also buying vinyl records and CDs again.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.