Missing Local Packs, Correction or Shakeout, Twitter 'Hellscape'

Google Local Pack Decline

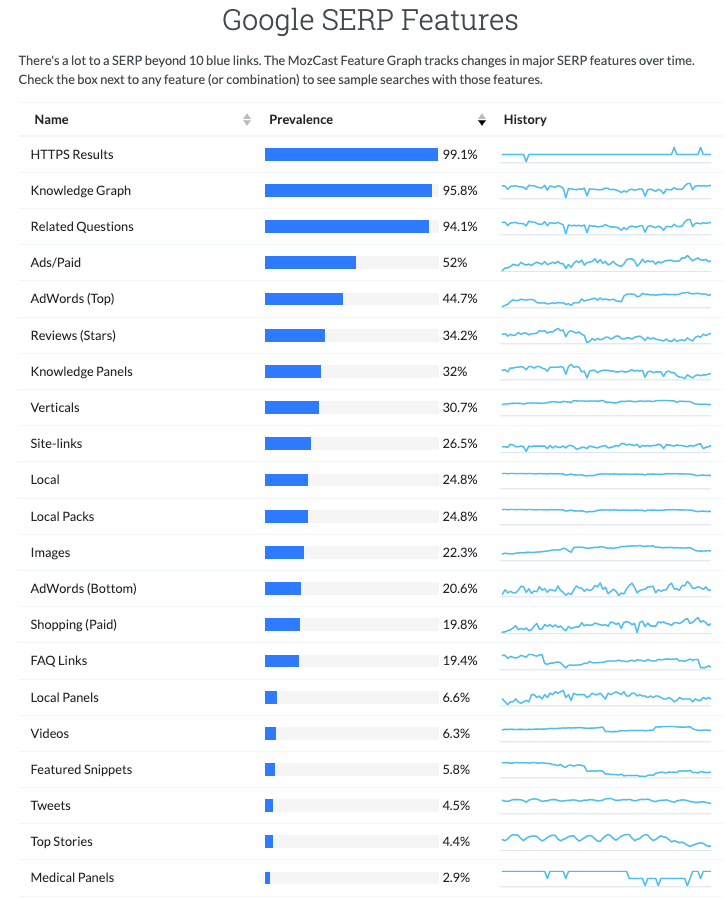

There's evidence that Google is reducing the frequency of Local Packs. Barry Schwartz has compiled data from Moz, Rank Ranger and Semrush that show a decline in the appearance of Local Packs in SERPs. Moz shows the biggest decline from 40% to ~25% of queries. The others are more stable and BrightLocal hasn't detected any changes. There are other, anecdotal observations of Local Packs not being triggered as they have been in the past. Moz's Dr. Pete Myers also observed other SERP features showing less often: "Image results, Video carousels, Twitter carousels, and Top Stories." In parallel, Google has rolled out an awkward and unpopular new UI for in-SERP editing of GBP details for SMBs and non-enterprise customers. It's not confirmed that Local Packs are showing less often. But why might it be the case?

Our take:

- The reduction in SERP-feature frequency, including Local Packs, may be Google's attempt to address antitrust "self-preferencing" claims.

- Semrush, in its recent study, found a much lower rate of "zero-click" searches (25%) than previous studies from SparkToro (65%).

- The move to reduce Local Packs is surprising against the backdrop of Google's emphasis on local at recent search events (e.g., Search On).

Q3: Temporary Correction or Shakeout?

The US is not in recession. But investors and advertisers are acting like it is, with many pulling back because of fear or caution. That showed up in weaker-than-expected results this week from Google and Meta. Investors punished both but especially Meta, whose revenue was down 4% YoY and net income off a whopping 52%. Yet the company continues with unabated spending on the Metaverse. Conversely Apple, Microsoft and Spotify beat expectations. But there was softness in Apple's record quarter (i.e., iPhone) and Microsoft was cautious in its outlook. Q4 will likely see a return to growth for most of the big companies, with the exceptions of Meta and Snap. Google should also see stronger ad-revenue growth; the question is how much amid intensifying competition. And while Amazon reported weaker-than-expected Q3 revenues, ad revenue was up 25%. The company also announced new ad formats.

Our take:

- Amazon's advertising ARR is now ~$40B. That compares with $115B for Meta and Google's $209B in 2021. Apple is expanding its ads programs.

- Investors care about growth outlook most. That will be hard for Meta and Snap. Paid search should benefit from holiday retail ad-spending.

- Meta is no longer one of US's 20 biggest companies. Zuckerberg appears to have lost interest in the core business. But the metaverse won't save Meta.

Ads, EU May Prevent Twitter 'Hellscape'

Elon Musk now owns Twitter. He has already fired most of the c-suite, save Chief Customer Officer Sarah Personette. Soon "mass layoffs" will reduce Twitter headcount by at least 1K, if not by thousands. (Hundreds already left for other tech companies.) Yesterday Musk sought to reassure advertisers, concerned about the relaxation of content moderation. He promised that Twitter won't become a "free-for-all Hellscape." However, Trump is likely to be "unbanned," which will serve as a gesture to the right and symbol of Musk's "commitment to speech." But according to the WSJ, many large advertisers have said that they will withdraw if Trump comes back. Regardless, the toxic Hellscape many fear probably won't come to pass for two reasons: advertiser outcry and the EU's Digital Services Act, which prohibits "illegal content," including disinformation and hate speech.

Our take:

- 90% of Twitter revenue is from ads. Advertisers will flee if content moderation is substantially degraded or eliminated.

- Musk won't be able to replace ad revenue with subscriptions. Perhaps reduced headcount, commerce and subscriptions will ease ad-dependence however.

- DSA can fine 6% of revs ($300 million for Twitter). Musk won't maintain separate content for EU and ROW. He'll have to play by EU rules.

Short Takes

- Yelp-Mailchimp deal will put Yelp content in email campaigns.

- Google algorithm changes cause "chaos" for publishers.

- Google buys AI avatar site Alter for ~$100 million.

- Like Netflix, TikTok is getting into gaming.

- Uber introduces geo-targeted ads based on destination (WSJ).

- Teen survey: 87% own an iPhone, TikTok #1 social media platform.

- New YouTube UI borrows a lot from TikTok.

- Instagram now has 2B users, soon more valuable than Facebook.

- Meta fined $25M for repeatedly violating state campaign finance laws.

- If Kroger-Albertsons happens, it will impact 67% of US shoppers.

- Department store foot traffic varies by segment but is recovering.

- Click and collect/BOPIS grows while curbside pickup declines.

- Republicans sue to get fundraising spam into your inbox.

- Spyware apps capturing calls and location data on Android devices.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.