Nadella Slams Google, Ads vs. Fees, Trust Sells

MSFT: 'Google Blocked Bing'

Earlier this week Microsoft CEO Satya Nadella testifed at the Google antitrust trial. The irony of the companies' role reversal should be lost on no one. Years ago, Google was the sympathetic upstart to Microsoft's "evil empire," which in 1999 was nearly broken up. That of course never happened after the company was partly vindicated on appeal, while agreeing to change some of its business practices. Following Steve Ballmer's disastrous tenure as CEO, Nadella has completely transformed Microsoft's image. And despite being one of the most valuable companies in the world, it's now the underdog – at least in search and mobile. Another irony: it was competition from Google that helped humble Microsoft, not antitrust. Highlights of Nadella's testimony, supporting the government's case against Google, include: "nobody changes their default search engine"; default agreements kept Bing from gaining access to enough user data to make it more competitive; and Nadella fears the same pattern will repeat with AI training data (exclusive deals that lock competitors out).

Our take:

- Google's persistent comeback in this trial so far has been: our products are just better, others' are weaker.

- When questioned, Google has hidden behind the cliché, "the competition is just a click away" – for at least a decade.

- Reality is in-between: Google does anti-competitive things but its product is better (or has been), partly because of its agressive behavior.

Ads vs. Subscription Fees

Netflix is planning to raise prices again. And soon it will be even more expensive to watch ad free. Other streaming channels, Prime, Discovery+, Disney+ and Hulu, are also boosting ad-free tier prices. While the companies speak of production costs, they also hope to push people into ad-supported tiers, partly to reduce "subscription fatigue" churn (high), while capturing more revenue from anti-ad "holdouts." The streamers also see a significant revenue opportunity in ads as they try to satisfy Wall Street's insatiable appetite for quarterly growth. What's emerging is not unlike an airline seat-class system; it will be increasingly expensive to enjoy the best (ad-free) experience. Enshittification in process. Meanwhile, social media companies are increasingly teeing up subscription fees, in some cases to address stricter consent-based, data-privacy rules in Europe. For example, Meta is proposing the equivalent of $14 per month for ad-free Facebook and $17 for both Facebook and Instagram. They're doing this, manipulatively, so they don't need to alter their systems: pay or consent to targeting. Separately, as Twitter's revenues have fallen off a cliff, Musk has tried to impose fees on users – no reach without Twitter Blue – and floated charging everyone on the platform.

Our take:

- Choice is great. But there's a lot of manipulation going on, as in the Facebook and streaming examples – punitive pricing, forced consent.

- Many marketers argue "ads are valuable content." That's true in a minority of cases. The public generally doesn't trust advertising.

- The problem with digital advertising is not that it exists – people want free content – but that the platforms are targeting without consent.

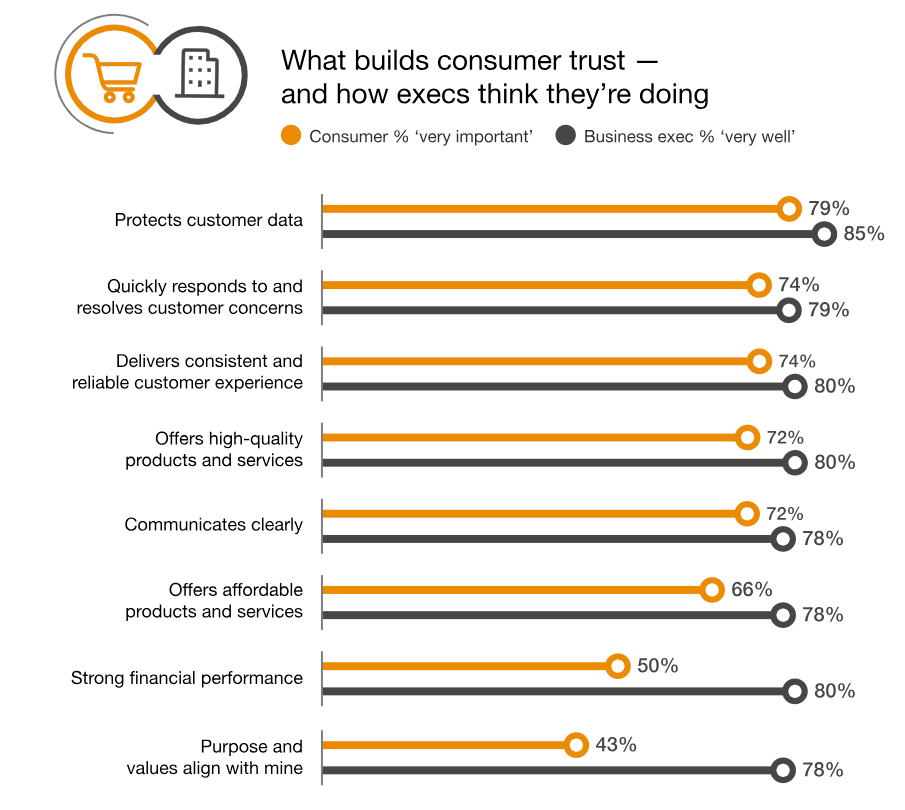

Trust Improves Revenue

There's often a conflict in marketing departments between investing in brand or performance marketing. The two are not mutually exclusive, in theory, but often are in practice, as quarterly targets take budgetary priority over longer-term reputation building. Of course these are abstract generalizations. But it's a fact that trusted brands have stronger long-term revenues, higher loyalty, lower customer acquisition costs and, generally, an easier time recruiting employees. One reason is better word of mouth, which also translates into brand search queries. Consumers are often willing to pay more – 46% more in a retail context – when they trust a brand. Apple and Amazon are top-of-mind examples of trusted brands with incredible loyalty. Telsa is another (although that's changing). Caveat: Amazon has done shady things (here, here), which so far haven't significantly hurt its brand (but see review fraud). Trust is the core of a healthy and successful brand and a function of multiple variables: UX, quality, service, privacy, values. Trust is very challenging to build but quickly and easily lost.

Our take:

- Look at the chart above: data protection is the top trust factor for consumers.

- Online reviews are a key way for brands to build trust – and the largest driver of conversions – however, the system is now polluted with fraud.

- Trust will only become more important as scams and fraud persist online. Brand trust is a key to organic growth and conversions.

Short Takes

- Google: HCU, spam update and now another "core update."

- GBP social profile rollout seems to be nearly complete.

- Optimizing product listings/results on Google retail SERPs.

- Google trial: restrictive carrier contracts blocked potential competition.

- Google sought to rebut Wired claim it changes queries for clicks.

- Apple quietly buying more AI startups than Google, Microsoft.

- Twitter/X's crowdsourced fact checking scaring brands away (WSJ).

- News aggregator Artifact becomes a Twitter competitor with posting.

- Social media traffic to news sites nosedives.

- Adobe to release easy-to-use AI photo editing tool – Stardust.

- Mailchimp and Wix in new partnership.

- Adobe says holiday e-commerce to reach ~$222B this year, up 4.8%.

- MSFT getting ready to close $69 billion Activision Blizzard deal.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.