Paid Search Winning, Healthcare Review Explosion, Too Big to Care?

Paid Search Is Winning

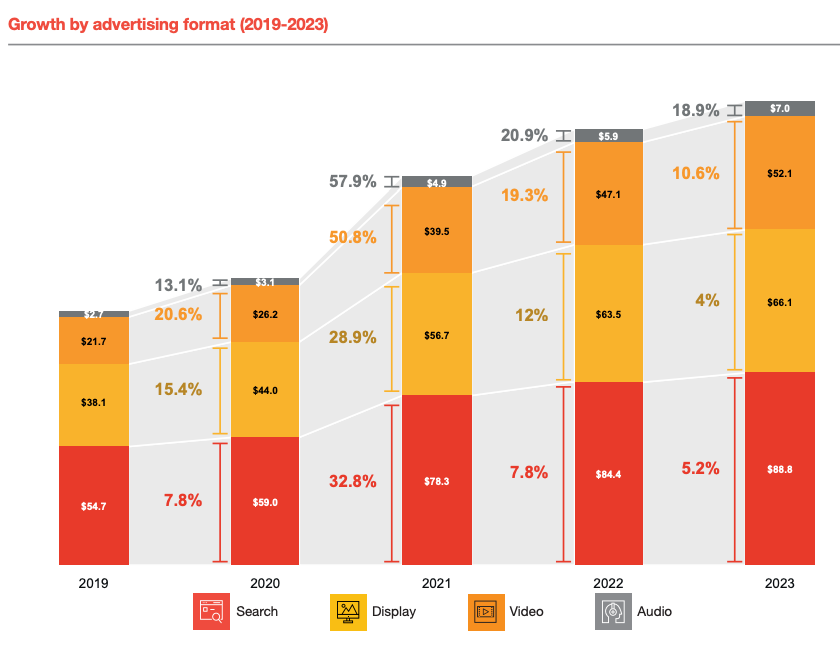

Last year was good for digital advertising, which grew more than 7% and brought in a total of $225 billion in the US. That's a new watermark, according to the 2023 Internet Advertising Revenue (IAB) Report. Paid search accounted for the largest share of online ad revenue (39.5%), coming in at roughly $89 billion, up more than $4 billion vs 2022. While paid search's share of total revenue declined, real dollars grew 5.2%. The report notes that "advertisers continue to prioritize paid search due to its effectiveness in driving brand and business results." Many analysts expect a deceleration in paid search because of its maturity. That's a safe prediction, but we can expect Google search revenues to continue to climb because of search's role in the buyer journey and the company's dominant status, as well as the company's ongoing efforts to monetize (everything). Google's new opt-in Ad Intents contextual format is an example of "creative" monetization. The other noteworthy dimension of the IAB report is that the top 10 ad platforms increased their share of US digital ad revenue, by 3%, to 79.8%. The IAB partly credits "Apple’s privacy practices" as boosting the largest platforms (walled gardens), which have lots of first party data and "closed-loop reporting."

Our take:

- The concentration of ad revenue in only a few companies has been true for some time but it's not healthy – a too-powerful oligopoly.

- The end of third party cookies and regulatory efforts, unintentionally, seem to be bolstering the power of larger platforms.

- In a world of increased online privacy, paid search should continue to see gains because it doesn't rely on cookies or other personalized targeting.

Massive Review Growth in Healthcare

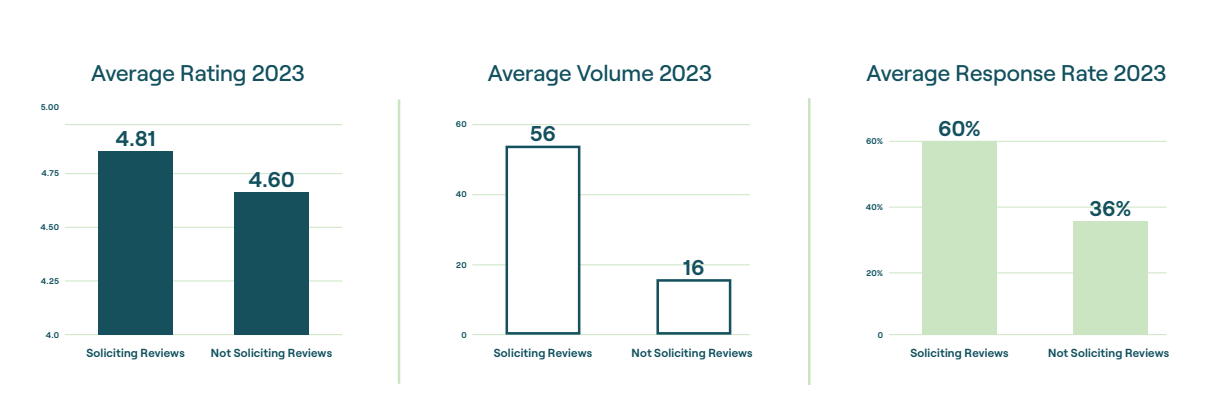

Reputation's new 2024 Healthcare Reputation Report, which argues in favor of active, SaaS-based review management, documents the significant growth of user reviews in the healthcare vertical. The reputation management platform says that roughly five years ago, healthcare "received 643,000 reviews annually." By the end of last year that number had grown 150% to "1.61 million reviews annually." Reputation said that the average rating for hospitals with active review solicitation programs was 4.41 stars vs. 3.49 for those not doing so. Review volumes were also significantly higher as were review response rates. And online visibility is much greater for hospitals with more reviews and higher scores. Finally, search is the dominant way consumers look for doctors, followed by insurance company portals. Reviews are typically, though not always, the top consideration in consumer buying decisions. In Near Media healthcare research (physicians and clinics), we saw consumers scroll deep into the Local Finder (especially in mobile), looking for the best reviewed doctor profiles. This frequently took them to positions 4 - 14 and beyond. And for those doctors under active consideration, the median rating was 4.8 stars, with at least 20 reviews.

Our take:

- The bottom line: active review management produces much better results across the board.

- You're probably not going to be considered without meeting review volume and ratings thresholds. The stakes are high for business owners.

- There's increasing review manipulation (see, here, here). According to a 2021 report from Uberall and The Transparency Company, between 8% and 9.2% of selected healthcare category reviews were suspicious.

Too Big to Care?

Should Google be considered a "public utility"? The idea that Google is like a power company has been raised multiple times by commentators, regulators and some public officials. In 2021, for example, Ohio's Republican attorney general sought to have Google declared a public utility to prevent it from "self-preferencing." The case has not been resolved but it's unlikely that Ohio will prevail. A Wired article explains why the logic behind the suit is "a mess." But the sentiment behind it may not be. Google certainly has competitors (e.g., Bing, Amazon, ChatGPT, TikTok) and may be more vulnerable than it has been in some time. Yet it's still a near monopoly in search, with 91% of the global market. (In North America it's lower.) In a recent interview with Jon Stewart, FTC Chair Lina Khan discussed the current state of antitrust and tech companies. Without mentioning anyone by name, Khan nonetheless described the attitude of many tech companies as "too big to care." What this means, she elaborated, is they can start mistreating stakeholders because there are no real alternatives. She also argues, these companies treat regulatory/legal fines as a "cost of doing business."

Our take:

- She's right that fines have historically been treated as a cost of doing business; although EU fines now have more teeth.

- Google is probably not committing "malfeasance" but "negligence": e.g., review fraud and potentially damaging UGC rankings (YMYL queries).

- Section 230 also protects companies like Google and enables "too big to care" indifference to potential harms "on the ground."

Recent Analysis

- Seattle Surgeon Guilty of Breaking Law with Review Practices, by Mike Blumenthal.

- A closer look at user behavior in Local: Conversion Cast discussion with Mike Blumenthal.

- Near Memo episode 153: Standardizing review processes to avoid fear, Google cries wolf around DMA, and the future of SGE.

Short Takes

- What to do when Google changes your Google Business Profile data.

- Increase in GBP booking button integrations.

- Anticipating SGE's impact on local search and local SEO.

- Brave launches "AI answer engine," less impressive than it sounds.

- No more draft review saving on Google Maps.

- Google Maps wants to help you lower your carbon footprint.

- Case study: Smaller internal link block boosted rankings.

- Google internally reorgs to accelerate AI adoption across products.

- Amazon Prime subscriptions reached a new high: 180M in US.

- Amazon says it's not walking away from Just Walk Out.

- Meta adding AI-powered assistants across its various apps.

- SparkToro building a tool that aggregates search "chip" frequency.

- EU: Meta cannot infer consent for behavioral ads; must be explicit.

- EC's Margrethe Vestager is moving on, will antitrust enforcement suffer?

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.