Reddit Search, Marketing Misalignment, Dark Side of DMA

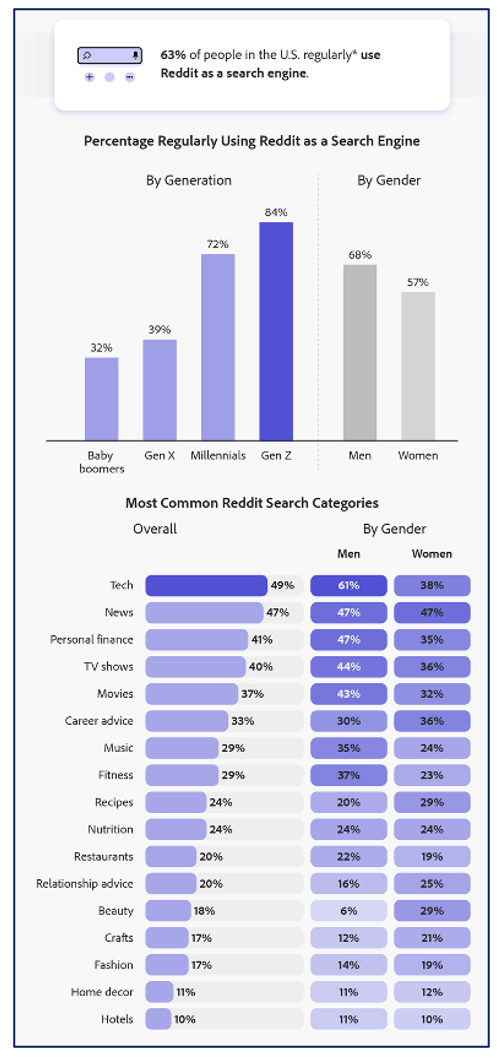

Reddit the Search Engine

The widely cited article "Google Search Is Dying" appeared in February 2022. It was really a discussion about Reddit as a search engine. Nearly three years later, Reddit has done a significant deal with Google and ranks #1 for numerous queries (it shouldn't). It's the 10th most visited site globally and number 5 in the US, ahead of Yahoo – partly because it ranks so well in Google. Now, an Adobe survey finds that 63% of consumer-respondents are using Reddit as a search engine at least once a week. GenZ and Millennials are the largest groups. GenZ trusts Reddit results more than Google's, although older users don't. The top three reasons, according to the survey, that people are searching on Reddit are: authentic reviews (67%), opinion diversity (52%), and sense of community (44%). And small businesses are increasingly viewing Reddit as a marketing platform, with 28% posting – replying to posts – on Reddit as part of their marketing strategies; 49% post at least weekly. In addition, roughly 10% of small businesses say a Reddit page (presumably that they're mentioned on) outranks "their business page" in Google.

Our take:

- Adobe did a similar survey about TikTok search. The two sites are being used by consumers for search in very different categories.

- Will success spoil Reddit? In a word "yes." The site is getting spammier and will only get worse as more people exploit Reddit for marketing.

- Reddit is also a public company, which brings (often unrealistic) growth expectations and pressure. That will mean more ads in more places.

Marketing Misalignment: Agencies & SMBs

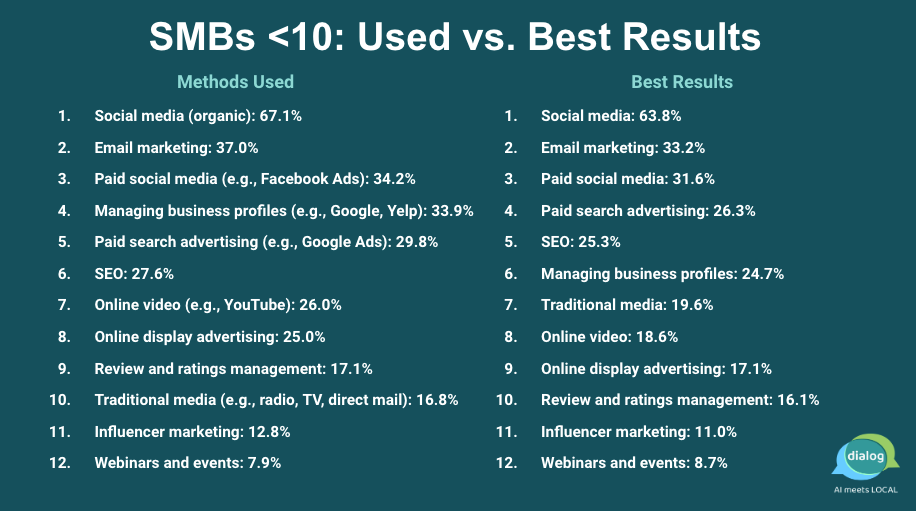

Two sets of data (from my other project Dialog) tell an interesting story of misalignment between agencies and their clients. In January, we published the results of a 1K small business survey (here only with <10 headcount). A new survey of 294 agencies came out in August. What the data show is general alignment but some meaningful gaps between agencies' offerings, demand and SMBs' performance perceptions. The first slide below shows channels these very small SMBs use and what they think works (emphasis on think). The second slide shows top agency offerings and their perceptions of demand (not segmented). The SMB channels vs. performance perceptions generally line up, although there are differences (e.g., traditional media). But with agencies there are larger gaps (offerings vs. demand). For example: SEO, reputation management and email. Reputation management is a core offering (#5) but not in demand, validated by the SMB data. Email marketing is not a top offering, yet it's in demand. On the SMB slide, email is #2 (used + results). Back to agencies, there's broad alignment with SEO, web/app design, and social media marketing, which is dominant among SMBs. But there are clearly missed opportunities here for agencies.

Our take:

- Segmenting agency data might tell a slightly different story. But why don't agency offerings and demand perceptions better line up?

- On the SMB slide, it's crazy that SEO, profile management (to some degree) and reputation management aren't higher priorities.

- Agencies have an opportunity to educate clients on the value of services like review management and expand offerings to better respond to demand.

Dark Side of EU Regulatory Zeal

Europe has shown resolve and regulatory courage where the US has failed to act legislatively. However, there's a darker side to the EU's zeal to become the world's tech regulator: economic nationalism. The Draghi report, about European competitiveness in a late-stage capitalist economy dominated by US and Chinese companies, calls on Europe to make a number of ambitious moves, including significant and costly investments, difficult reforms and to aggressively enforce the Digital Markets Act (DMA). As you know, the DMA seeks to boost competition in Europe by restraining so-called "gatekeepers." The designated gatekeepers – there are only six, although Booking.com will likely become one – are Google, Amazon, Apple, ByteDance, Facebook and Microsoft. That's five US companies and TikTok's Chinese parent. On the one hand this is entirely appropriate, given how powerful these companies are all around. Ensuring fairness, ethical behavior and transparency are critical. However, the "quiet part" is that the DMA targets US tech providers so EU companies can succeed; in other words, regulation as a tool of nationalistic economic competition (not different from tariffs in a way, though seemingly more principled). Accordingly, the DMA is one part principle and one part power play.

Our take:

- Regulating complex industries is hard, often with unintended consequences.

- Tech companies are trying to push back with lobbying and PR, arguing too-strict regulations impair EU competitiveness, rather than advance it.

- There is some truth to the argument, although it's transparently self-interested and not really about Europe's economic health or well-being.

Recent Analysis

- ICYMI: Tool – How Many Reviews Do You Need to Reach a 5.0 Rating? by Mike Blumenthal.

- Near Memo episode 174: How consumers look for hotels, impact of recent EU fines on Google, possible remedies to prevent Google self-preferencing.

Short Takes

- How many local citations do you need?

- Clicks may support rankings even when links are removed.

- Mail Boxes Etc. misused to mislead on UK business addresses.

- How to get keywords in the text of reviews.

- No LSA bid minimum – or maximum?

- Google search antitrust trial judge lays out remedies schedule.

- LinkedIn (MSFT) trained AI on user data before telling users.

- The TikTok-ification of YouTube continues.

- Google-employed lobbyist watering down privacy for consumers.

- Google offered to sell Adx to avoid EU antitrust probe.

- Investors see Google break-up as inevitable (WSJ).

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.