Review Fraud, K-Recovery, Context Is King for Mobile

Leak Shows Massive Scale of Review Fraud

The scale of the review fraud problem online is not precisely known, except that it's big. This is especially true for destinations like Google and Amazon where review ratings and volumes impact rankings (and sales). On Amazon, reviews heavily factor into "Amazon's Choice" status, which can juice sales. Now, a significant data leak associated with an offshore fake reviews operation hints at the massive scale of the problem. As many as 250,000 individuals and their identities were leaked. These are "verified purchasers" paid to generate positive reviews on Amazon. The leaky server was Chinese but the fake reviewers are from Europe and the US.

Our take:

- Consumers rely heavily on reviews. That, plus algorithms that reward reviews and lax enforcement by platforms have created this mess.

- Review fraud is a problem across major review sites, although it's much greater on some than others (i.e., Amazon, Google).

- There's growing consumer awareness of review fraud (67%) and the FTC appears ready to crack down, albeit with weakened authority.

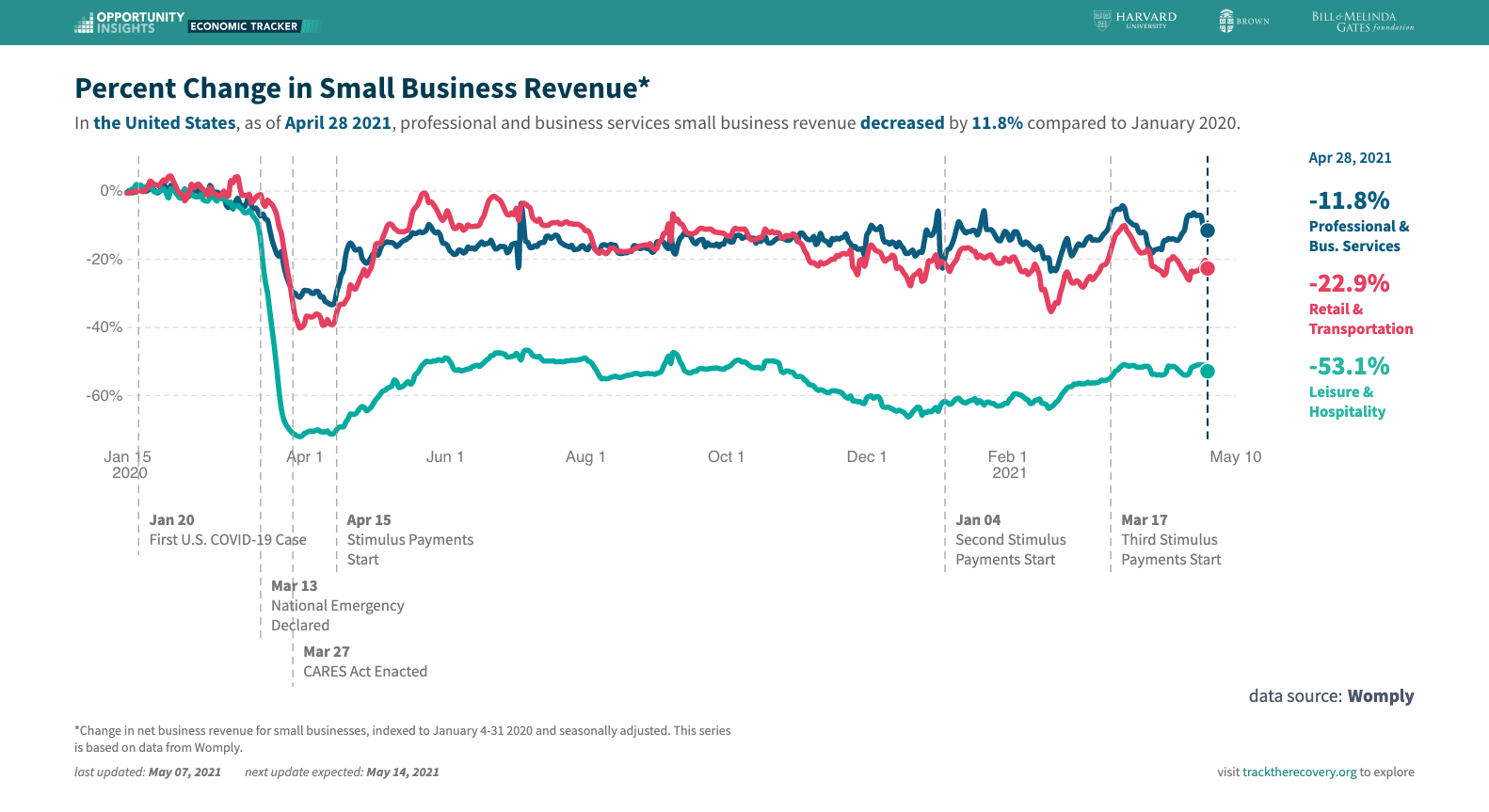

K-Shaped Recovery: 34% of SMBs Still Closed

While many large companies are reporting solid or boffo Q1 results, below the surface all is not well. We're in a "K-shaped recovery;" some but not all sectors are recovering. Certain categories of workers are struggling and most SMB revenues have not returned to pre-COVID levels. Revenues are down for professional services (-11.8%), retail and transportation (-22.9%), leisure and hospitality (-53.1%). Nationally, 34% of small businesses remain closed. San Francisco, Boston and Washington, D.C. have the highest percentage of closed businesses (47% - 48%); Salt Lake City, Memphis and Honolulu have the lowest (24% - 26%). On a positive note, new business applications are up. (H/T to Neal Polachek.)

Our take:

- The economy is a study in contrasts: pain for some, massive gain for others. The theme of winners and losers will continue.

- Notwithstanding positive data, these imbalances represent a structural problem for the US economy over the long term if not addressed.

- Caveat: we probably can't extrapolate these numbers fully; 34% closed represents millions of SMBs.

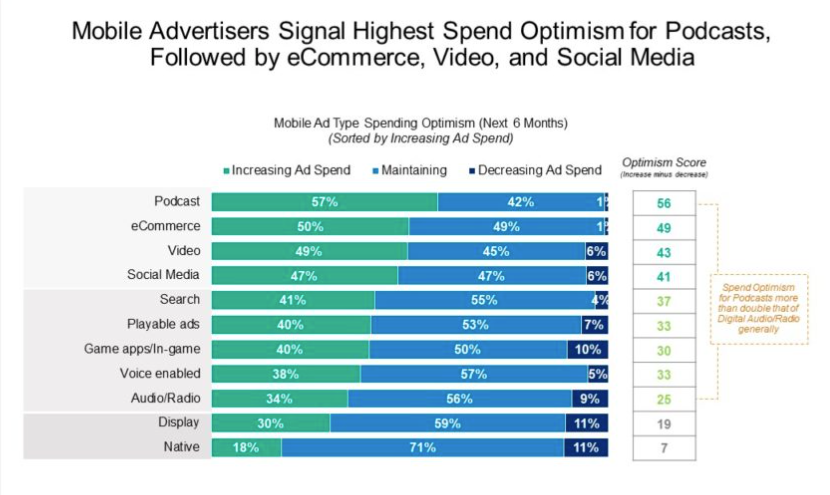

Survey: Contextual Ads Gain, Location Usage Declines

A recent Advertiser Perceptions survey of 252 advertisers (40% marketer, 60% agency) finds that in the near term context will drive mobile marketing spend. These insights come against the backdrop of cookie and IDFA "deprecation." However, this is a transitional time and a similar survey later this year could reveal different strategies. Big walled gardens are set to win, while marketers appear to be pulling back in their use of precise location. Approximate location is now "good enough." Category winners will be paid-social, e-commerce, display, search, video and podcasting according to the study.

Our take:

- This is an especially volatile time for marketers. But Google, Facebook and Amazon will continue to win.

- Context and demographics may dominate mobile ads if tracking rejections continue at their current pace.

- Smaller/sites publishers will struggle, pushing more into the paid-content or subscription model.

Short Takes

- Google prohibits SMB keyword stuffing, yet it's rampant and it works.

- As usage declines, Clubhouse comes to Android.

- Social media and mental health: conflicting data (study vs. study).

- Ads on streaming services more expensive, more irritating than cable.

- DataGrail sees opportunity in need for two-sided market transparency.

- Apple expanding own ads biz as it imposes privacy rules on others.

- Police tapping Amazon Ring camera footage for protest surveillance.

- Snap leading the integration of augmented reality and commerce.

- Walmart buys MeMD to further healthcare delivery strategy.

- Tile partners with Amazon's (creepy) Sidewalk network to survive.

Please let us know what you think. Email us with suggestions and recommendations.