Snap My Places, Restaurateur DoorDash, SOCi Buys Brandify

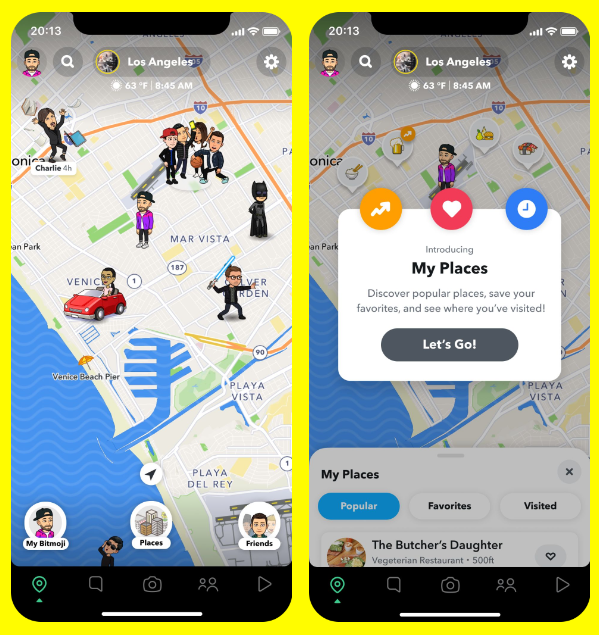

Snap Personalizes Map with 'My Places'

It's "places week." On Wednesday Apple relaunched its Maps Connect listings portal, as Places on Maps. And now Snap has introduced "My Places" on its Snap Map. The Map originally debuted in 2017 as a (semi-creepy) user location-sharing feature. My Places is intended as a source for local business recommendations. Snap says My Places will allow users to discover "more than 30 million businesses, log their favorite local spots, and even find personalized recommendations." Users can tag and share their favorite places and see popular nearby businesses. Tapping on the "map tray" will bring up a full local business profile.

Our take:

- Snap's audience is mostly under 35 but getting older. Snap claims to reach roughly 90% of Americans under 24.

- This will be meaningful in certain categories (i.e., travel/hotels, restaurants and entertainment). Less meaningful in home services.

- My Places is the heir to Foursquare's consumer app. It's also something Facebook could have built but never did.

DoorDash Expands into Restaurant Operations

Call it "RaaS" -- restaurant as a service. This is essentially what DoorDash is now offering local restaurants. The company announced a new partnership model for its DoorDash Kitchens division. Here's the pitch: "Full Service can be a flexible and cost-efficient opportunity for restaurants to test new markets as DoorDash takes on many of the tasks associated with opening and operating a storefront such as hiring, meal prep, procuring equipment and sourcing ingredients." Effectively, the restaurant owner licenses its brand to DoorDash, which operates the physical restaurant (think food court at a mall) and then shares proceeds with the restaurant owner. It appears there is a potential continuum of restaurant involvement.

Our take:

- DoorDash has been something of a villain in the industry. But the company says this idea came from restaurants asking for more support.

- Brand licensing to food service operators is not new model, but still a provocative move for DoorDash. How scalable is this?

- Will local and national restaurants be comfortable turning over their brands/reputations to DoorDash?

More Consolidation: SOCi Buys Brandify

Founded in the 1990s by Manish Patel, Brandify began as store locator platform Wheret2GetIt. The company changed its name to "Brandify" in 2014 and grew to offer a wide array of local marketing services. Now SOCi has purchased its former rival for an undisclosed amount. SOCi will take on the Brandify team and also take ownership of StreetFight, which was acquired in 2017 (to counter Yext's Geomarketing in part). Earlier this year SOCi raised roughly $80 million in a Series D round. This news comes on the heels of Uberall's June acquisition of MomentFeed. As Andrew Shotland pointed out in a recent Near Media analysis piece, these acquisitions are part of a larger local consolidation trend.

Our take:

- According to Localogy, Patel will retain the ad-related portion of Brandify and operate those services under a new brand, "Omni Local."

- Expect still more consolidation. There will be a small group of global O2O platforms, with smaller competitors/resellers focused mostly on SMB.

- Product and messaging differentiation will be an interesting challenge in this intensifying competitive segment.

Short Takes

- Twitter tests "shop module" (e-commerce) on selected brand profiles.

- Facebook's revenue ($29B) grew at fastest pace since 2016 in Q2.

- Amazon's $113B quarter wasn't enough for investors.

- Virtual goods to be primary revenue driver for Facebook's metaverse.

- Not rankings, but CTRs influence features in Google results.

- Many restaurants may not survive a return to COVID mandates.

- Amazon adds "just walk out" option for two more SoCal grocery stores.

- Europe fines Amazon nearly $900M for non-compliance with GDPR.

- Microsoft flying largely under the antitrust radar.

- Senators introduce federal privacy bill to supersede state rules.

- Social audio competitors slowing Clubhouse's momentum.

- Canada taking sweeping legislative action against illegal online content.

- Advocacy groups ask FTC to limit or ban surveillance tech.

- Study: Lack of awareness a major problem for B2B marketers.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.