FTC to Speed Rulemaking to Fight Digital Deception

Rebecca Slaughter, the acting Chair of the FTC, disdains fake reviews and has elevated rulemaking at the FTC to do something about it.

In late March Acting Federal Trade Commission Chairwoman Rebecca Slaughter announced the formation of a new rulemaking group. This announcement flew under my radar at the time but there appears to be more there than I originally thought.

The FTC is charged with protecting consumers and promoting competition. Thus they deal with antitrust issues as well as consumer fraud and deception. They do so with via two mechanisms: a rule with strict requirements and penalties and guidelines, which define guardrails and offer suggestions but impose no hard and fast requirements nor standard penalties when violated.

Faster Rules to Address Digital Deception

The idea behind the new rulemaking group is to centralize the organization and skills needed to create new rules more quickly and easily. Because of the complexity of rulemaking compared to the relative ease of creating guidance, very few new rules have been created over the past few decades.

Acting FTC Chair Slaughter said in a press release, "We can and must use our rulemaking authority to deliver effective deterrence for the novel harms of the digital economy and persistent old scams alike. Our rulemaking power under section 18 has gotten a bad reputation for being too hard to use, but longstanding FTC rules… have provided significant benefits to consumers."

When she speaks of “novel harms of the digital economy,” she is referring to things like fake online reviews or influencers who have been paid but not sufficiently disclosed that fact.

Cracking Down on Fake Reviews

Most in the marketing space are familiar with the FTC guideline around Use of Endorsements and Testimonials in Advertising, which includes requirements around online reviews like full disclosure of any incentives, truthful representation of actual ratings and a prohibition of self-serving reviews.

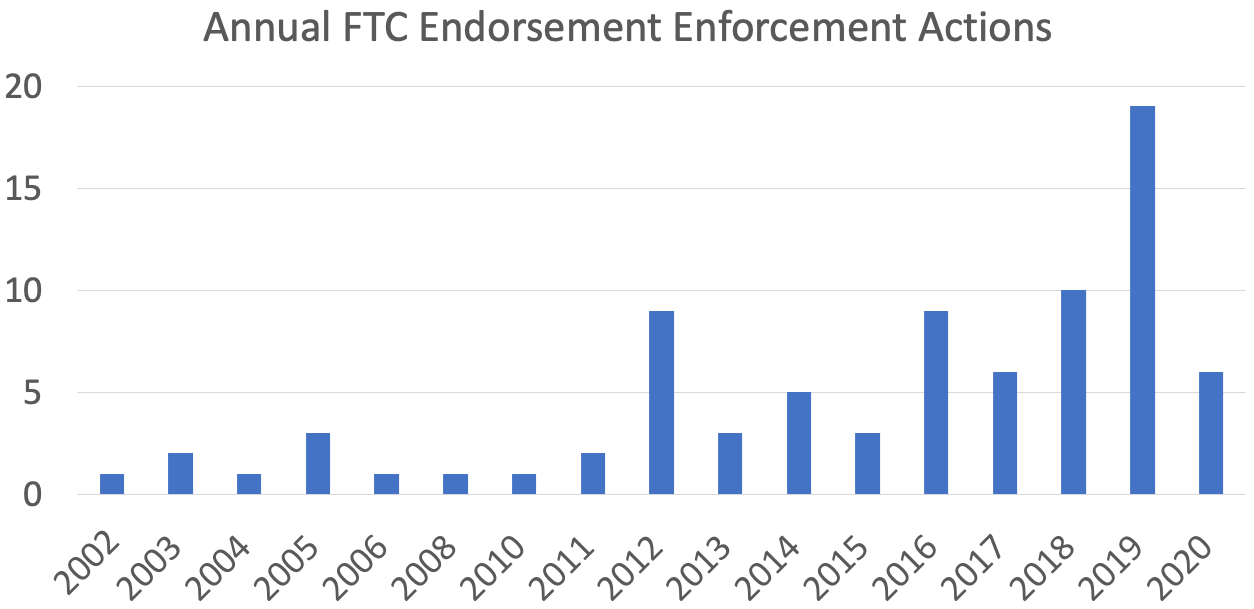

With the exception of 2020, the FTC has seen increasing numbers of annual enforcement actions focused on online reviews and endorsements.

Soft Penalties

Despite the increase in cases, FTC enforcement actions have usually involved a slap on the wrist of the offending business. Most commonly the business signed a consent agreement to not participate in the review deception again. This has been true even when the the FTC had clear and obvious evidence of egregious abuses such as in the case of Sunday Riley. The FTC had proof that the CEO had not only instructed employees to write fake reviews but went so far as to use a VPN to mask where the reviews were coming from to avoid detection.

Until I read up on the new rule making process I could not understand why this had been the case. The Sunday Riley violations fell under the province of the Endorsement Guideline and as such there was no prescribed penalty. The FTC in this case and others, as dictated by precedent and common practice, generally meted out very soft penalties to violators. Only if a business had also seriously defrauded consumers of large sums of money or if they violated the consent decree in a similar future abuse would they see any significant penalties.

(Note: A Supreme Court decision today in AMG Capital Management, LLC v. Federal Trade Commission limits the FTC's future ability to seek monetary remedies against bad actors; however, Congress may restore that capability.)

Need for Tougher Remedies

In the case of Sunday Riley two FTC commissioners filed public statements in strong, vociferous disagreement with the settlement and noted at the time:

- Fake reviews distort our markets by rewarding bad actors and harming honest companies. The problem is growing, and the Federal Trade Commission should attack it.

- Regulators around the world are concerned about fake review fraud. But by proposing a no-money, no-fault order for an unambiguous violation of law, this action does little to address the epidemic of fake reviews online.

- Going forward, the FTC should seek monetary consequences for fake review fraud, even if the exact level of ill-gotten gains is difficult to measure. The agency should also comprehensively analyze the problem of fake reviews, including whether or not e- commerce firms have the right incentives to police their platforms.

The statements clearly indicate that the two commissioners who disagreed with the majority ruling were worried about fake reviews and the possibility that honest businesses and consumers were being harmed. Clearly they believe that the penalties should be financially punitive even if the Googles of the world don’t police their platforms.

'Novel Harms of the Digital Economy'

The commissioners that signed on to the statement disagreeing with the settlement: Rohit Chopra and Rebecca Kelly Slaughter. Slaughter, as noted, is the Acting FTC Commissioner who approved and encouraged the new rulemaking authority to deal with “novel harms of the digital economy."

I have no idea how long it might take to create new rules, nor how aggressive the FTC might become but it appears at long last that there is someone at the helm that finds fake reviews despicable and clearly has the power to do something about it (although monetary penalties have been curtailed for the time being). She clearly has disdain for fake reviews; she understands the FTC bureaucracy and how rulemaking can ensure consumer well being and she is now IN CHARGE.

Here’s to Rebecca Slaughter; may she succeed where others have only given lip service. And may the Googles and Amazons of the world take notice.