Travel Places Sites, Mapquest's Demise, Prime Day Mania

Study: Places Sites in Travel

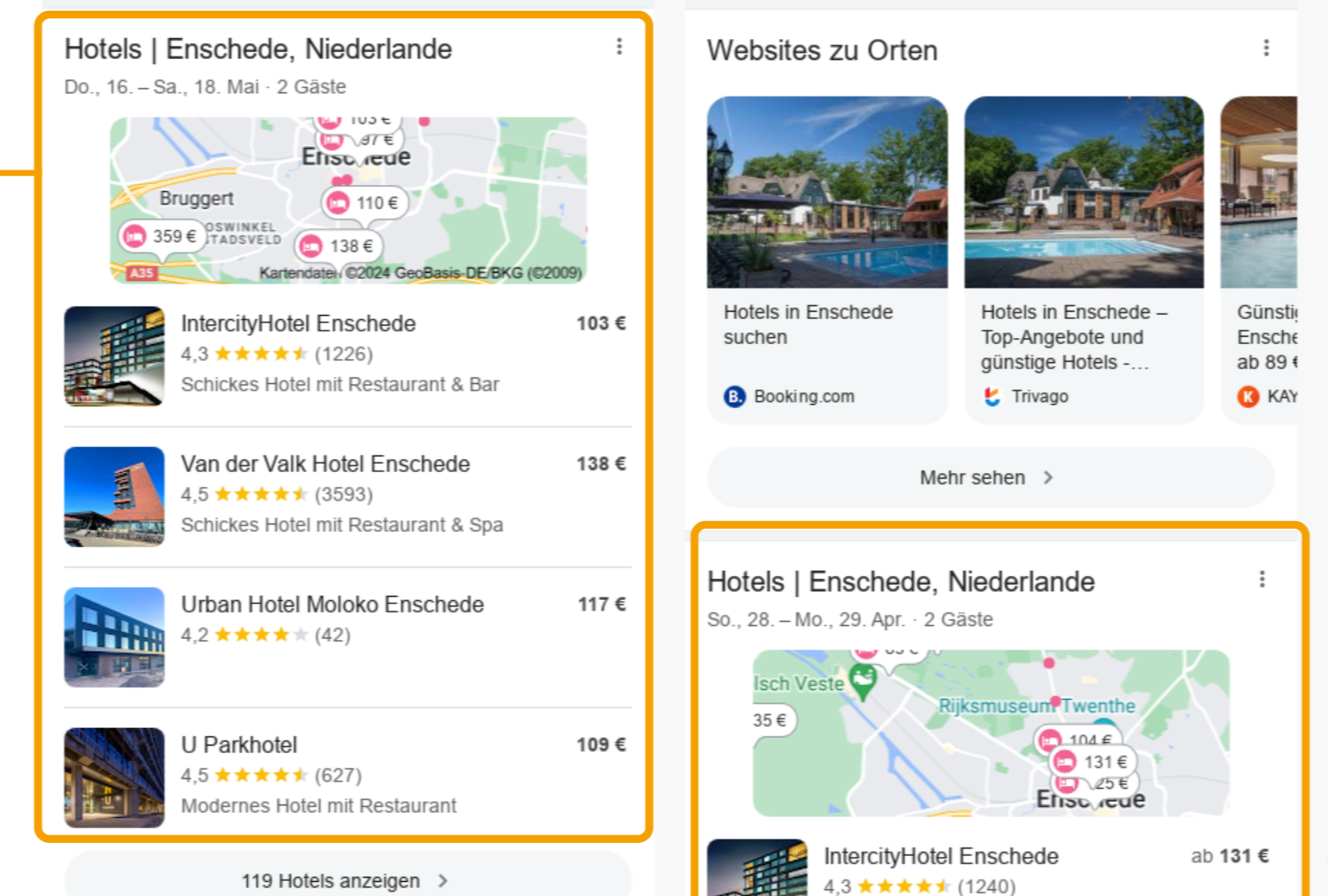

At Near Media we've been documenting the impact (or lack thereof) of Google's new DMA-SERP features (e.g., Places Sites) on EU searcher behavior. And we've just completed a study covering Ireland, Germany and France. But this week seoClarity published rankings research on the Hotel vertical in Europe in the wake of Google DMA-compliance changes. The DMA applies to large "gatekeepers" like Google, Meta, Apple, Amazon and Microsoft and is supposed to level the playing field for competitors vs. "self-preferencing." The seoClarity study looked travel SERPs triggered by 156,000 hotel keywords (mobile only). Prior to the launch of Places sites, seoClarity said that the Google Hotel Pack ranked in the top organic SERP position 95% of the time. That dropped to 70% after Places Sites rolled out. The study found, "Overall, the presence of Google hotels in position one went from 146,000 of our 153,000 keyword set to around 108,000." However the Hotel Pack remained in the top three after the change. Places Sites in the hotel vertical feature well-known aggregators such as Hotels.com, Tripadvisor and Booking.com. "In Germany, by far, Booking.com shows up most often — over 40% of the time — dominating the first and most visible position in the carousel," explained seoClarity. So while the Google Hotel Pack lost potentially meaningful visibility, it's important to note that this is a ranking study, not a search-behavior study, and doesn't indicate whether Places Sites are actually driving traffic.

Our take:

- Travel is a vertical the European Commission is very focused on. Surprisingly it's not equally focused on Local. Local is not really a vertical but is equally worthy of DMA scrutiny because of its economic importance.

- What Near Media's research has found to date is that despite the SERP prominence of Places Sites they're not driving meaningful clicks.

- Google's rhetorical position on DMA compliance re local is something like: by helping aggregators (its competitors) we're harming local businesses.

Rise and Fall of Mapquest

Last month I wrote about how Google Maps came to dominate rivals, such as Yahoo Maps and Mapquest, and accelerate their demise partly through self-preferencing. But there was also massive spending – Yahoo couldn't/didn't want to continue investing at Google's level – and neglect, which is partly what killed Mapquest. James Killick, who was a pre-launch Mapquest employee, tells the whole story of the company from birth as a spin-off of print publisher R.R. Donnelley to its current zombie-like status. It's an insider take on the evolution of digital mapping in the early internet era and also offers a behind-the-scenes look at the 1999 AOL acquisition. According to Killick, the company's "slow demise" began in 2000 following the acquisition. It partly got lost in the bureaucratic quagmire of AOL Time Warner and the unwillingness of the corporate parent top pay sufficient attention and make the necessary investments to keep pace with Google in particular. Its brand strength was such that it wouldn't have had to match Google dollar for dollar, just continue to update and improve the product. But it didn't, instead mostly coasting until it was too late. The site still exists and there's still the echo of a brand but it's a zombie shell of what it once was.

Our take:

- Mapquest (and the internet) helped kill paper maps. Remember Thomas Guides and AAA TripTiks?. Then Google largely killed Mapquest.

- Once the top travel site, Killick's Mapquest story is a cautionary tale about neglect, complacency and poor corporate management.

- Mapquest is just one of dozens of companies that were once robust and ambitious competitors in local, but now defunct or zombies.

Prime Day Mania

Prime Day is now 10 years old. Consumer awareness is extremely high and that paid off, as this year's Prime Day was Amazon's biggest to date. US consumers spent $14.2 billion during the two-day event, which was up 11% year over year. There was also a "halo effect" for selected other retailers (especially Walmart), boosting their online sales as well. We think of electronics as the "marquee" e-commerce category – heavily featured in third party deal roundups – but it ranked 6th in Prime Day sales according to Numerator: "1) Apparel & Shoes, 2) Home Goods, 3) Household Essentials, 4) Beauty or Cosmetics, 5) Health & Wellness, 6) Consumer Electronics, 7) Pet Products, 8) Groceries, 9) Toys/Video Games, 10) Small Appliances." The average price paid per item was $28.06. The typical Prime Day shopper is a female Prime member, over 35, who lives in an urban or suburban area. Many shoppers bought things they had intended to buy but were waiting for a sale to purchase. Bullish analyst firms have projected that e-commerce in the US will reach $1.2 trillion this year and constitute roughly 23% of all retail sales. It's probably closer to 16% according to US government data.

Our take:

- Mobile devices drove roughly half of Prime Day shopping in 2023; however I didn't see publicly released 2024 data. We should assume similar numbers.

- Most Amazon shoppers are Prime members; the company has a kind of captive audience. CIRP estimates that 180 million Americans had a Prime membership in Q1 – roughly 70% of the US adult population.

- The mix of brand awareness, high trust, pricing and marketing power and huge audience make Amazon almost unique among global retailers.

Recent Analysis

- How Google's (Local) Development –>Deprecation Process Affects Innovation, by Mike Blumenthal.

- ICYMI: Hindsight: Self-Preferencing Behind Google Maps' Rise, by Greg Sterling.

Short Takes

- What to know about Google "suggest an edit" Google Maps scam.

- Google testing Knowledge Panels with store ratings/reviews.

- Site reputation abuse update having a big impact on some revenues.

- Hoping to revive growth, Nextdoor reassembles old leadership team.

- Report: Meta mulls big investment in Ray-Ban glasses parent.

- Italy accuses Google of misleading consumers to get more data.

- House lawmaker wants Google to address AIO misinformation.

- Google Search Notes finally being shut down, but it was DOA.

- EU investigating Google-Samsung deal to embed Gemini in Galaxy phones.

- Why AI and natural language inputs may not enable better search results.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.