Apple Opt-in Hurts Facebook, Voice Search Stalls, Stores = CX

Apple's Opt-In Ad Rules Hurt Facebook

There are many cynics who believe Apple's opt-in tracking rules (ATT) aren't about protecting consumer privacy but instead about boosting Apple's own ad revenue. Apple is marketing privacy as a differentiator vs. Android devices. But whatever Apple's actual motives, ATT is starting to have an impact on Facebook. It's apparently driving higher ad prices. Among other impacts so far: underreported web conversions, lower ROI, higher ad loads and (a few) defecting advertisers and investors. In damage-control mode, Facebook is seeking to restore confidence in its capacity to measure and do attribution. Despite measurement problems, most advertisers will likely remain faithful. Finally, anecdotal reports say SMBs are seeing a bigger impact than brands.

Our take:

- SMBs consistently cite "social media" as their top marketing channel. They may have become too dependent and probably need to diversify.

- Much of this discussion is anecdotal and speculative. We'll have a much better sense of reality when Facebook reports third-quarter earnings.

- Separately, WaPo reports that multiple apps are not respecting iOS user tracking choices and sharing data with third parties via "fingerprinting."

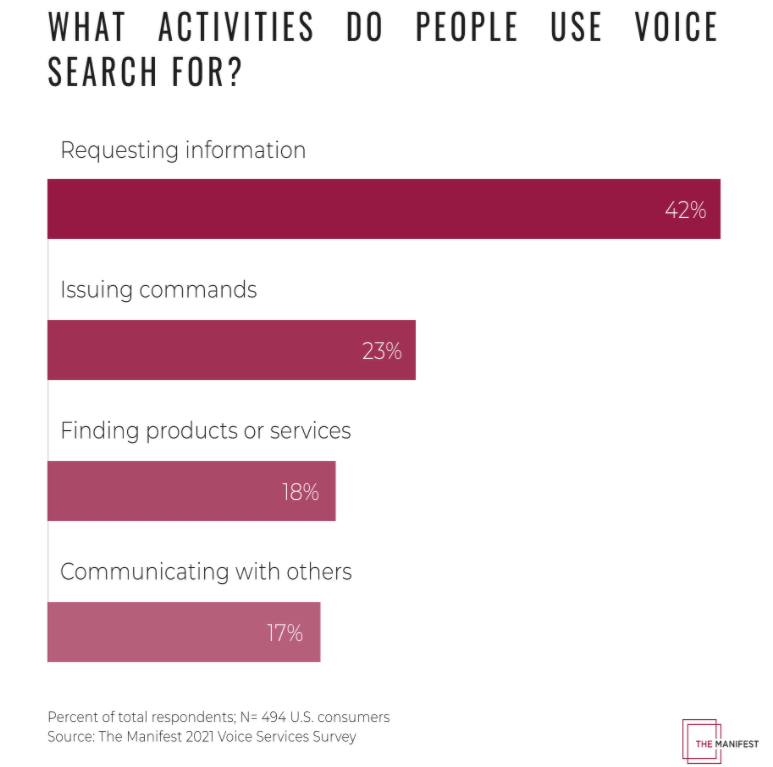

Survey: Voice Search Stalling

For several years, "voice search" – a mashup of smart speakers and voice input on smartphones – was a shiny new object. I wrote many stories for Search Engine Land (example) about the growth of voice search usage. A kind of metaphor, there was a widely cited (but now debunked) stat that half of all search queries in 2020 would be voice searches. There was also a heated debate about whether marketers could optimize for voice search. But now, a survey from The Manifest finds voice search usage frequency declined in the past three years. Among the other findings: "only 18% ... use voice search more than once a week, compared to 53% in 2018." And 60% say they never use voice search, though younger users are more inclined than older people to do so. This is just one survey, so we should be cautious. But it's instructive.

Our take:

- Much of the voice search discussion was propelled by virtual assistant novelty. Smart speakers, however, are not driving "search" queries.

- Speech recognition is gaining sophistication but not translating into voice search volume. There may also still be user inhibitions in play.

- Much like contactless payments, there will be a contingent of power users. The rest remain casual users. Voice/virtual assistant adoption will continue incrementally. But the revolution hasn't come as promised.

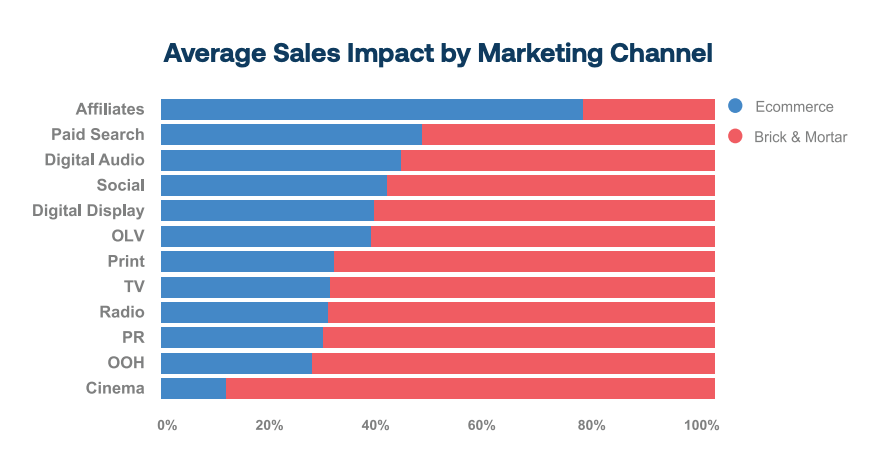

Again: Stores Critical for Brand, CX

There have been perhaps 20 or more"Future of Retail" reports in 2021. Most emphasize the acceleration of e-commerce while allowing that physical retail has a role to play. The superficial ones argue e-commerce will only continue to gain at the expense of stores. The thoughtful ones explore the symbiosis (avoided "synergy"). As we enter Q4, here are a few data points that underscore the vital importance of stores: 92% of consumers want to shop in stores (Square); "shoppers return 5-10% of what they purchase in store but 15-40% of what they buy online" (Happy Returns); 75% will spend more after receiving high-quality service from store associates (RetailEXPO); "a combined physical and digital presence can help brands drive increased impact by 32%" (Analytic Partners); "a physical store gives you a chance to create [an] immersive brand experience" (LS Retail). I could go on. The most successful retail experiences will recognize and utilize (avoided "leverage") the interdependence of the digital and physical. This is not two channels but one holistic customer experience.

Our take:

- Having said all that, BAU retailers will probably fail. Physical retail needs to be reinvented and many are trying (see Bloomie's).

- Walmart is a paradox: very digitally innovative but stumbling with basic in-store experiences (register wait times, in-stock items).

- The store of the future may be more about branding and service than direct sales. Although this will vary by store and target audience.

Short Takes

- Warby Parker and Allbirds see stores as the key to future growth.

- Google talking with TikTok, Facebook for deeper access to content.

- Amazon dept. stores: private-label clothes, high-tech dressing rooms.

- Roku and Shopify deal enables SMBs to distribute ads on OTT service.

- Shopify deal with Yahoo enables non-cookie ID ad targeting for SMBs.

- Zeus: The WaPost's new ad network for publishers "of all sizes."

- Google showing richer automotive data via a direct data-licensing deal.

- Google provides more advertiser information under "about this ad."

- Google brings more NLP sophistication to keyword matching.

- Instacart gig workers want consumers to delete Instacart.

- Restaurant SaaS platform Toast's IPO makes founders billionaires.

- Snapchat's visual search tool Snap Scan an IRL discovery engine.

- US and EU regulators to coordinate efforts to restrain "big tech."

- New in Google travel: things to do ads, ticket links, eco-badges.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.