Wealthy Shoppers, Amazon Price Fixation, Ignoring Climate Change

Who's Buying More Online? Affluent Consumers

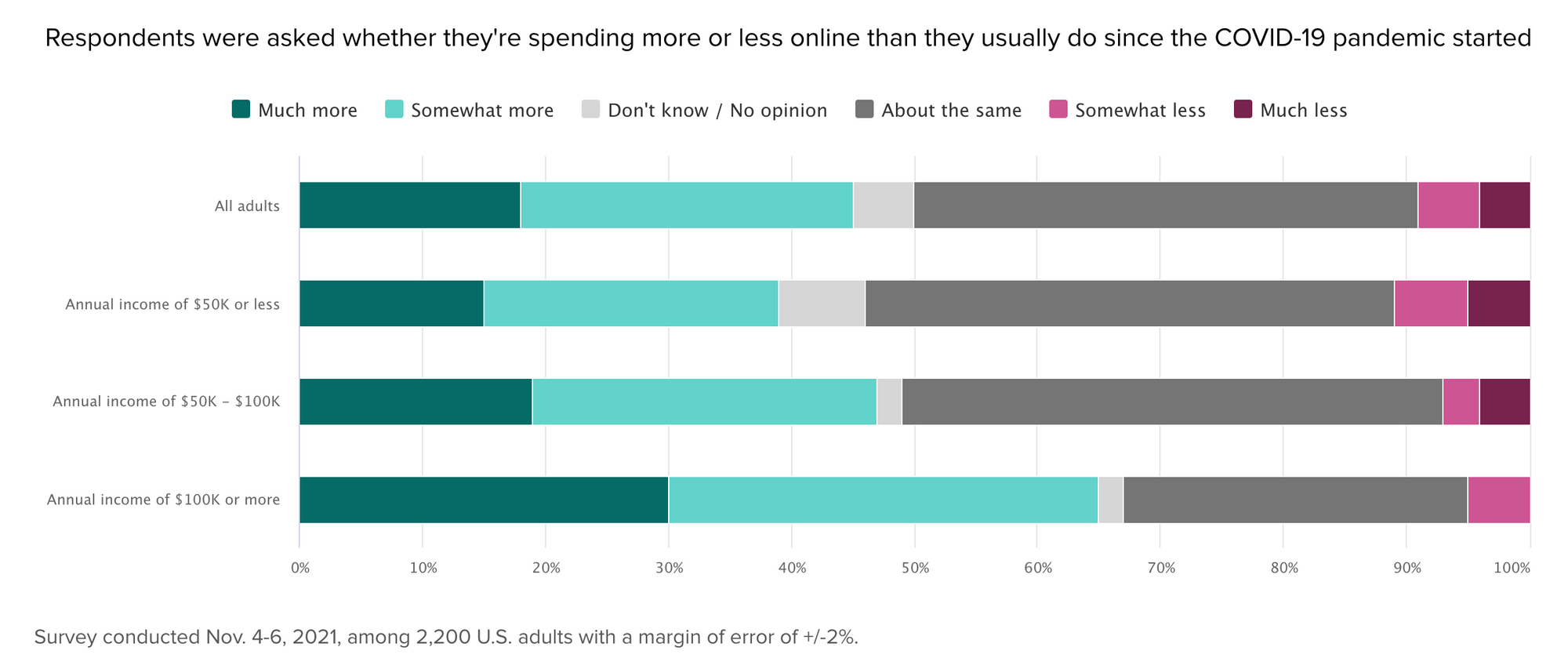

As we head into the holiday shopping season in earnest, there's lots of speculation about the mix of online and offline spending that will occur. Some surveys argue consumers will spend most of their money online, but there's also considerable evidence of foot traffic returning to stores. Who's right? Both. Consumers are increasingly comfortable in stores and malls, while some shoppers will be spending more/most of their money online. Morning Consult survey data reveal this complex picture. In particular, ~65% of wealthier consumers ($100K+) are spending more or much more online since COVID compared to others. Overall there has been a net gain in online shopping (though stores promote e-commerce) but it appears much more pronounced among wealthy buyers.

Our take:

- This data suggests different tactics for different segments. Luxury goods/services companies should be mindful of this shift.

- This survey doesn't show it, but some verticals appear more prominently in online buying patterns, adding another wrinkle.

- The big beneficiary of this shift is probably Amazon. A hidden factor is likely Prime membership (more common in upper income levels).

Amazon Forcing Lower Prices on Sellers

Amazon is forcing third party sellers to match the lowest prices available for their products, according to a report from The Seattle Times. Critics believe, while this may benefit consumers in the short run it's bad for the market overall. According to The Times, "The retail behemoth has been pressuring some of its top sellers to drop prices to ensure shoppers cannot find a lower price anywhere else — online or in a brick-and-mortar store." One of the primary consumer use cases for Amazon is price comparisons. Aware of this, Amazon sees low prices as a key to consumer retention and its brand promise, hence the pressure campaign. Even though Amazon says publicly that third party sellers are free to set their own prices, Amazon has reportedly blocked them from listing new products until they comply with the company's pricing demands.

Our take:

- If the allegations are true the conduct in question is anti-competitive even though it appears to benefit consumers.

- Amazon defended itself on the grounds of "protecting the customer experience." But it could result in higher prices for consumers eventually.

- Expect this report to generate more scrutiny of Amazon and calls in Congress for new regulation or to break the company up.

Climate Change: Existential Threat – to Marketers

There's a New Yorker cartoon (below) that captures one kind of marketing mindset. The caption reads, "Yes the planet got destroyed. But for a beautiful moment in time we created a lot of value for shareholders." Many in the digital marketing industry operate in this universe, focused on growth and largely ignoring growing social, economic, political and environmental crises. Marketing seems to just merrily chug along, willfully blind to these hard-to-ignore problems. Sure, "edgy" brands (e.g., Salesforce, Patagonia, Nike) sometimes address hot-buttons (or perhaps co-opt them). And I understand that marketers shy away from divisive issues, worried about alienating buyers. But your Black Friday campaign or post-cookie attribution strategies won't matter if the planet is uninhabitable.

Our take:

- What prompted this rant was the conclusion of the COP26 conference, which arguably failed. Marketers shouldn't simply regard an event like this as wholly irrelevant – though it's extremely challenging to address.

- Helping businesses succeed – through digital marketing – is important, but it shouldn't operate in a void, indifferent to real-world events.

- Brand marketers will ultimately be forced to confront major issues as external pressure mounts. Do the right thing; get ahead of it.

Recent Analysis

- Near Memo episode 41: Vista's elegant rebrand, opportunities for new search engines, Google expands SMB propaganda campaign.

- Google’s New Business Profile: When Search Becomes a Political Tool, by Mike Blumenthal.

Short Takes

- Podium raises $201M more, valuation hits $3 billion.

- For good or for ill: Dollar stores are taking over.

- Google begins test of Bing's IndexNow protocol after initially resisting.

- Apple buying ads for third party apps to drive App Store downloads.

- Ways to hold Facebook accountable given likely Congressional inaction.

- AR + VR and more: Google gets serious about "Google Labs" projects.

- LinkedIn officially launches its Fiverr gig marketplace competitor.

- Toast looks deeper into restaurant back office services for growth.

- Your ISP doesn't really care about your privacy.

- Facebook CTO: Metaverse moderation at scale "nearly impossible."

- Hanke vs. Zuckerberg: Will the "real metaverse" be AR or VR-based?

- Icelandverse parody of Meta's announcement doubles as tourist ad.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.