Whither Local Pack, Made with AI, E-Commerce Ceiling

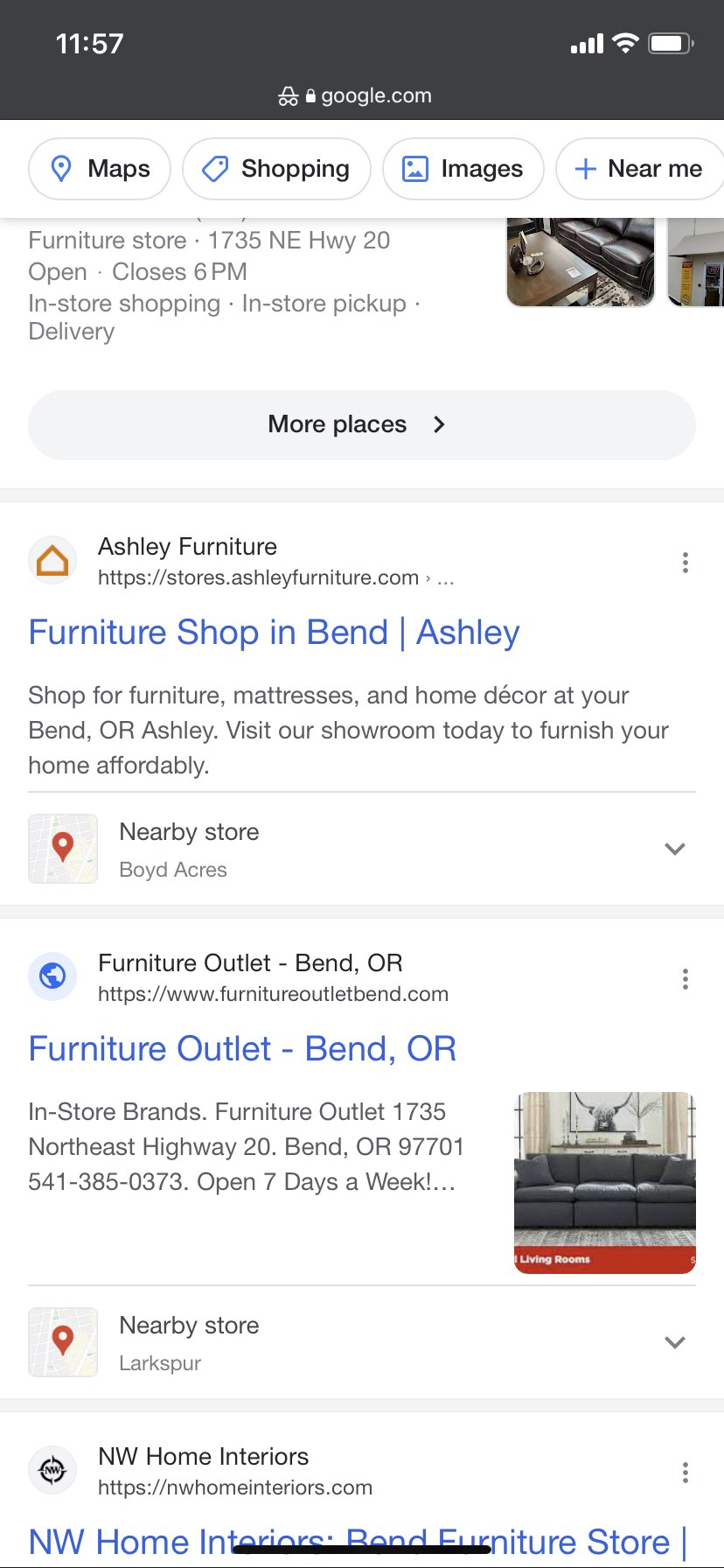

Whither the Local Pack?

After the EU's Digital Markets Act (DMA) passed a year ago, we began to speculate about the impact it could have on Google local results. Among other things, the DMA prohibits "self-preferencing" vs. competitors. That directly implicates the Local Pack and other Google-branded modules at the top of the SERP. (Similar US legislation never made it to a vote.) Last year, in June, Mike wrote a piece about how Google's SERP might change if it didn't or couldn't put the Local Pack at the top of results. He showcased localized SERPs where Google showed a mix of "local cards" and organic results, without a Local Pack. When clicked, the cards take users to GBP pages. These "local card" or "local snippets" SERPs have started showing up again. We believe that Google has been testing them in the event they're forced to kill the Local Pack. That may be a certainty in Europe; however, in the US there's no similar rule in place. So we may see the evolution of the local SERP diverge significantly in Europe and North America.

Our take:

- In recent user research we observed the Local Pack appeared in nearly 80% of searches for a vertical service category.

- Most often, it was at the top of the page. But it also appeared in a range of positions further down the page, as low as 7 and below.

- Google may be preparing to de-emphasize the Pack (at least in EU). Few Packs have ads, while the company is clearly making money off LSAs.

Ethics and AI Labeling

The FTC mandates that advertising and paid promotions be disclosed to avoid potential consumer deception. This extends to social media influencers, many of whom violate the rule with impunity. Trust in media, social media and internet content is in overall decline. As we enter the AI era, that may get worse. We need strong ethics and disclosure rules for AI, as marketers, publications and even academics begin using ChatGPT in earnest (e.g., CNET, Wired, BuzzFeed). More content in search results will soon be partly or substantially generated by machines. Assessing its credibility will be challenging for casual users. And we may come to recognize a bright line before and after AI. ChatGPT will clearly be a boon to productivity but also to scams, hacking and mis/disinformation. As with all technologies there will be benefits and harms, some of which will be unforeseen. People have a right to know if content they're consuming was in some way created by machine, which will be less and less obvious, so they can better evaluate it.

Our take:

- There's a risk of content dilution/pollution with rampant use of AI. Tons of blog posts will be generated with ChatGPT before 2023 is over.

- Labeling might cause more judicious use of ChatGPT. Greater transparency can also help build user trust.

- But there's a risk that disclosures will be empty or over-broad. That could have a "negative halo effect," spreading distrust across the internet.

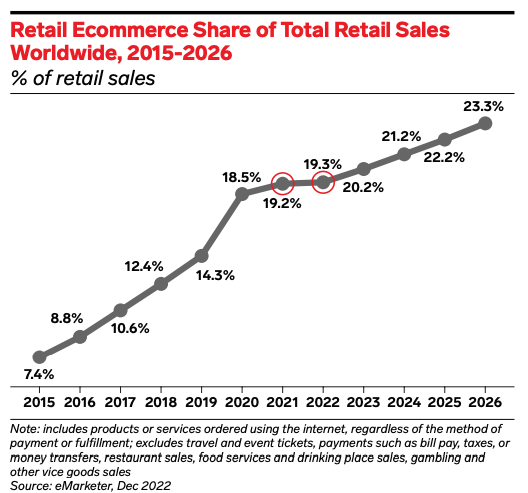

E-commerce Ceiling

E-commerce grew by triple digits during pandemic lockdowns. In July 2020, McKinsey famously said we've seen "10 years’ [e-commerce] growth in 3 months." That acceleration prompted massive tech company hiring, which has now been reversed. As COVID subsided people (mostly) returned to prior shopping habits. Regardless, the internet is the starting point for most purchases. But that's not synonymous with e-commerce. A sponsored report from eMarketer points out e-commerce grew less than a point from 2021 - 2022. And in 2022 it declined as a share of overall retail in Western Europe and parts of Asia. The forecaster predicts a return to growth this year, especially in Asia. Emarketer argues the US market will see 10.5% e-commerce growth this year and that it will represent just under 16% of total retail sales. That's in line with US government data. However, the report assumes that e-commerce will keep on growing, just at a slower pace.

Our take:

- in 1998, Jeff Bezos thought e-commerce would plateau at about 15% of total retail sales in "the next decade." It took 25 years but we're here.

- Indefinite e-commerce growth is not given, though how it's defined is shifting, with things like click and collect, in-store digital integration.

- The future will depend on improving the UX, trust, brand loyalty, pricing and the state of in-store retail simultaneously.

Recent Analysis

- Near Memo episode 105: New Google GPB Bug, TikTok search ads, local-social mapping tool GoWalla returns.

Short Takes

- Google Maps on desktop adds a new "recents" sidebar display.

- A year later, Google Maps Immersive View rolling out.

- Bing Chat Answers replace Bing Search Answers in SERPs.

- New ChatGPT prompt generator from Joe Hall.

- Amazon sued in NY for not disclosing facial rec. in Go stores.

- Opinion: Spotify's TikTok-inspired redesign is misguided.

- TikTok to report 150 million active users, up from 100 million.

- Glaze, a tool helping artists stop AI from ripping them off.

- Netflix now has 1 million users for its ad-supported tier.

- How SEOs can build trust in the brands they work for.

- Amazon cutting 9,000 more jobs.

- US index: SMBs report average performance right now.

- Many of tech's big leaps occurred during industry downturns.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.