Big Brand Problem, Forbes Content Farm, Social to Store

Google's Big Publisher Problem

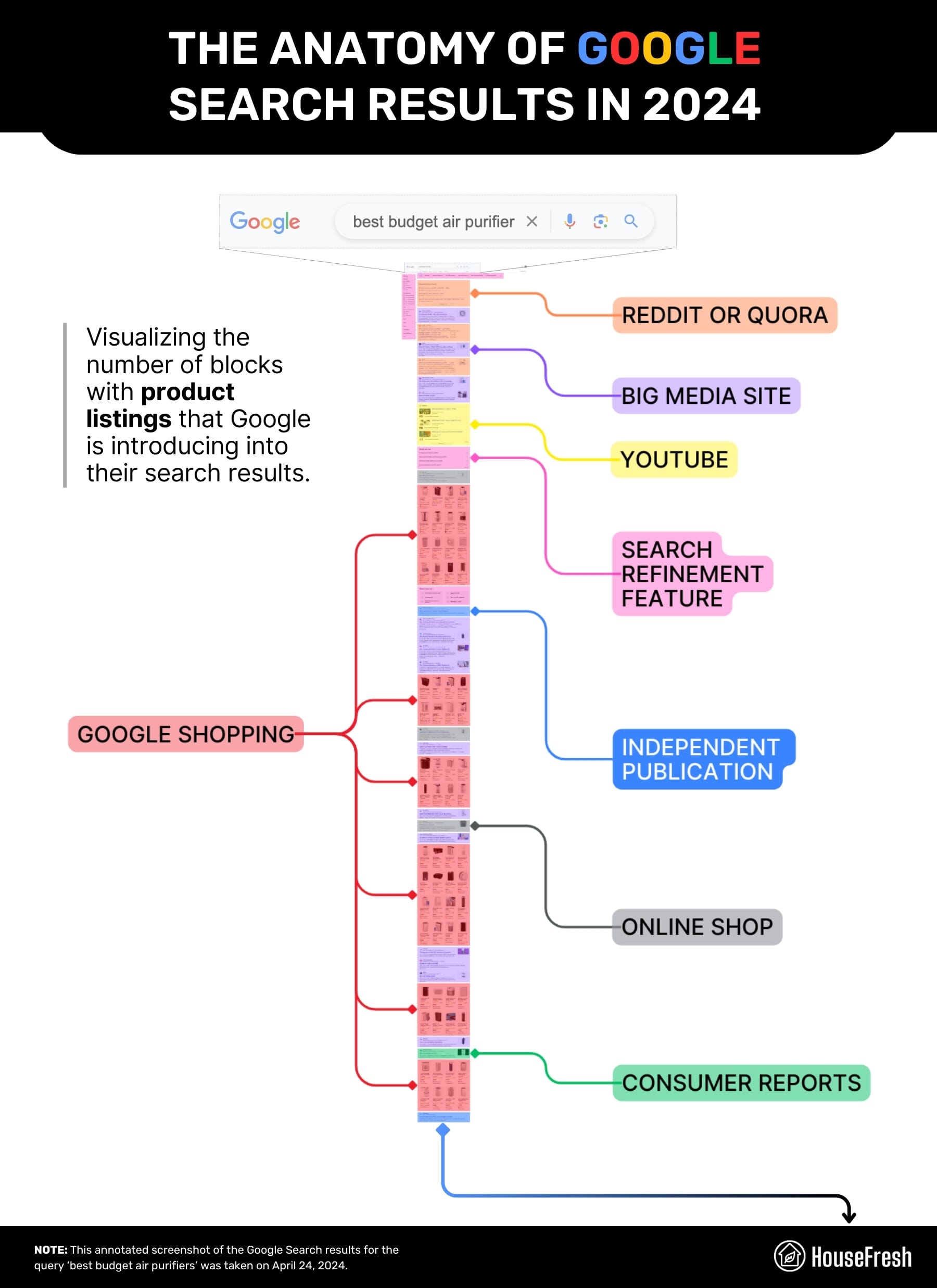

HouseFresh is back to warn us about how Google's favoritism of big brand sites is pushing out independent publishers. In February, the small product review site called out bigger media publishers that were publishing product reviews (often with affiliate links) "without firsthand testing and simply paraphras[ing] marketing materials and Amazon listing information." Now HouseFresh says it has "virtually disappeared" from Google results because of "keyword swarming" tactics by larger publishers. The principal example used is Dotdash Meredith, which "allegedly identifies small sites that have cemented themselves in Google results for a specific (and valuable) term or in a specific topic, with the goal of pushing them down the rankings by publishing vast amounts of content of their own." Another example is Forbes, which has lots of content tied to affiliate revenue (not just coupons). However, the HouseFresh article cites numerous examples from different publishers. It also discusses how the site is trying to adapt (barnacle SEO, social channels) to being demoted in the SERPs.

Our take:

- Google is punishing some of the affiliate revenue behavior discussed in the article with its site reputation abuse policy and enforcement.

- Google has pledged to reward "the best content" regardless of the source. But it doesn't seem to be able to do that in practice, partly because it relies heavily on brand and behavioral signals, which creates a self-reinforcing pattern.

- Is this brand favoritism simply a "bad product" problem, which David Mihm has described as a "content oligopoly," or is it an aspect of the Google monopoly problem?

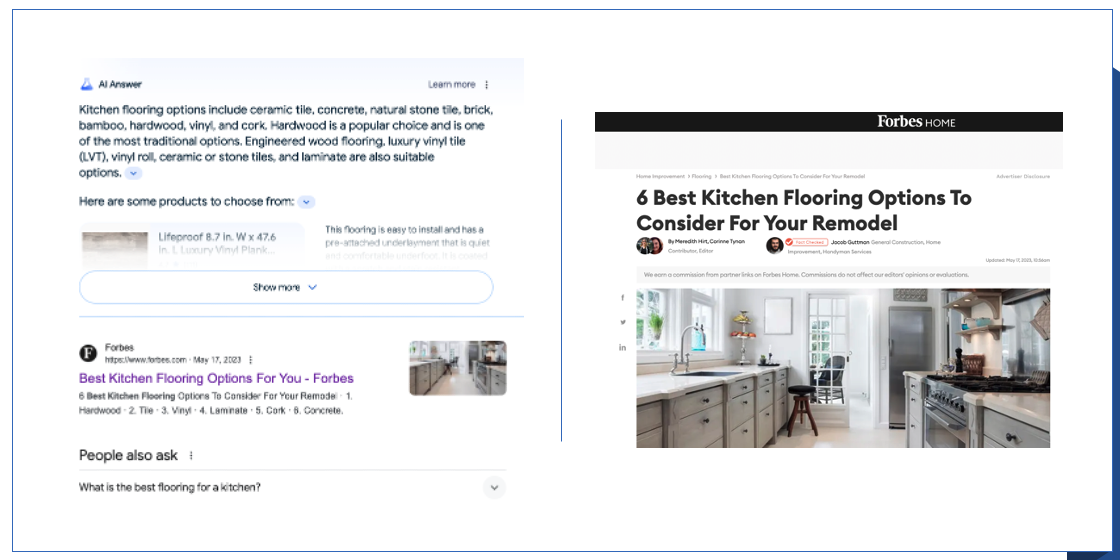

Forbes: Financial Mag to Content Farm

At one time Forbes was a respected business news magazine. In the past ~15 years it has become an SEO-driven "platform" (read: content farm) that ranks for almost every conceivable topic, including things like "best kitchen flooring" that have no relationship to the original brand. Facing a traditional media revenue crisis, Forbes made a strategic decision in roughly 2010 to open up to "contributors" and effectively become a blogging platform. According to Wikipedia, two years later it had 1,000 outside contributors generating thousands of articles. In 2019, Forbes was reportedly publishing 100 articles a day. Most of this was monetized by display ads and video but also affiliate links. The company, which had a huge coupons subdomain, just removed those pages in anticipation of Google's enforcement of its "site reputation abuse" policy. Like others, Forbes sought to capitalize on its domain authority and rankings – Google rewards brands – to maximize revenue with affiliate links/content. I am no fan of Forbes and am often dismayed by what it ranks for, but one could argue that its strategy and choices are an entirely a rational response Google's algorithmic biases.

Our take:

- The Forbes site experience is almost totally unusable. But the clicks keep coming (brand familiarity), creating a feedback loop Google rewards.

- Google largely created this monster and now has to clean up its mess. Enter site reputation abuse, which is something of a blunt instrument apparently.

- Forbes may be a symbol of what's wrong with internet content; it's also a byproduct of how sites respond (rationally) to Google's market power.

GenZ: Social to Store Shoppers

After the closure of Bed, Bath & Beyond (BB&B) stores in July 2023, Overstock.com bought the domain and has been capitalizing on BB&B's brand authority. After traffic dropped significantly around the liquidation, the domain has partly recovered. According to Semrush, monthly uniques are ~5.4 million vs. ~22 million two years ago. Without stores, the brand is likely to fade over time; we know that stores drive online buying. A report from research firm 2 Visions reinforces the importance of stores, both as a stand-alone channel and as a support for e-commerce. At the highest level the report finds hybrid shopping is critical for retailers but that there are nuanced age, income and geographic differences in shopping behaviors. Most interesting is the discussion of GenZ. Younger shoppers tend to discover products on social media but prefer buying in stores (more than other generations). Somewhat surprisingly, GenZ is relatively less price sensitive vs. other groups. The majority of GenZ also perceive the in-store experience to offer higher product quality. Internet-centric buyers, by comparison, like the larger selection, convenience and price discounts offered online.

Our take:

- This report reinforces what we've seen and argued repeatedly; consumers want both online and offline options from retailers.

- And with very few exceptions online-only retailers are at a disadvantage vs those offering both experiences – though stores are expensive to run.

- In a more competitive, unpredictable and costly SEO/PPC environment for product sellers, stores offer differentiation and branding.

Recent Analysis

- Near Media podcast episode 126: (from the vault) Do searchers use the Local Finder?; how many links does a local site need?; Google's content BS.

Short Takes

- Google testing GBP SERP for 'near me' queries in multiple categories.

- How to rank in local results using service-area pages.

- New Google Business Profile categories.

- Keyword stuffing in business names shouldn't work but it does.

- Kendrick-Drake rap feud escalates onto Google Maps.

- Early impact of Google manual actions on media coupon subdomains.

- Google: post HCU recoveries possible but could take months.

- Apple's AI work should result in a more capable Siri with iOS 18.

- Google seems to be changing flight search results to satisfy EU regs.

- Statcounter Google search-share drop an error.

- Google-Apple default search deal supposed to last through 2026.

- Here are the DOJ's "closing argument" Google trial slides.

- Most common features of SMB websites.

Listen to our latest podcast.

How can we make this better? Email us with suggestions and recommendations.